The digital revolution has reshaped the way we shop, with e-commerce and social commerce taking center stage. Indonesia, with its burgeoning online population and rapid digitalization, has emerged as a hotspot for e-commerce growth. In particular, the rise of social commerce, epitomized by platforms like TikTok Shop, has been a game-changer in the Indonesian market.

However, recent regulatory developments have cast a shadow over this thriving sector. In this article, we will delve into the growth of e-commerce and social commerce in Indonesia, the prominence of TikTok Shop, and the implications of the ban regulation on this innovative marketplace.

The explosive growth of e-commerce and social commerce

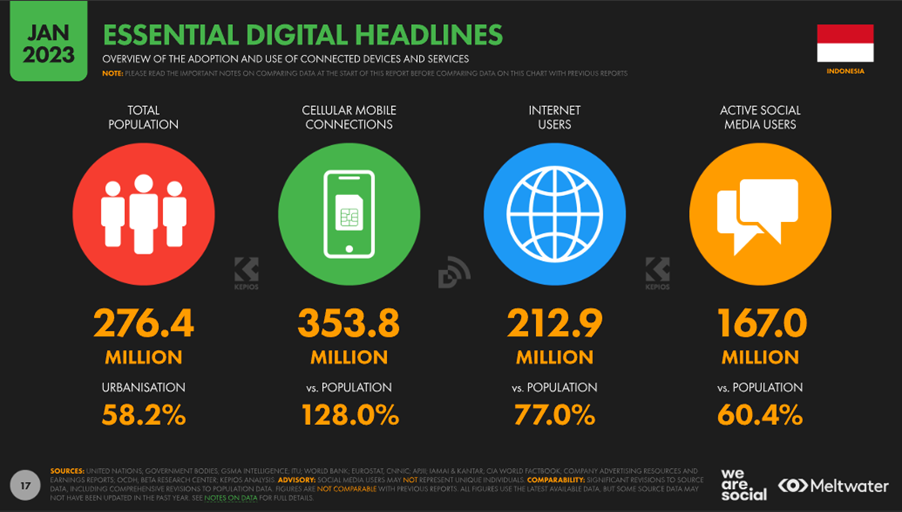

According to We are Social (January 2023), Indonesia boasts a total population of 276.4 million, with a significant digital presence as 77% of its populace, totaling 212.9 million individuals, are internet users. Among these, a remarkable 60.4% or 167 million people are active on social media platforms. What’s striking is the level of engagement, with the average Indonesian spending an impressive 3 hours and 18 minutes per day on social media through various devices. These statistics underscore the nation’s substantial online presence and its robust social media culture, making it a key player in the digital landscape.

E-commerce in Indonesia

Indonesia’s e-commerce landscape is on a meteoric rise. According to predictions by experts, the Gross Merchandise Value (GMV) of the e-commerce industry in Indonesia is set to soar to $104 billion by 2025. This growth is fueled by a staggering 158.6 million e-commerce users, representing 57.9% of the total population, as per the Social Commerce Report 2022 by DSInnovate.

Social Commerce in Indonesia

With 60.4% of the population being active on social media platforms, this colossal user base has provided fertile ground for the emergence of social commerce, where buyers and sellers can interact freely and transact directly on social media platforms. This novel approach to shopping has attracted a massive following, with social commerce transactions contributing approximately $3 billion to Indonesia’s total of $8 billion GMV in 2020, as stated by Digitalpreneur Diatce G. Harahap , as stated by the Digitalpreneur Diatce G. Harahap on the Spire Insights article by technobusiness.id.

E-commerce vs Social Commerce

In line with a report titled “E-commerce in Southeast Asia 2023” released by Momentum, the cumulative sales value of TikTok Shop in 2022 did not achieve the top spot in Indonesia. According to this data, the GMV in Indonesia, encompassing six e-commerce platforms, reached USD 51.9 billion or IDR 803.7 trillion. The report disclosed that sales on TikTok Shop only contributed to 5 percent, which equates to approximately IDR 40.1 trillion in 2022.

