BCA partners with KlikACC (PT Aman Cermat Cepat) p2p lending platform to fasten the realization of SMEs credit. By this means, BCA will act as a funding source by alocating Rp25 billion to distribute via KlikACC platform as channeling agent.

The contract’s signing is done by BCA’s Commercial Business & SME Executive Vice President Liston Nainggolan and KlikACC’s President Director Rusli Hidayat.

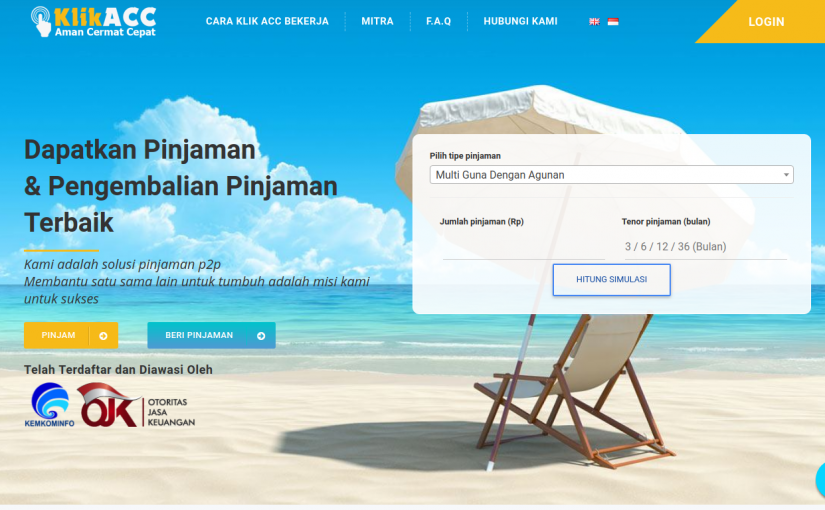

“As a company providing digital funding platform that bridging borrower and lender, KlikACC has prepared a platform to help potential borrowers get some funding.” he explained, quoted by Katadata.

To get the KUR facility, borrower can apply via KlikACC. Furthermore, they need to fill some required documents. KlikACC will perform credit analysis of the data obtained.

The result will be used for recommendation to BCA, whether to accept or reject the applications.

“The recommendation will become BCA’s consideration in accepting application based on prudent banking principle.”

Borrower can apply for credit limit minimum Rp20 million and maximum RP100 million. With maximum three-year tenor. For credit under Rp100 million, KlikACC does not require collateral.

It is currently claimed, KlikACC has distributed loan of Rp30 billion in 2017. Company’s client has reached more than 100 partners in total. This year is targeted to get Rp400 billion distribution by reaching 5000 partners.

KlikACC is one of the investees from BCA’s venture capital subsidiary, Central Capital Ventura (CCV). CCV is claimed to pour initial investment for companies other than KlikACC, it is Garasi.id.

Garasi.id is an automotive marketplace established by Kaskus. It is officially launch in August 17, 2017.

CCV Injection

Quoted from Bisnis, BCA prepares Rp2 trillion allocation funding for subsidiary development. BCA’s President Director Jahja Setiaatmadja has not given the detailed information related to each subsidiaries.

However, he ensures to allocate the funding one of which for CCV’s activity. In CCV establishment last year, BCA has allocated Rp200 million seed funding.

“We did not go into detail due to the difficulty in predicting what subsidiary needs. More importantly, whether there is a necessity (additional funding), should be in RBB,” he said.

BCA is currently had seven subsidiaries in supporting company’s business, such as BCA Finance, BCA Finance Ltd, BCA Syariah, BCA Sekuritas, BCA General Insurance, Central Sentosa Finance and CCV.

–

Original article is in Indonesian, translated by Kristin Siagian