The concept of offering stock through crowdfunding or known as equity crowdfunding (ECF) began to emerge in Indonesia. Some new platforms are adopting the concept. There are three startups officially acquired license form OJK per December 2019, namely Santara, Bizhare, and CrowdDana.

Simply put, the ECF platform presents to help business or projects to raise a fund with the crowdfunding mechanism. Then, those who participated (investors) will receive shares with adjusted percentage.

It’s similar to an investment, the ones who “plant” their money into a business or project will eventually receive the outcome. Obviously, with various amounts based on different risks.

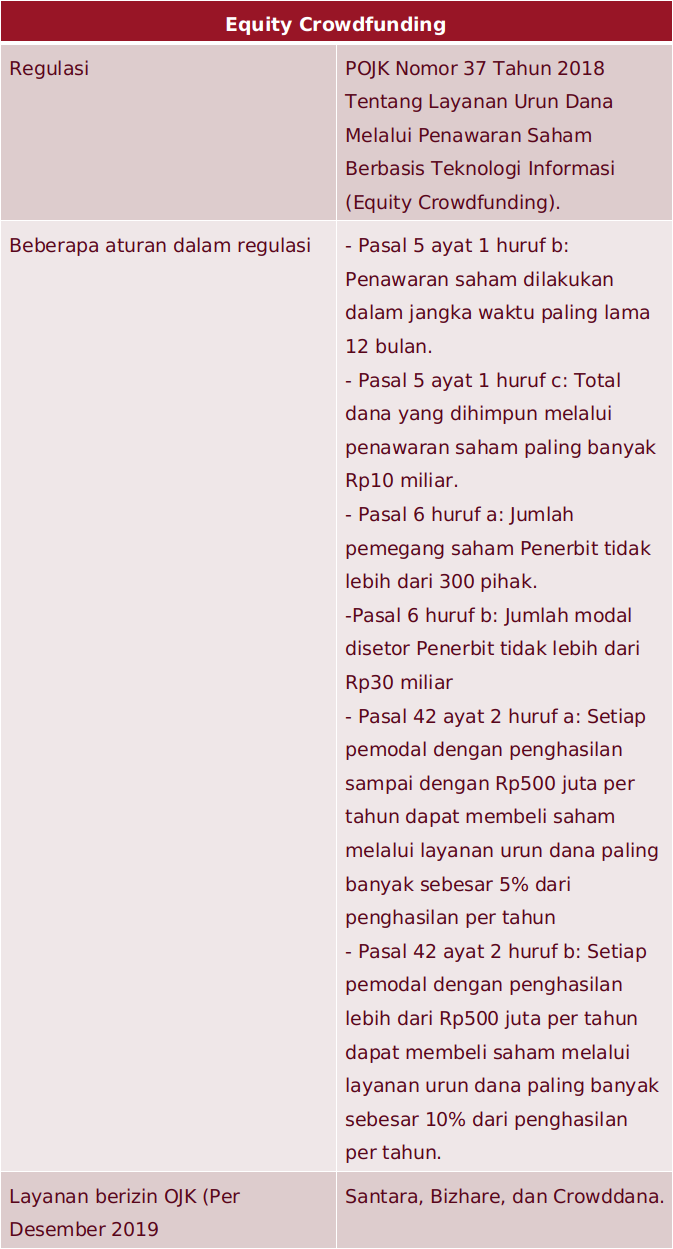

The FSA has already issued regulations regarding the ECF as stated in POJK Number 37 of 2018 concerning Crowdfunding Services through Information Technology-Based Stock Offering. It regulates platforms, investors, and the amount of money raised from crowdfunding.

Further details on the ECF platform in Indonesia

Of the three services which officially obtained OJK license (per December 2019), two of them come with the same concept, namely Santara and Bizhare. Both are creating opportunities for SMEs to offer their shares through platforms and raise funds. Looking for a different market, CrowdDana allows offering shares/investments in property assets to be more affordable.

Santara‘s CEO, Avesena Reza claims that they currently have the largest distribution of funds, investor base, and publishers. However, he did not reveal the exact number. In fact, Santara’s optimism is visible through their plans in 2020.

Starting from building portfolio management, strengthening risk management, network distribution, and adding technology into the execution plans to-do-list.

“We’ve made various improvements in terms of technology, such as user experience, easy access, integration with Dukcapil, collaboration with other technology players. We also plan to implement blockchain technology later this year, as a back-office recording mechanism for all digital assets,” Reza explained.

A similar statement comes from Bizhare‘s Founder & CEO, Heinrich Vincent. He said they already had 35 thousand investors from 34 provinces throughout Indonesia by 2020. The distributed fund has reached Rp27 billion, with total dividends to investors reaching Rp1.5 billion per January 2020.

“Our plan in 2020 is to help more SMEs in Indonesia gain more benefits and rapid expansion, by improving our analysis system while conducting education and utilizing digital technology to assist them. In addition, we will also launch a secondary market feature for investors, to be able to sell their shares, as well as other surprises that we will inform soon,” Vincent added.

Meanwhile, CrowdDana announced two boarding projects successfully funded earlier this year. The value reached Rp14.6 billion and it is likely to increase by now. In their latest interview with DailySocial, they mentioned there will be a new vertical, namely the food and service business.

“From the public and franchise business owners’ responses, the demand is huge. On the investor side, investing in a restaurant or service business is also easier to understand, compared to property. From the publisher [franchise owner] side, they are to expand the business but have no access to financial funding,” CrowdDana’s Co-Founder & Chief Product and Marketing Officer, Stevanus Iskandar Halim said.

The possibility for the ECF industry is getting wide open since some companies have entered the processing stage for a license. One of which is Likuid, an ECF platform that offers stock offering services for creative projects.

Appreciated regulations and education on progress

The regulation issued by FSA is very appreciated by Reza and Vincent. Both agreed on the current beleid is enough to protect the industry, either for investors, platforms, or businesses. However, it still requires coordination to keep the regulation relevant to the current situation in the field.

“To date, the equity crowdfunding regulation in Indonesia is enough to keep all parties fulfilled, from the Providers, Issuers, or Investors. Although there are still some things to improve, especially in terms of adjustment to players on field,” Vincent said.

Meanwhile, Reza said, “In terms of principle, the issuance of POJK 37 is a quite a good step to legitimize that the ECF platform activities are licensed by the regulator or the FSA, not a bulging investment. The regulation that is yet to have its complexity related to the implementation of the ECF is a potential that should be optimized for the organizing platform to innovate / breakthrough in existing business processes.”

Currently, the challenge has been on public education and business owners. In terms of the public, there is an urgency to socialize there are other investment options besides gold, mutual funds, or shares on the stock exchange called equity crowdfunding. Including understanding the existing regulations and risks.

–

Original article is in Indonesian, translated by Kristin Siagian