The mutual fund investment platform startup, Bibit, today (03/5) announced the $65 million worth of funding equivalent to 938 billion Rupiah. Sequoia Capital India, previously led Bibit’s $30 million funding earlier this year, also leading this one. Prosus Ventures, Tencent, and Harvard Management Company are also participated in this round, also the previous investors AC Ventures and East Ventures.

Fresh funds will be focused on launching new products/features, developing technology, recruiting employees, and increasing public education regarding investment.

According to IDX and KSEI, the number of retail investors in Indonesia grew 78% YoY in 2020 to 3.2 million investors. This one was part of millennials contribution; 92% of new investors in 2020. In the first quarter of 2021, there are 1 million new mutual fund investors registered in the capital market. Despite the significant increase, Indonesian people contribution in the capital market is still less than 2%.

“Previously, Indonesian capital market was considered a frightening place to invest, and limited to certain groups. Bibit is leveraging technology to make investment more accessible to everyone, including novice investors. Therefore, we see a sharp increase in interest of retail investors in the capital market,” Bibit’s Director, Sigit Kouwagam said.

He also added, “We believe all Indonesians deserve a better future. Helping to increase financial inclusion and encouraging investment habits in the right way is one way to make it happen. We are very proud to have the support of our partners and investors to speed up the mission.”

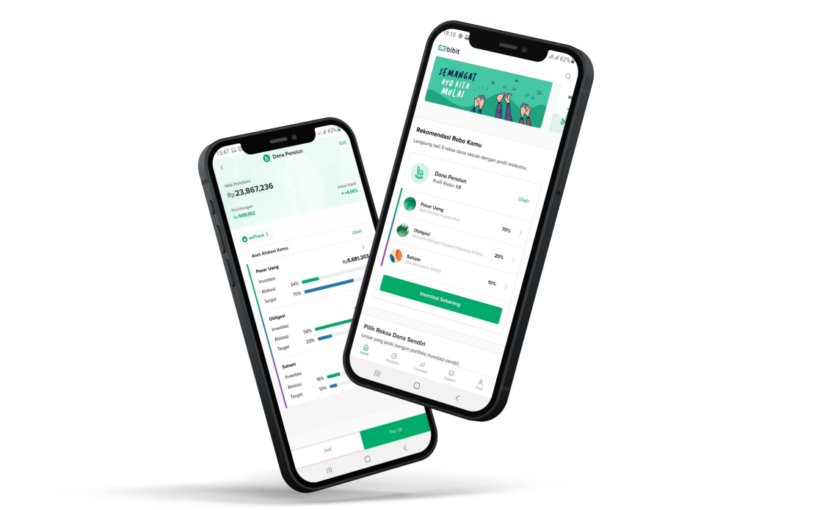

Bibit has been acquired by Stockbit since 2019. Stockbit is known as an information service of the capital market. Bibit platform is designed as a “robo-advisor” for mutual funds in Indonesia, helping investors own portfolios according to their risk profile and investment objectives. Based on the data, 90% of Bibit users are millennial investors who previously had no experience with investing.

One of its rival for mutual fund applications is Ajaib. Recently, Ajaib announced Series A funding worth IDR 1.3 trillion led by Ribbit Capital. In addition, there is Bareksa, an investment platform that has joined and integrated with the OVO group. While Bukalapak, the unicorn, is preparing their “new ammo” PT Buka Investasi Bersama to focus on serving mutual fund investments for millions of customers on the online marketplace platform.

In a survey we conducted in mid-2020, mutual funds (67%) were the most popular investment instrument for digital purchase. Followed by gold (62.7%), stocks (44.5%), P2P lending (16.3%), and bonds (11.5%). Regarding the the type of investment, respondents shared one voice that this was based on the risk profile (48.8%), novice (24.4%), friend recommendations (10.4%), and most familiar (8.1%).

–

Original article is in Indonesian, translated by Kristin Siagian