P2p lending startup Amartha announced an acquisition of a Surabaya based software company, Twiscode (PT Dapur Rumah Sejahtera) with an undisclosed value. Twiscode talents will join Amartha’s engineer team to accelerate product and technology development plans.

Amartha‘s Chief Commercial Officer, Hadi Wenas explained to DailySocial, the company is currently in need for engineer talent to proceed with innovation and expansion plans after securing the latest fund. Twiscode is considered a perfect fit for the business’ demand.

Moreover, both companies maintain adequate relationship through several collaborations, therefore, Twiscode’s talents have proven reputation and quality. “As we’ve already work together, the chemistry is there, they also want to be part of Amartha to realize the mission,” Wenas said.

Amartha’s Senior Vice President of Engineering, William Notowidagdo added, the pandemic and the work from home (WFH) policy have proven the fact that digital talent demand can be fulfilled without having to rely only to Jakarta’s supply.

“Today’s local talents throughout Indonesia have the same opportunity to contribute to startups like Amartha,” he said. After the acquisition, the entire Twiscode team of 47 people became part of Amartha’s R&D office, named “Amartha Development Center Surabaya”.

Technology development plans

Wenas also mentioned a lot of technological scope at Amartha that could be improved. They are currently focusing on three segments from lender, internal and borrower.

For example, in terms of lender, every one lender will be possible to fund each project in Amartha starting from Rp100 thousand from the previous minimum rate of Rp5 million. “Furthermore, there are some things can be accelerated from the lender registration and verification in the future.”

Moreover, in the internal side, as 1/3 of the borrowers do not have a smartphone, Amartha requires a field officer for the verification process and fund disbursement through a separate application. The company is to launch the latest technology for cashless loan disbursement.

“We want to increase our coverage field officers, therefore, increase their productivity.”

William mentioned another technology to assist borrower verification and attendance is to provide a face recognition feature, enough with the manual process using signature. This solution is to overcome the field conditions, where most of these borrowers are illiterate and whose fingerprints unrecognized using a biometric machine.

To comply with TKB, aside from field officers and absenteeism, Amartha applies four groups with 92 parameters for credit scoring, including business parameters, demographics, ability to pay, and willingness to pay. All of these parameters are made specifically for the underserved segment, it will be different from most p2p players.

“Our survey is not whether he can pay or not, but a survey based by looking at the house condition, for example whether they’re using LPG or kerosene, the presence of refrigerator, dirt or tile based floor, and so on. In the future, we will definitely evolve.”

One of the popular scoring parameters is borrowers’ awareness towards smartphone. The one supporting factor is for the children to study. This should gradually made the increase of social media awarness to borrowers.

“When social media usage increases, we will attit with 92 parameters considering that digital adoption in the village will increase in the future,” Wenas said.

The company released Amartha Plus with three features, Warung Loan Non Mitra, Warung Loan Mitra, and Amartha Pulsa/PPOB. In the first feature, the company becomes a financial partner for paylater products for stall partners registered in the Sampoerna Retail Community (SRC) network. This collaboration allows SRC’s stall partners to pay the due date for each stock purchase.

Next, for the Warung Loan Mitra, it allows stall partners in the Amartha network to purchase FMCG product stocks wholesale through Tanihub, company’s agritech partner. Currently, it has available at 11 points in East Java, there are more than 100 partners shop regularly, and offering more than 4 thousand SKUs .

Last, Amartha Pulsa, whose service is more straight forward for balance top-up and PPOB. This service has been used in 93 points out of 497 Amartha network points.

The growth of fintech lending

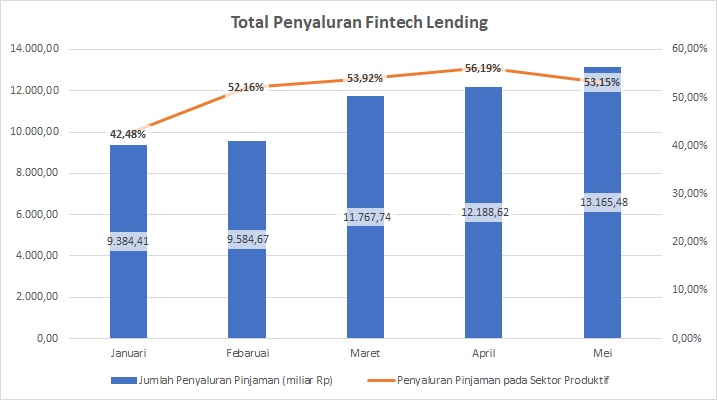

Throughout 2021, the fintech lending industry continues to growth rapidly. Based on OJK’s statistics as of May 2021, there are 118 conventional and 9 sharia fintech lending providers. The total assets owned reach 4.1 trillion Rupiah. The platforms also managed to accommodate around 8.7 million lender accounts (p2p) channeling 13.8 trillion Rupiah of funds.

In order to maximize this momentum, the company has taken a number of strategic actions. Most recently, they appointed former Minister of Communication and Information Rudiantara as Commissioner. In June 2021, they received 107 billion Rupiah investment from Norfund which is an institution owned by the Norwegian government. It follows the previous round of IDR 405 billion led by WWB Capital Partners II and MDI Ventures.

–

Original article is in Indonesian, translated by Kristin Siagian