TikTok Shop still trails behind Shopee, which maintains a dominant position in e-commerce revenue within Indonesia. Shopee managed to amass a total revenue of 36 percent or IDR 289.3 trillion from the sale of goods. Following closely are Tokopedia, Lazada, and Bukalapak.

Interestingly, sales on TikTok are on a steady upward trajectory despite not leading the pack. Shoplus, an analytics tool for TikTok, reported an upswing in supply and demand within the TikTok e-commerce sphere during the fourth quarter of 2022. In December 2022, the number of creators on TikTok Shop surged by 92 percent in comparison to October, and during the same timeframe, e-commerce-related videos registered an impressive increase of 127 percent.

It is worth noting that the proliferation of influencer-based e-commerce activities, as per the report, played a pivotal role in broadening TikTok Shop’s content and expanding its reach. Consequently, the proportion of e-commerce influencers in total sales revenue in Indonesia has seen a substantial surge. The count of TikTok Shop influencers reached its zenith in December 2022, which subsequently sparked fierce competition in Indonesia.

In the fourth quarter of 2022, sales generated by TikTok Shop influencers constituted 34 percent of the total sales in TikTok Shop Indonesia, making Indonesia the leader among other countries. Shoplus, in general, indicated that 8.4 percent of TikTok Shop influencers accounted for a significant 86.9 percent of the market share during the same period. In Indonesia, influencers in professional services, finance and investment, fashion, vlogs, and other niches rapidly garnered followers.

To provide context, according to CNBC Indonesia, the Gross Merchandise Value (GMV) on TikTok Shop in Indonesia over the past year tallied at US$ 2.5 billion. This figure formed the majority of the total GMV in Southeast Asia, which amounted to US$ 4.4 billion. This implies that TikTok has set its sights on transactions worth over US$ 5 billion (IDR 75 trillion) in Indonesia for 2023. This information stems from credible sources familiar with the matter. On a broader scale, the GMV of TikTok Shop for all of Southeast Asia is projected to exceed US$ 15 billion, marking a remarkable triple-fold increase from the previous year.

The emphasis on Indonesia is not without reason. Insider Intelligence’s research firm reported that by Q1 2023, active TikTok users in Southeast Asia had reached a staggering 135 million, with Indonesia contributing a significant chunk, boasting 113 million users. The potential of TikTok Shop has not escaped the attention of established e-commerce giants like Shopee, Tokopedia, and Lazada, despite TikTok Shop’s relatively recent introduction to Southeast Asia in 2021.

According to a survey by Cube Asia, users’ spending habits have shifted away from platforms like Shopee and Lazada in favor of TikTok Shop. User spending on Shopee, Lazada, and offline stores in Indonesia, Thailand, and the Philippines witnessed declines of 51 percent, 45 percent, and 38 percent, respectively. Nevertheless, it’s crucial to note that Shopee still maintains a significantly higher GMV than TikTok Shop, with Shopee’s Southeast Asia GMV reaching US$ 73.5 billion in 2022, while Lazada achieved a GMV of US$ 21 billion.

The Rise of TikTok Shop

Among the array of social commerce platforms in Indonesia, TikTok Shop stands out as a frontrunner. Alongside Facebook Shops and Instagram Shopping, TikTok Shop offers a unique blend of social media engagement and direct shopping. A Populix survey conducted in 2022 revealed that TikTok Shop is the preferred platform for the majority of Indonesian respondents who have shopped via social media. This thriving marketplace caters to a diverse range of products, with clothing, beauty products, food and beverages, and cellphones and accessories topping the list of items frequently purchased.

