Investree announced another debt funding worth of $10 million (over 142 billion Rupiah) from responsAbility Investments, a Switzerland based asset manager that focuses on follow-up investments. responsAbility is an investor partner of one of the institutional lenders at Investree, Accial Capital, which first entered as a lender since 2017.

This debt funding will be redistributed to facilitate the financing needs proposed by Investree’s borrower or SME players. For responsAbility, channeling funding to Investree means directly contributing to the United Nations Sustainable Development Goals (SGDs), in relation to limited financial access for SMEs which limits job creation, triggers inequality, and hinders economic development.

Investree’s Co-founder & CEO, Adrian Gunadi said, this is a very big stepping stone for Investree because in its third funding round, Accial Capital invites one of its co-investors, responAbility to participate through the Investree platform.

“In line with responsAbility’s vision and mission as a sustainability investment ‘home’ specializing in impact, we will target funding from the responsAbility-Accial Capital partnership to finance our borrower projects with significant economic, social and environmental impacts on life, especially amidst a recovery period due to this pandemic,” Adrian said in an official statement, Thursday (10/28).

One of Investree’s ongoing projects is to help empower women as ultra-micro traders in the Gramindo ecosystem. These traders have group characteristics, consisting of women without access to banks and running businesses using conventional and sharia schemes. The number has reached 5,700 on the Investree platform.

For responsAbility, this is a unique credit transaction model in Southeast Asia, especially in Indonesia as it is collaborated with Accial Capital to provide financing support to SMEs through the Investree platform.

responsAbility’s Deputy Head of Financial Inclusion Debt, Jaskirat S. Chandha said, “We are very pleased to be able to partner in this innovative structure to provide working capital funding that is urgently needed by SME borrowers in Indonesia. Financial technology is a key driver of financial inclusion. We are delighted to have found the right collaboration at Accial Capital and Investree with the required expertise.”

Investree entering its 6th year

In its 6th year, the company has grown far beyond just a fintech lending company. During 2021, the company has empowered 5 thousand ultra micro women entrepreneurs who need financial support to develop their simple businesses.

Next, partnering with digital freight forwarder Andalin to offer access to customs and tax financing for Andalin clients through Buyer Financing products. This collaboration aims to help ease the burden on clients’ costs so they don’t have to incur large initial costs, therefore, the company’s cash flow management can be optimized.

As of September 2021, Investree booked a total loan facility of Rp 12 trillion, rises 51% yoy from last year, and the value of disbursed loans was Rp 8 trillion. In terms of the number of lenders and borrowers, there were 46 thousand lenders and 6 thousand borrowers at the end of the third quarter of 2021, joined Investree cumulatively. The ratio is 40:60 of the number of individual lenders and institutional lenders that fund.

Investree’s contribution to the fintech lending industry in Indonesia is real.

Investree’s outstanding loans contributed 8.3% to the national productive outstanding loans. As of September 2021, their TKB90 is 98.22% – better than the national average of 93.3%.

Productive sector has quite small portion

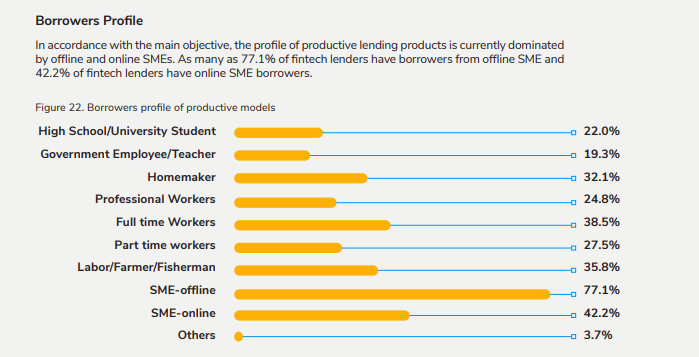

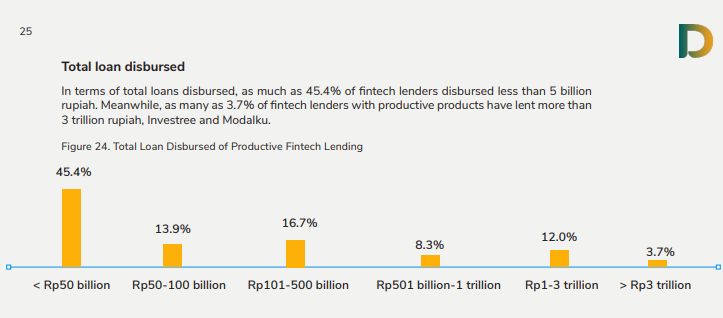

According to reports from DSInnovate and AFPI last year, 36.1 million borrowers in the productive sector borrowed Rp. 2.5 million to Rp. 25 million. Only 17.6% of them borrowed more than Rp500 million. This sector still needs to be further boosted by regulators, especially during this pandemic, many MSMEs still down and need to survive.

–

Original article is in Indonesian, translated by Kristin Siagian