Ayopop fintech payment aggregator rebrands to Ayoconnect and shifting their business focus after securing Pre-Series B funding worth of $5 million (more than 73 billion Rupiah) led by BRI Ventures.

There are some other investors involved in this round, including Kakaku.com, Brama One Ventures, and the previous investors, Finch Capital, Amand Ventures, Strive, and AC Ventures. Overall, the company has raised over $10 million.

Ayoconnect’s Co-Founder and CEO Jakob Rost said this fresh money will be channeled to invest in technology and develop partnership networks to connect billing providers and payment partners, with the trusted basic infrastructure, safe, and fast digital bill payments.

The company is to immediately double the employees, from the current 100 people in Indonesia headquarter and technology centers in India.

“We expect a solid partnership with our previous investors and new investors, which is in line with Ayoconnect’s vision to shape Indonesia’s billing ecosystem into a centralized network,” he explained in an official statement, Wednesday (5/8).

On the occasion, he also announced the appointment of Alex Jatra as the new CFO. He has a strong financial track record with experience working in the private equity industry, venture capital, and served as C-Level at startup, HARA and Dattabot.

One API solution

Rost said, Ayoconnect’s new business focus is the billing network provider (open bill network) with the One API solution that allows billing companies to expand their payment points with minimum effort, while payment partners have direct access to 2500 billing products.

The solution is to answer bill payment industry problems in Indonesia that is mostly offline, separate, and manual. Integration through the API will streamline the process, therefore, consumers will be easier to transact.

In this billing network, Ayoconnect connects bill providers (electricity/water companies, telecommunications, educational institutions, etc.) with online and offline payment partners (including Indomaret, Pos Indonesia, and financial institutions) for customers can pay their bills easier through Ayoconnect network.

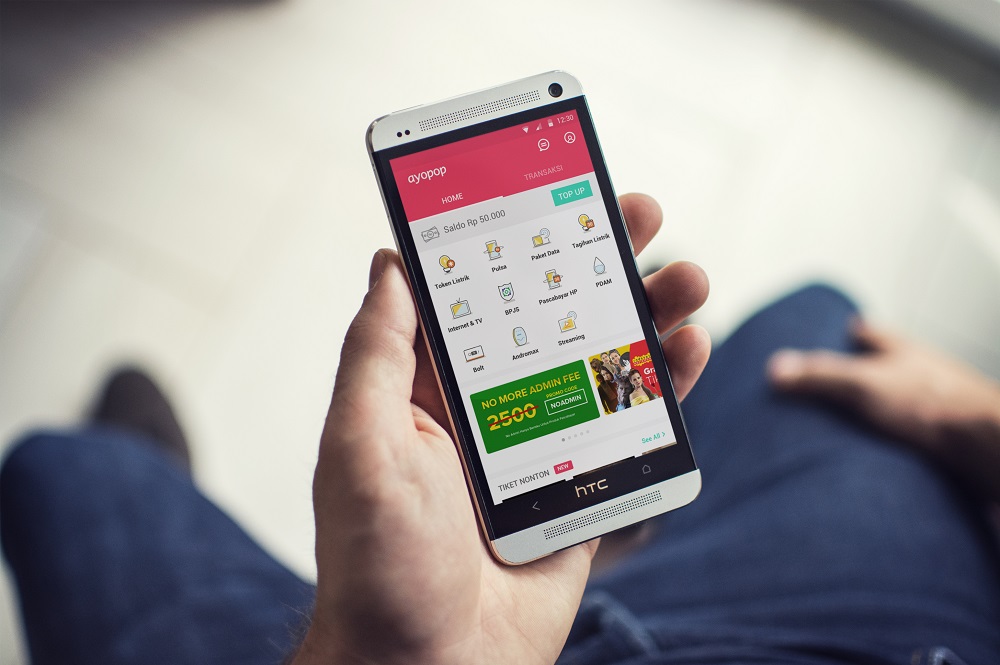

The company has introduced this business model since Ayopop starts operating in August last year. It still uses the name Ayopop Open API. Some previous B2B partners already connected, including Dana, LinkAja, Pos Indonesia, BRI Bank, Permata Bank, Bukalapak, Lazada, and Pegadaian.

“Therefore, we want to clarify that we are no longer just payment aggregators. Payment aggregators are part of the payment products that we offer. We are agnostic to our partners. Moreover, we continue to run the Ayoconnect brand. Ayopop will be part of the Ayoconnect network,” Rost explained separately to DailySocial.

BRI Ventures’ CEO, Nicko Widjaja also added, “Bill payment technology plays an important role in the vertical industry that is currently underserved, and there is a great opportunity in digitizing these sectors.”

Ayoconnect’s Co-Founder and COO, Chiragh Kirpalani mentioned that online bill payments play a big role in the pandemic because consumers prefer to shift into digital. One ongoing solution is the Billing Reminder which has been proven to help partner companies, such as Bank Mandiri Card Division and other financial institutions, do auto-debit for bill payments.

Until July 2020, the company has processed more than 40 million payments through 600 billing networks and 40 payment partners. The number of transactions recorded an increase of 400% in a period of six months during the first six month period this year.

In March, the Open API business contributes around 80% of the gross transaction value (GTV). In fact, the company only started in November of last year.

“We will remain dedicated to bill payments yet build more B2B technology for value-added solutions for us to provide to bill providers and channels. We are currently pursuing very broad (blue ocean) categories, there are hundreds of thousands of micro-billers, therefore, we need to build partnerships and improve the technology required to drive digitalization in that area,” Rost concluded.

–

Original article is in Indonesian, translated by Kristin Siagian