Challenges for TikTok Shop in Indonesia

Despite its rapid growth, TikTok Shop faces formidable challenges in its quest for sustained success. According to experts at Cube Asia, TikTok must operate flawlessly to achieve its GMV target of US$ 15 billion in Southeast Asia. Recent challenges include regulatory scrutiny, such as the Vietnamese government’s investigation into TikTok for disseminating negative content, and the Indonesian Ministry of Communication and Information blocking content related to “online begging.”

Jianggang Li, CEO of Momentum Works research firm, underscores that regulatory challenges aren’t confined to TikTok in the United States and Europe. TikTok must convince governments in Southeast Asia that its service benefits the local population and SMEs.

Additionally, TikTok Shop faces challenges related to product pricing and limited logistics. Products on TikTok tend to be lower-cost, leading to impulsive purchases. For pricier items like electronic devices, TikTok has yet to gain preference. Moreover, TikTok Shop relies on third-party courier services, and Indonesia’s archipelagic nature often poses logistical challenges, particularly for deliveries to remote islands.

Roshan Raj, Head of Research at Redseer, notes that customers outside Java may feel underserved by TikTok Shop, as established e-commerce platforms possess stronger internal logistics capabilities. Consequently, TikTok’s delivery ratings still trail behind those of established players.

Looming Competition

These challenges present opportunities for established players like Shopee, Tokopedia, and Lazada to solidify their positions. The Financial Times reports that Lazada, led by Jiang Fan, has secured additional funds from Alibaba to bolster its competitive strategy. Shopee, on the other hand, is anticipated to intensify competition after two consecutive profitable quarters. The e-commerce landscape in Southeast Asia, particularly in Indonesia, is set to witness intriguing developments in the coming year.

An In-Depth Look at the Ban Regulation

In an unexpected turn of events on September 25, 2023, the Indonesian government unveiled a significant policy shift by implementing a comprehensive ban on e-commerce transactions conducted through social media platforms, as outlined in Regulation of the Minister of Trade (Permendag) No. 31 of 2023. Trade Minister Zulkifli Hasan, in a statement to the press, highlighted that the primary objectives of this regulation are to foster “fair and just” business competition while also safeguarding the data protection rights of users. This multifaceted approach aims to address a variety of pressing issues affecting Indonesia’s business landscape.

Impact on Local Business

One prominent concern that led to this ban was the adverse impact of social media-based e-commerce on the local small and medium-sized enterprises (SMEs). The rapid influx of imported goods, particularly from China, through platforms like TikTok Shop disrupted the equilibrium of the market. Traders in Tanah Abang, Southeast Asia’s largest wholesale center, voiced their grievances, reporting a staggering profit loss of over 50 percent due to their inability to compete with imported products offered at significantly lower prices on TikTok Shop.

In a recent interview with Temmy Satya Permana at tvOneNews, Assistant Deputy of Financing and Investment for Small and Medium Enterprises (SMEs) at the Ministry of Cooperatives and SMEs in Indonesia, it was revealed that Indonesia ranks as the world’s second-largest TikTok user base, with users spending an average of 3.5 hours per day on the platform. TikTok had already become a widespread habit among Indonesians even before it received official permission in May 2023. Surprisingly, he added that within just one year, TikTok’s revenue matched that of Alibaba’s 10-year earnings in China. However, concerns about pricing have emerged, as some items, such as shoes and hijabs, were sold at extremely low prices, with a majority being imports. The World Economic Forum reported that Indonesia is the largest buyer of hijabs globally, with 75% of these products being imported.

Impact on Offline Business

Moreover, the “live” feature on TikTok, enabling individuals to directly sell goods, was deemed detrimental to local MSMEs that predominantly operate offline. Iyal Suryadi, a textile seller, expressed frustration over the situation, highlighting that the prices of items sold on TikTok Shop “do not make sense.” This is because goods are sold directly to consumers at factory prices, bypassing distributors or resellers, disrupting the traditional business model.

