PT Bank Permata Tbk (PermataBank) officially introduced a trade finance services using blockchain technology. It is said that PermataBank is the first bank to serve trade finance transactions using blockchain technology in Indonesia.

In order to deliver blockchain, PermataBank is collaborating with Contour Network, which is a technology network provider company for global trade finance. In Southeast Asia, some banks have been using Contour technology, including HSBC, Standard Chartered Bank, and Bangkok Bank.

Trade finance is a financing facility for domestic and international trade transactions. The use of blockchain allows data transactions to be carried out in a decentralized system in real-time with the concept of a distributed ledger.

PermataBank’s Wholesale Banking Director, Darwin Wibowo said, the blockchain adoption is PermataBank’s step to answer customer needs through digitizing its various services and navigating the national payment system with technology.

Moreover, he thought the trade finance transactions are very conventional that they are less efficient and often take a long time. The process got even more complicated when the Covid-19 pandemic occurred. Social and activity restrictions have an impact on delays in transaction procedures.

He said, blockchain implementation will facilitate global trade transactions to the issue of the letters of credit (L/C). With its advantages, blockchain is considered capable of saving transaction time, minimizing the risk of fraud, and simplifying complex processes that have been a major challenge in trade finance transactions.

“Also, blockchain technology will expand PermataBank’s service range. Trade finance customers can also make transactions without having to come to PermataBank branch offices,” Darwin said.

Meanwhile, Contour’s CEO, Carl Wegner added that global trade plays an important role in the Indonesian economy. However, manual trade finance transactions have hampered trade growth. Therefore, Contour’s involvement in the trade finance facility at PermataBank is expected to open access to communities around the world.

Transformative technology for commerce

Based on the 2020 Global Trade Survey report released by the International Chamber of Commerce, trade and finance activities in the world are on the verge of uncertainty due to Covid-19.

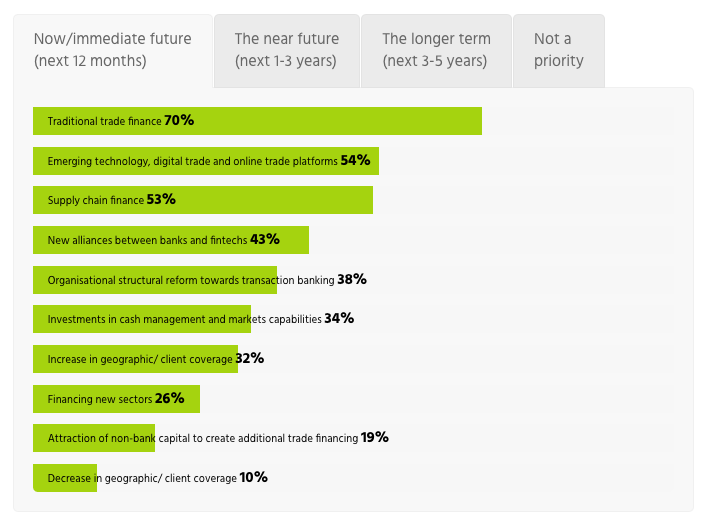

Based on the survey results of 346 banks from 85 countries in the world, respondents expressed their concern about the decline in the growth of trade finance transactions. However, respondents think that the lockdown and WFH activities have actually accelerated the transition of trade to digital platforms, one of which is through blockchain technology.

As many as 54% of respondents said transformative technology is its priority area of development and strategic focus in the short term as companies want to ensure future growth. According to respondents, digital technology can spur greater transformation opportunities in the global financial industry, which is still synonymous with paper-based manual processes.

In her writing, R3’s Head of Trade and Supply Chain, Alisa DiCaprio said that trade finance activities are among the most difficult to modernize. The reason is, the transaction still involves many paper-based manual processes which are considered no longer suitable in the digital era. According to Asian Development Bank (ADB) data, nearly $1.5 trillion of trade finance applications were rejected because of inefficiencies.

She observes that blockchain is having tangible results in reducing costs, risks, and potential delays for parties involved in trade finance transactions. With effective implementation, blockchain could potentially unlock $1.5 trillion in global trade finance.

–

Original article is in Indonesian, translated by Kristin Siagian