Baru-baru ini, Garibaldi ‘Boy’ Thohir resmi menggenggam saham PT Tri Adi Bersama (Anteraja) sebesar 10 persen senilai Rp70,55 miliar. Kini, Boy Thohir kembali dikabarkan akan membeli 5-10 persen saham milik PT Autopedia Sukses Lestari Tbk (IDX:ASLC).

Baik Anteraja dan Autopedia sama-sama merupakan anak usaha dari PT Adi Sarana Armada Tbk (IDX: ASSA). Sementara, Boy tercatat sebagai Komisaris Utama PT GoTo Gojek Tokopedia Tbk (IDX: GOTO) yang mana juga baru saja resmi melantai di Bursa Efek Indonesia (BEI).

Akuisisinya terhadap saham Anteraja otomatis membawa perusahaan logistik tersebut ke dalam ekosistem raksasa milik GoTo. Tentu aksi korporasi ini akan sejalan dengan strategi hyperlocal yang tengah digenjot oleh GoTo.

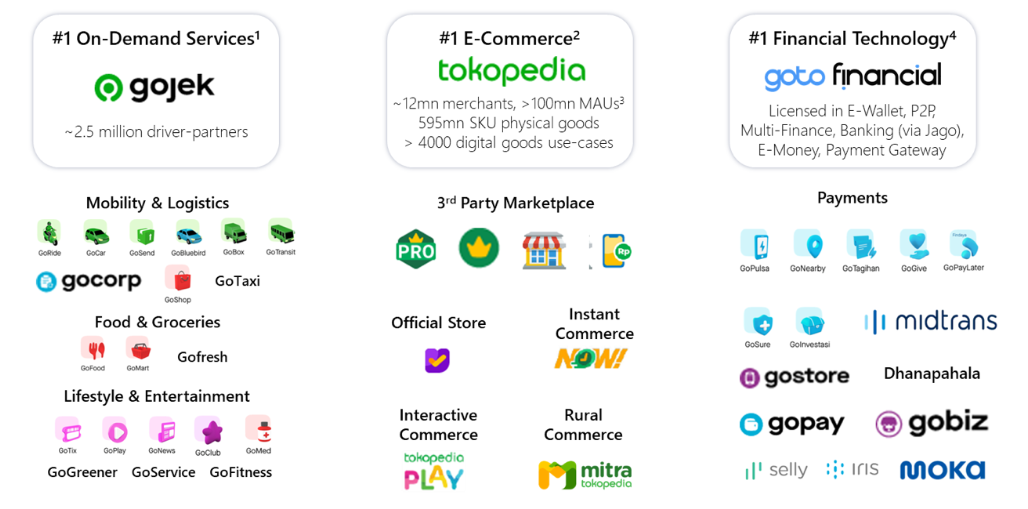

Berdasarkan paparan publik beberapa waktu lalu, Co-founder dan CEO GoTo Andre Soelistyo menyebut akan menggunakan dana IPO untuk mengeksekusi strategi hyperlocal lewat tiga anak usaha, yakni Gojek (ride-hailing), Tokopedia (e-commerce), dan GoTo Financial (fintech). Pada lini ride-hailing dan e-commerce, logistik memainkan peran yang sangat penting.

Lalu bagaimana dengan Autopedia?

Penjualan mobil O2O

Jika melihat model bisnisnya, Adi Sarana saat ini punya posisi kuat di sektor otomotif lewat tiga pilar bisnis, yakni JBA Indonesia, Caroline.id, dan Cartalog.

JBA merupakan platform lelang kendaraan, baik online maupun offline, yang didukung 34 jaringan lelang offline di seluruh Indonesia. Sebagian besar menyasar B2B yang melibatkan perusahaan pihak ketiga, yakni pembiayaan dan diler. Cartalog adalah platform untuk engine berbasis teknologi AI yang menyediakan daftar harga kepada seluruh pemain di industri otomotif, khususnya penjual dan pembeli mobil bekas.

Kemudian, Caroline.id adalah marketplace C2C dan B2C yang menghubungkan pembeli dan penjual mobil bekas dengan harga transparan. Melalui platform ini, penjual dapat mengirimkan appraisal untuk menilai, melakukan listing, dan memproses mobil yang akan dijual. Di ranah B2C, Caroline.id bersaing dengan sejumlah pemain, seperti Carro, OLX, dan Carsome.

Per kuartal ketiga 2021, JBA Indonesia telah melelang sebanyak 75.000 unit kendaraan, lebih dari 20.000 pengguna, dan lebih dari 50.000 unduhan di Google Play Store. Caroline mencatat transaksi lebih dari 100 unit mobil, dan memiliki 1.000 unduhan aplikasi di Play Store, sedangkan Cartalog masih 5.000 unduhan.

Berdasarkan wawancara dengan DailySocial.id tahun lalu, Direktur Adi Sarana Armada Jany Candra mengatakan tengah fokus memperkuat digitalisasi pada tiga pilar bisnisnya dan meningkatkan ekosistem otomotif berbasis digital yang terintegrasi dengan teknologi terkini. Autopedia juga tengah membidik untuk menjadi O2O untuk mobil bekas lewat brand Caroline dan JBA.

“Saat ini, kami masih fokus untuk mengembangkan bisnis yang sudah ada dan memperkuat fundamental perusahaan dengan melakukan inovasi-inovasi teknologi berbasis digital. Namun, kami masih harus lihat perkembangan bisnis ke depan jika bicara kemungkinan kolaborasi dengan platform yang punya ekosistem digital besar,” ujarnya kepada DailySocial.id.

Jika benar masuk ekosistem GoTo, skenario yang cukup memungkinkan adalah mengintegrasikan layanan yang dimiliki Adi Sarana ke platform Tokopedia yang juga sudah merambah ke penjualan mobil baru maupun bekas. Ekosistem raksasa yang dimiliki GoTo memungkinkan Adi Sarana untuk memperluas channel penjualan mobilnya.

Salah satu kolaborasi Tokopedia yang sudah berjalan adalah bersama Carro. Carro mencatat tren pembelian mobil secara contactless mengalami peningkatan 100% dari bulan ke bulan. Per September 2020, sebanyak tiga dari sepuluh mobil terjual, terjadi secara contactless.

Selain itu, platform car marketplace juga bisa menjadi alternatif bagi mitra pengemudi Go-Car yang mungkin membutuhkan bantuan pengadaan armada. Seperti diketahui, platform serupa Autopedia biasanya juga bekerja sama dengan lembaga pembiayaan untuk pembelian mobil bekas — atau kegiatan tukar-tambah.

Bisnis car marketplace berkembang pesat

Di Indonesia, bisnis car marketplace berkembang dengan baik dengan model bisnis C2B2C. Beberapa platform yang telah melayani pasar ini di antaranya Carsome, Carro, Moladin, OLX Autos, sampai dengan yang paling baru ada Broom. Selain memberikan platform, mereka juga bertindak untuk membeli dan menjual mobil bekas langsung dari/ke pelanggan.

Di industri jual-beli kendaraan bekas memang masih ada sejumlah tantangan klasik yang dihadapi pelakunya. Mulai dari fragmentasi pasar, transparansi harga, inventarisasi produk, sistem inspeksi, sampai dengan kemudahan dalam pembiayaan. Setiap bermain berlomba-lomba untuk menyajikan solusi terbaik dalam menyelesaikan isu tersebut.