Blanja informed its users on its platform that starting September 1, 2020, all purchasing activities will be stopped. In its official statement, Telkom said that this is part of the e-commerce business transformation in the company, in an effort to strengthen the company’s profitability. As of October 1, 2020, Telkom will only focus on e-commerce in the business segment, targeting both corporates and SMEs.

Regarding the next moves, Telkom told DailySocial, “In accordance with Telkom’s strategic plan, which leads to B2B Commerce, it can develop from its own resources (build), partner with other parties (borrow), or develop external competencies (buy) including startups. . ”

Blanja is part of Telkom’s digital business, under the leadership of Fajrin Rasyid. The appointment of Bukalapak’s co-founder is to support the agenda of increasing business opportunities and the company’s potential profits from digital business.

Blanja was not alone, Telkom took eBay as a strategic partner. For the continuation of their cooperation, Telkom is still unable to comment, “The continuation will be announced later”. While we have also tried to request an official statement from eBay Indonesia, as of this writing no comments have yet been made.

Towards the end of 2019, we had an interview with Blanja’s CEO, Jemy Confido. He claimed, the amount of revenue obtained has increased by 84% compared to 2018. There was an 11% increase in EBITDA and about 4% of Net Income. He also emphasized that the company’s main metric is no longer GMV, but revenue.

Hard to catch up

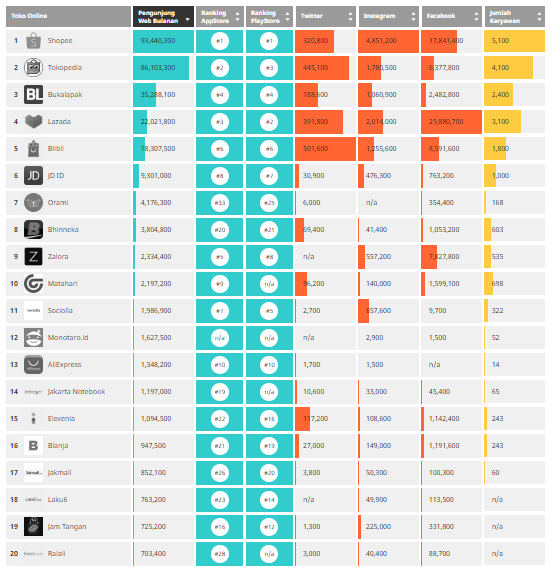

As an e-commerce platform that focuses on B2C / C2C, Blanja’s position has been less attractive lately. One of them is proven by the results of research conducted by iPrice, as of the second quarter of 2020, Blanja’s position is in the 16th rank – one rank just below Elevenia (PT XL Planet), which was previously also managed by the telco company XL Axiata but has been fully released to the Salim Group. .

In its research, iPrice uses several variables, two of which are site visit statistics and app ranking.

With experience in establishing and raising Bukalapak, Fajrin’s business intuition has clearly been honed. Although the details are not given, there is certainly a strong argument that underlies Blanja’s chances of leading the local e-commerce market are very small, not proportional to the efforts put in.

The market leader is filled with unicorns who continue to compete and innovate to be at the forefront. The scope of its business is also very broad, not only as a place for online buying and selling, but includes aspects of fintech (payments and loans), logistics, online-to-offline (partnerships with shops), and others.

Even though Blanja in 2020 has a target to sharpen its digital products, including payment of various bills, insurance, investment, even digital products for education. The strategy is by cooperating with other players, for insurance they choose Invisee as a partner; for payments and paylater there is LinkAja and Finpay.

But the plan is just the plan, now all focus will be shifted to B2B Commerce. Then what about the market share and business opportunities that Telkom will explore?

Potential B2B commerce

B2B Commerce refers to the exchange of goods and services between companies through digital medium. Most of the business models adopted are marketplace or direct-to-consumer. According to a report released by ecommerceDB.com entitled “In-depth: B2B e-Commerce 2019”, the market value of B2B Commerce in 2019 was $ 12.2 trillion, 6x larger than the B2C market.

Interestingly, Asia Pacific leads the market with a contribution of nearly 80%, making global players step on the gas to work on their B2B units here. So far there are two players that stand out the most, namely Alibaba and Amazon Business. There is a possibility that it will be even more hectic, because the competition landscape has begun to be enlivened by Rakuten, Mercateo, Global Sources, IndiaMART, to Walmart.

In Indonesia, so far there are Bhinneka, Mbiz, Bizzy, AXIQoe, Monotaro, and Ralali. There aren’t many B2C players who have played there either – one that has jumped in is Bukalapak through the BukaPengadaan service. While Bizzy is also a pivot, instead of providing e-commerce for businesses, they are now prioritizing logistics and distribution services.

Chief of Commercial & Omni Channel Bhinneka Vensia Tjhin, through his latest interview with DailySocial, explained that the business contribution from B2B Commerce has reached 90%, compared to B2C last year. Apart from B2B.id, several other supporting features have been rolled out, including Bhinneka Smart Procurement, developing O2O omnichannel, and having selected merchants.

Frost & Sullivan projects a CAGR of 59% in 2017-2022 for B2B Commerce growth in Indonesia, about double the growth rate of B2C Commerce during the same period. MSMEs have the potential to be the main driver in this landscape – according to BPS, MSMEs contribute to 60.3% of national GDP.

DSResearch once released a report “Indonesia B2B Commerce 2018”, in which it discusses developments in terms of platforms and public perceptions. As is known, one of the uniqueness of B2B Commerce is that it allows businesses to get an e-procurement system, integration with ERP, e-invoicing, taxation, and others – adapting to the procurement system in offices. On average, B2B platforms also target government institutions, so players often define their business as B2B2G.

The B2B market for e-commerce may be in its infancy, trying to democratize the existing procurement system. The potential is clear, as people become more familiar with e-commerce. In addition, there are many benefits that can be obtained by businesses, including convenience, transparency, and flexibility.

Telkom in B2B Commerce

Delivered by Telkom, efforts to build B2B Commerce have actually started before. One of them is through the UMKM Digital Market (PaDi), in collaboration with 8 other BUMNs. It consists of a data center for UMKM and BUMN shopping (Control Tower Dashboard), a digital UMKM market for BUMN (PaDi UMKM B2B), and a marketplace feature with centralized access for MSMEs (PaDi UMKM B2C).

Telkom also supports Kemendibud in the online procurement of school goods and services through the School Procurement Information System (SIPLah). SIPLah is designed to take advantage of a marketplace that has certain features to realize school budget work plans and meet the needs of the Ministry of Education and Culture in supervising the use of BOS (School Operational Assistance) funds in accordance with applicable regulations.

It is likely that more products will be initiated. With its infrastructure and business position, Telkom has the potential to maximize its potential to help business consumers. Especially through its many units, the company continues to intensify digital transformation, including through MDI Ventures by investing in digital startups.

There were also rumors about Telkom’s acquisition of the Bhinneka platform to strengthen the B2B Commerce business, but when asked again Telkom was reluctant to comment.

–

Original article is in Indonesian, translated by Kristin Siagian