ALAMI P2p lending startup is reportedly received $17.5 million (approximately 252 billion Rupiah) series B funding led by Quona Capital through the Accion Quona Inclusion fund.

According to DailySocial’s source, some Middle East venture capitalists and angel investors are participated in this round. It was also backed by East Ventures, AC Ventures, and K9 Industries.

We tried to contact ALAMI’s representative, however, they declined to comment on the matter.

Quona Capital is ALAMI’s existing investor of a $20 million funding round in equity and debt earlier this year. The round was led by AC Ventures and Golden Gate Ventures.

Quona has also led and been involved in several fundings for other local startups, including KoinWorks (2019, 2020), Julo (2019), Ula (2020, 2021), and BukuWarung (2020).

Developing digital bank

In a previous interview with DailySocial, ALAMI’s Co-Founder Dima Djani explained that the group is preparing to launch Bank Hijra to the public. Currently, the waiting list still open for interested prospective customers.

ALAMI’s existing customers will be the main target of Bank Hijra’s early market acquisition. They can make savings easier and the integration process more seamless. The yield offered is claimed to be higher for the average fixed income instruments such as sharia deposits, state sukuk, and sharia P2P.

In terms of SME banking segment, Bank Hijra and ALAMI will synergize business, from financing channeling and cross selling other Islamic financial products. The synergy is in compliance with OJK’s regulation and guidance. Therefore, Bank Hijra is not just ALAMI’s institutional lender for SME.

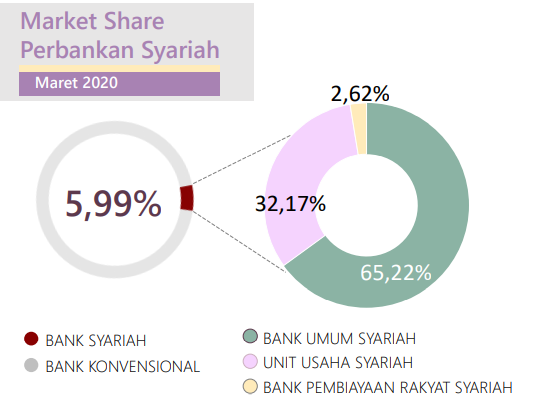

Statistically, based on OJK’s data, the market share of Islamic banking in Indonesia is still around 5.99%. Many believe that the large Muslim population can offer big potential in the future.

Performance-wise, ALAMI users grew by 1,000% year-on-year (yoy) with total distribution of Rp200 billion in the first quarter of 2021. The distribution rate is claimed to be positive with the ratio of loss or default at 0%.

The company has collaborated with eFishery and BukaPengadaan to widen the range of its credit distribution. In addition to individual lenders, ALAMI is supported by a range of institutional lenders, such as Bank Syariah Indonesia (BSI), BPR Syariah, and seven other BPRs.

OJK noted that as of April 2021, out of 381 licensed and registered fintechs in Indonesia, only 17 of those adopted the sharia economic system. Ten fintechs are engaged in p2p lending and the rest are in digital financial innovation (IKD).

With the current limited number, the opportunity is quite large for sharia-based fintech to grow and develop. Supported by the rapid development of fintech, the Islamic economic system could be the trend in Indonesia.

–

Original article is in Indonesian, translated by Kristin Siagian