Crypto-asset earning platform Blocknom announced to temporarily halt its services from July 1, 2022. Blocknom did not specify the reason, however, it is said to consider the market situation and government regulations. On the other hand, the company is yet to have an operational permit or authority license, in this case from CoFTRA.

In its blog post, Blocknom’s management said to discontinue support for Decentralized Finance (DeFi), for which daily interest on USDT, USDC, and XIDR will also stop accruing.

“At this time, we advise you to withdraw your assets from the platform as soon as possible. You need not worry because your assets are safe. Please withdraw all your assets before July 31, 2022,” stated on the post.

According to management, the platform has stopped accepting new users and deposits since June 20, 2022. In order to simplify the asset withdrawal process, it appeals to users to immediately withdraw assets before July 31, 2022. After that, it is most likely that withdrawals will only be made via offline CS.

“We will come back stronger with more services as soon as we get our license. Please wish us luck.” Blocknom team stated.

Recently, crypto asset management services have risen in Indonesia. This is in line with the increasing number of people diversifying into this virtual currency. According to CoFTRA, as of February 2022, there are an estimated 12.4 crypto investors.

Aside from Blocknom, with a unique mechanism, several startups also offer crypto-earn services, including NOBI and Finblox. Both have received equity funding support from venture capitalists.

Recently secured funding

For a general note, Blocknom was initiated in January 2022 by former Gojek & Shopee employee Fransiskus Raymond and former engineer Ritasi Ghuniyu Fattah Rozaq. Blocknom is known to be one of the incubation startups in the Y Combinator batch Winter 2022.

Blocknom has recently secured seed funding of $500,000 or over IDR 7 billion from three investors, including Y Combinator, Number Capital, and Magic Fund last March.

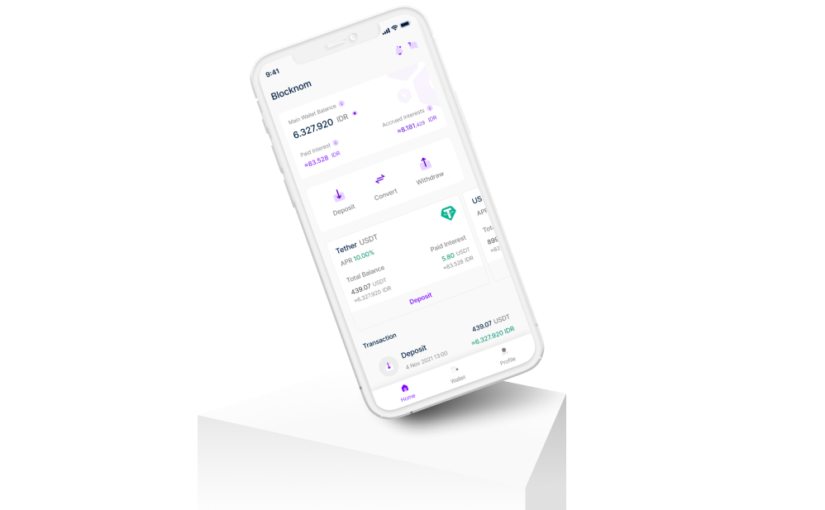

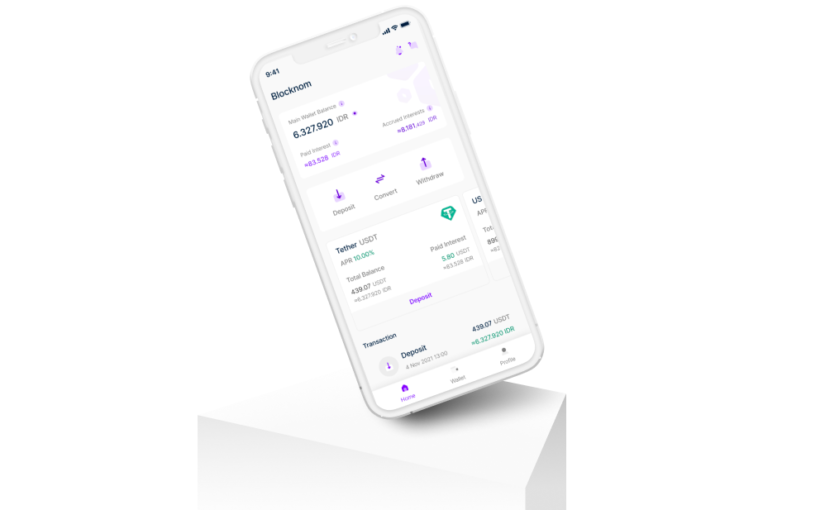

In increasing the added value to its platform, Blocknom offers deposit yields on stablecoin-based crypto assets, namely USDT (Tether), USDC (Circle), and XIDR (StraitsX).

In addition, Blocknom applies transparency to the fund management process and has proof of a community system in the DeFi selection process for managing investor funds, and unlimited incentive programs for its community.

Since the last few months, Indonesia’s digital ecosystem has been hit by a bubble burst phenomenon due to global situations and conflicts. Crypto asset prices are also reported to continue to fall, including Bitcoin and Ethereum.

–

Original article is in Indonesian, translated by Kristin Siagian