Aside from gradual integration with the Gojek ecosystem, PT Bank Jago Tbk (IDX: ARTO) is also preparing to extend the coverage of digital banking services in 2021.

This year, Bank Jago targeted the middle income and mass market segment, including MSMEs and retail (consumer), both conventional and sharia.

Bank Jago’s President Director, Kharim Indra Gupta Siregar revealed that they will be focused on two things, digital-based sharia services and lending through digital platforms for MSMEs.

The following is an extension of DailySocial’s exclusive interview with Kharim Indra Gupta Siregar and Bank Jago Commissioner Anika Faisal.

Sharia digital banking

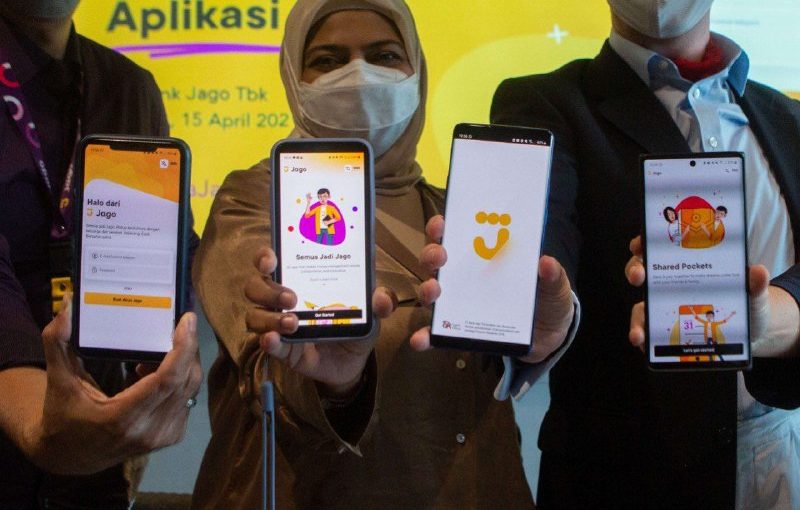

Currently, Bank Jago is exploring whether this digital sharia will be presented in a new app or just an additional service in an existing one, Jago App. The company has considered several things regarding this development.

Kharim thought, today’s Islamic banking products in Indonesia tend to be associated as different products from its parent company, which in fact is a conventional bank. This is the factor that makes the new sharia services development to follow the conventional way.

The market opportunity for Islamic banks is very large considering its penetration is quite low in Indonesia. Referring to data from the Financial Services Authority (OJK), the market share of Islamic banks was only 6.33% as of October 2020. The increase was not too significant compared to the market share in 2017 which was only 5%.

In addition, the current Islamic mobile banking services have mostly used the USSD menu considering that the digital ecosystem was not ready at that time, smartphones and airtime were still quite expensive.

He observed that Bank Jago’s position as a tech-based bank provides space for companies to utilize 100% of the same capabilities in developing Islamic banking platforms. Whether it is presented in the form of a new app, it will duplicate the Pocket Jago App feature to the sharia platform.

“Currently, we are going through various processes, such as approval and others. We will have it soon. We’ve seen a good opportunity where sharia users can get similar services on the Jago App. We provide all the capabilities there,” Kharim said.

Meanwhile, Anika Faisal considers that there are no Islamic banking products in Indonesia to date that are able to provide a good user experience. She said, these various considerations are to ensure the company can provide a product proposition that is as good as Jago App.

“I have my own preference for sharia services, not in the context [service preference] for usury or not. Unfortunately, sharia mobile banking in Indonesia is currently not able to provide convenience. Therefore, I challenge Bank Jago to have good convenience products. The product [sharia] is basically the same, but what matters is the service,” she said.

Digital lending for MSME

In 2020, the number of MSME players in Indonesia is estimated to reach more than 65 million, contributing more than 50% to Indonesia’s GDP, and absorbing 97% of the active work budget in Indonesia.

The Bain & Company report in 2019 recorded that there were as many as 92 million people or 50% of the total population who did not have access to banking services (unbanked). 25% or 47 million of them do not have adequate access to banking services (underbanked).

Bank Jago observes promising potential in these two segments. In its 2020 financial report, Bank Jago is said to build a financing business with a digital ecosystem managed through Partnership Lending (Business Finance Solution). Since last year, Bank Jago has collaborated with fintech platforms to channel financing.

Some that have been announced include Akseleran, Akulaku Finance, and Adakami.

The collaboration is expected to accelerate the customer acquisition process, which Bank Jago defines as the productive pre-prosperous segment. This segment is considered to have passed the poverty level, but still needs financing. The company targets this lending to be significantly distributed to this segment.

“We will prepare products/services for the entrepreneurial segment as we see great potential from this segment of business players who are yet to be fully formalized. We are going to announce and it’s in progress. After the second right issue, we get strong capital to pursue lending growth because we don’t have a lot of legacy lending products. Therefore, we can focus more on partnerships. Currently, we have partnered with ten lending sites,” Kharim said.

Overall, he said, Bank Jago has closed good number on growth in lending. According to its records, as of the end of 2020 until the first quarter of 2021, Bank Jago has disbursed loans from around Rp900 billion to Rp1.3 trillion with an increase of 40%.

Kharim revealed that his team will collaborate with partners to provide lending products on the Jago App to support the underwriting process and determine whether prospective customers are eligible for loans.

“Currently, Gojek customers have been offered PayLater products. It means, there is analytics support to provide lending to customers. In this model, we want to expand what can we provided through lending products. This also depends on the ecosystem, such as Gojek’s user ecosystem, partners drivers, and merchant partners. Each has a different approach. We can do this after the Jago App and Gojek integration is running,” he said.

–

Original article is in Indonesian, translated by Kristin Siagian