Misuse of Personal Data

Another factor that drove the Indonesian government’s decision to prohibit e-commerce transactions via social media channels, including TikTok Shop, was the need to prevent the misuse of personal data. Trade Minister Zulkifli Hasan (often referred to as Zulhas) shed light on the necessity of this move, emphasizing the clear distinction between social media and social commerce. He asserted that social commerce should serve as a platform for promoting and directly selling goods and services, separate from the broader realm of social media.

The amalgamation of social media and social commerce raised concerns about a potential monopoly over algorithms, which could be exploited to misuse consumer personal data for business purposes. Minister Zulhas underlined the importance of segregating these realms to prevent such misuse. By implementing the ban, the Indonesian government sought to maintain a clear boundary between the two and safeguard the integrity of consumer data.

No PMSE Permit

Furthermore, another significant reason for TikTok Shop’s closure was the absence of a necessary Trading Through Electronic Systems (PMSE) license. TikTok, despite being a widely used social media platform in Indonesia, was registered as an Electronic System Provider (PSE) with the Ministry of Communication and Information Technology (Kominfo). However, it lacked the requisite PMSE license, a critical permit for conducting e-commerce transactions through electronic devices or procedures.

The distinction between PSE and PMSE licenses is essential. PSE licenses encompass the use of electronic systems for both public and non-public services by state administrators, individuals, businesses, and the general public. In contrast, PMSE licenses are specifically tailored for online trading activities carried out through electronic means, essentially enabling companies to engage in e-commerce.

Tragically, TikTok Shop’s absence of a PMSE license rendered it incapable of facilitating direct buying and selling transactions on the TikTok platform. In light of these regulatory and compliance issues, the Indonesian government’s decision to ban TikTok Shop aligns with its commitment to upholding legal and data protection standards while fostering a fair and competitive business environment within the country.

Impact on Merchants and Affiliates

Unsurprisingly, this ban has sparked mixed reactions among stakeholders. TikTok Indonesia expressed its commitment to adhering to the new regulations while highlighting concerns for the millions of local sellers and creator affiliates who rely on TikTok Shop for their livelihoods. The platform reportedly said that it has received complaints from local sellers and has sought clarification from authorities regarding the ban’s implementation.

Proponents of the TikTok Shop ban argue that it levels the playing field for traditional merchants and curtails the onslaught of online businesses that undercut prices. Market Promotion Manager Herry Supriatna from Tanah Abang Market welcomed the ban, foreseeing healthier price competition and the potential for increased turnover for traditional traders.

Similarly, textile seller Iyal Suryadi and seller Mr. Raden from Tanah Abang Market have welcomed the move, emphasizing the adverse impact of cheap online prices on their businesses. They propose restrictions on the sale of items through social media rather than an outright ban to accommodate those who have adopted TikTok Shop as a selling channel.

Conversely, some argue that TikTok Shop has been a lifeline for businesses, especially during the challenges posed by the COVID-19 pandemic. Sellers like Fahmi Ridho believe that online platforms offer a way for stores to recover and adapt in a changing landscape.

Andre Oktavianus, a children’s clothing business owner, credits TikTok Shop for a dramatic increase in income and nationwide reach. He highlights how the platform’s social media features enable improved product quality and consumer engagement.

Content creator Wenny Wijaya echoes this sentiment, stating that TikTok Shop has provided her with an opportunity to increase her income, transcending her role as a housewife.

Public Dilemma on the TikTok Shop Ban

During a recent interview with Raymond Chin at tvOneNews, a business consultant, several critical points regarding the state of TikTok Shop and its impact on the Indonesian market were discussed. Chin highlighted the remarkable strength of China’s manufacturing capabilities and supply chains, which have allowed products imported from China to flood the Indonesian market at exceptionally low prices. This phenomenon has raised concerns of predatory pricing, as local businesses in Indonesia struggle to compete with the cost-effective manufacturing power of China.

