DOKU announces $32 million (over 458 billion Rupiah) funding round from Apis Growth Fund II, a private equity fund managed by Apis Partners LLP, a UK-based asset manager that supports growing financial services and fintech businesses. DOKU is Apis Partners’ first portfolio in Indonesia.

DOKU is a subsidiary of PT Elang Andalan Nusantara (EAN), a joint venture owned by Emtek and Alibaba. Based on Emtek’s financial report, PT Kreatif Media Karya (KMK) holds a 55% stake in EAN’s second-tier subsidiary. Furthermore, it is sold to a third party.

The transaction resulted in KMK to lose control in EAN and subsequently stopped consolidating EAN’s financial statements to the Group’s consolidated financial statements.

DOKU will use the fresh funds to accelerate the development of some new offerings for businesses and consumers, as well as to expand the company’s geographical reach in providing access to digital payments for the Indonesian people.

“[..] We believe by supporting such company as DOKU, we will benefit from its proven experience. This collaboration with Apis Partners is a new chapter for DOKU and we are very excited to continue this partnership,” DOKU’s Co-Founder and COO, Nabilah Alsagoff said during a virtual press conference, Thursday (5/8).

In an official statement, Apis Partners Managing Partner and Co-Founder Matteo Stefanel said, “We are delighted to partner with DOKU in Apis Partners’ first investment in Indonesia, which reflects our trust in this country as an investment field. We are delighted to be working with a team that has built a market-leading organization [..],” he said.

In global realm, Apis Partners has several payment gateway startup portfolios, such as EPS (India), DPO (Africa), GHL (Malaysia), Adumo (South Africa), and Codapay (Singapore).

DOKU’s growth

DOKU was founded in 2007 as the sole digital payment player in Indonesia with the most complete payment license from fund transfer, e-wallet, and e-money to customers. The company also has a remittance license, collaborated with partners in neighboring countries to facilitate transfers between countries.

Last year alone, DOKU processed 47 million transactions with a total processed value of $2.9 billion. One of the reasons of the increase transactions was the game vouchers purchase as many people had to stay at home. Furthermore, it also comes from online transportation payments, the result of DOKU’s collaboration with Maxim.

“Game purchasing recorded an increasing number, one of which was due to stay at home policy. Moreover, we are intensifying partnerships with game publishers, such as Unipin, also Google Play, soon to live with TikTok, and Facebook for advertising purchase,” DOKU’s CMO, Himelda Renuat said.

One fascinating data is the surge in newly registered QRIS merchants with 1583% YOY and an increase of more than 30% for the retail, game, and digital content merchant categories.

DOKU’s core business is payment gateway, which contributes as much as 70% to the total service. Apart from that, DOKU’s other businesses are Collaborative Commerce (DOKU Wallet) and Transfer Service (remittance and disbursement).

Last April, the company announced a rebrand for its payment gateway business to “Jokul” with objective to create more familiar approach to users from all business circles, corporations, startups, MSMEs, to individual sellers. Jokul is a slang word in the 90s that means “to sell”. It is said that more than 5 thousand businesses have registered as organic merchants.

The large market of payment gateway

According to research by Mordor Intelligence, the global payment gateway service market has reached $17.2 billion in 2020. It is projected to grow at $42.9 billion by 2026.

In Indonesia, there are several players who provide related services, helping digital businesses to accommodate payments. Among those are Midtrans, Faspay, Xendit, and others.

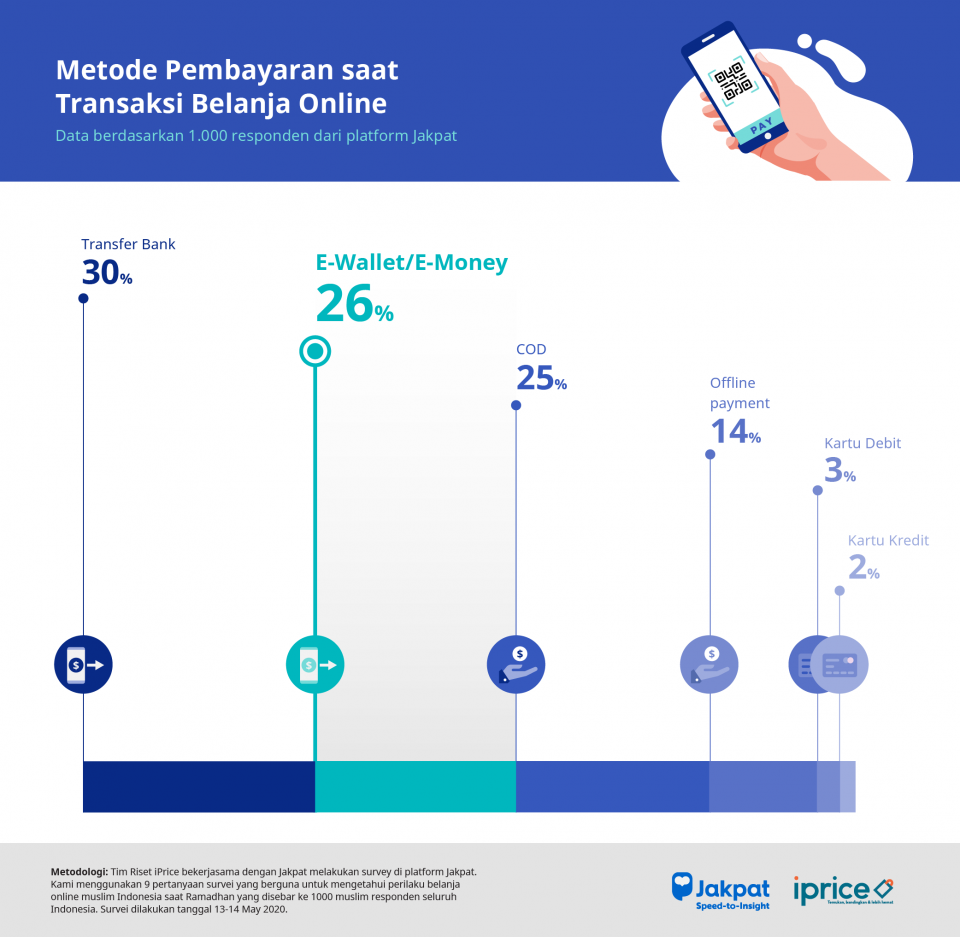

The potential is there and wide, considering that consumers in Indonesia have varied options for their online payment system. According to a survey by iPrice and Jakpat last year, bank transfer still dominates, followed by e-wallet and other payments.

The role of payment gateway service is to provide simplification for developers. Instead of having to do manual integration for each payment system, they can use a ready-made service by plugging the payment gateway API into the application backend.

–

Original article is in Indonesian, translated by Kristin Siagian