Despite TikTok Shop achieving a Gross Merchandise Value (GMV) of 2.5 billion dollars last year, it still lags far behind other e-commerce giants with GMVs of around 50 billion dollars. However, Chin predicts a significant upswing in TikTok Shop’s performance, potentially growing four to five times its current value in the coming year.

The dilemma lies in balancing the desire for consumers to access affordable and high-quality products with the need to create a fair competitive landscape for local Small and Medium-sized Enterprises (SMEs). Chin emphasized the pivotal role that SMEs play as the backbone of the Indonesian economy and suggested that policies and regulations should be put in place to support their growth and competitiveness.

On a more positive note, Chin acknowledged the positive impacts of TikTok Shop, which has emerged as a new marketing platform. This development has led to the rise of content creators and local sellers, with some indigenous brands achieving remarkable success, with up to 80-90% of their sales coming from TikTok.

In conclusion, Chin believes that social commerce, exemplified by TikTok Shop, represents an innovative frontier in the market. Rather than advocating for its closure, he suggests that the platform should be subject to proper regulation to ensure fair competition and equal opportunities for all players in the market.

In conclusion

The ban on e-commerce transactions through social media platforms, particularly affecting TikTok Shop, represents a significant regulatory shift in Indonesia. As the first Southeast Asian country to implement such a ban, Indonesia’s decision has sparked debates and discussions among stakeholders. While the ban aims to protect traditional businesses and curb predatory pricing, it also disrupts the livelihoods of millions of sellers and creator affiliates who rely on TikTok Shop.

The long-term impact of this ban remains uncertain. Some argue that it will drive businesses back to established e-commerce platforms like Shopee, Lazada, and Tokopedia, which offer more trusted options for online purchases. Meanwhile, others contend that the ban may stifle innovation and economic growth by limiting opportunities for small entrepreneurs and content creators.

In this ever-evolving landscape, Indonesia’s approach to regulating social commerce will continue to shape the future of e-commerce in the country and serve as a case study for other nations grappling with similar challenges.

How Orderfaz can help enable Social Commerce on TikTok

As TikTok continues to evolve as a platform for social commerce, with features like FYP, Live Stream, and TikTok Ads, Orderfaz emerges as a compelling solution for Tiktok Shop Merchants. Our platform offers a range of features designed to empower users and enhance their success in the realm of social commerce:

- Checkout Link; Every product listed by our users is equipped with a unique checkout link. This checkout link can be seamlessly integrated into livestreams or advertisements, enabling customers to complete their purchases with a single click. This technology streamlines the shopping experience, as buyers only need to fill out their information the first time they use an Orderfaz link.

- WhatsApp Keyboard; For sellers who prefer to finalize transactions through WhatsApp, our platform provides a smart keyboard compatible with both Android and iOS devices. This keyboard simplifies the customer service process, offering features such as AutoText, Send Checkout Link, Send Invoice, Send Shipping Rates, and Order List.

- Landing Page Builder; To captivate potential buyers and provide them with comprehensive information about products, Orderfaz offers a versatile landing page builder. Sellers can create customized landing pages to showcase their products, explain their unique features, usage instructions, and the positive impact their products can have on customers.

- Storefront; Our Storefront feature empowers users to establish their own online shops effortlessly, without the need for coding skills. Sellers can share their storefront links on their social media profiles, allowing potential customers to explore their offerings. Additionally, these links can be conveniently shared via messaging apps like WhatsApp, serving as a convenient “Catalog” for potential buyers.

With these powerful features, Orderfaz is poised to transform the social commerce landscape on TikTok, enabling sellers to provide a seamless shopping experience, streamline customer interactions, and effectively showcase their products to a wider audience. Embrace Orderfaz to thrive in the dynamic world of social commerce on TikTok.

–

Disclosure: This writing was entirely composed by Reynaldi Gandawidjaja with minor formatting edits. The content does not necessarily reflect the views of the DailySocial.id editorial team.