CICIL fintech lending platform expands its business to close loop financing for MSME productive loans. This is the first partnership for both companies in developing the financing product.

CICIL’s Co-Founder & CEO, Edward Widjonarko said this diversification strategy is part of the company’s innovation in developing its services. Although the company still focusing on education financing since it was first established in 2016.

“This step opens up an opportunity for us to be able to diversify our market segments and services to encourage inclusive and responsible productive financing,” Edward said to DailySocial.

In a series of education financing products, he continued, CICIL has four financing products, tuition fees (CICIL Tuition), college supplies (CICIL Barang), course financing and certification (CICIL Learning), in collaboration with various edtech platform services.

“Besides funding for students, we have also developed financing for institutions (CICIL Institutions), especially for university level, schools, and course institutions to fulfill the required cost of developing digitalization of campus infrastructure.”

Furthermore, to launch a non-financing feature, CICIL Jobs aiming to help students with side jobs that can help them pay off their education installments independently. Furthermore, CICIL Learns to provide a wide selection of course, training, and certification vouchers.

Currently, CICIL has distributed more than 85 thousand education funding for students across 260 universities in 57 cities by maintaining TKB90 at 97.8%. With a combination of all products, he attempts to achieve financing distribution of up to Rp300 billion by the end of 2021.

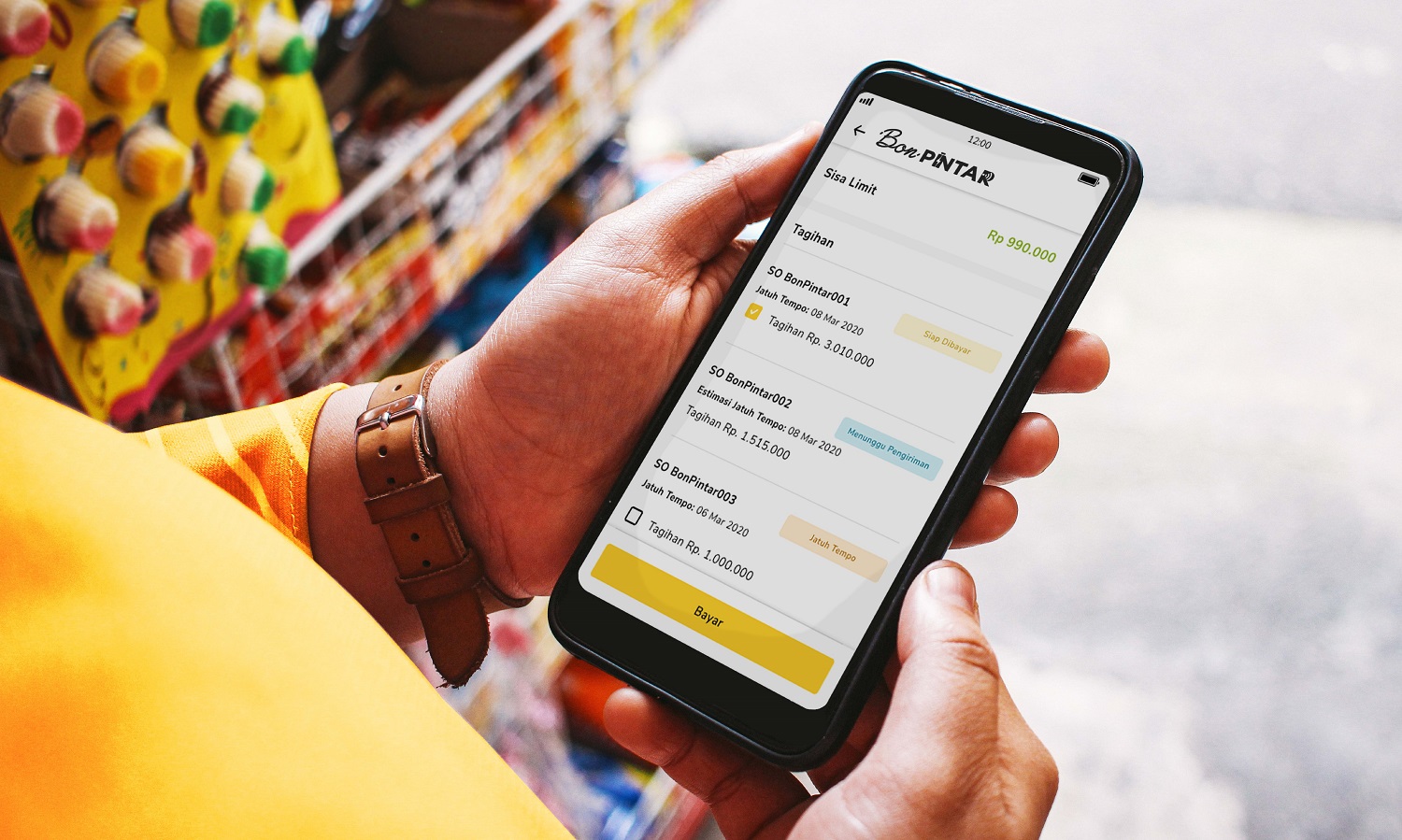

Bon Pintar (Smart Bill)

Along with Warung Pintar, CICIL developed Bon Pintar, a payment method solution for shop owners to buy goods right away and make payments when they are due (buy now pay later) on the e-commerce platform.

By utilizing transaction history data and application usage, Warung Pintar facilitates its users to increase stock without having to seek additional capital from outside the ecosystem.

The mechanism is fairly simple, it’s through the Warung Pintar application, from submission, verification, to the use of the funds. After passing the verification, the shop owner can immediately restock and pay the bill 14 days later.

The shop’s business is said to be more efficient because the Warung Pintar application is getting more functional to provide all the needs of a warung, from stock fulfillment, product tracking, monitoring stall performance, and access to capital.

Warung Pintar’s Group CEO, Agung Bezharie said, Warung Pintar as a platform aims to view the needs from stall entrepreneurs standpoint, while in this challenging situation, getting additional capital to increase stock or widen stock options is a pain-point for almost all Warung Pintar partners.

“CICIL has the same vision to provide loan products for MSMEs. [..] Within a few weeks of being launched, thousands of shop owners have been helped by Bon Pintar’s services. We continue to bring the spirit of mutual cooperation to continue to grow this service, therefore, it is to rise with the half million shop owners on our platform,” Agung said in an official statement.

He explained, each stall gets a different capital size according to the shopping history data and activities in the Warung Pintar application. After obtaining permission from the shop owner, transaction data will be used as a credit score to be developed along with CICIL. Moreover, Warung Pintar can minimize the risk of late payments.

Warung Pintar is targeting 150 thousand active Juragan (stall owners in Warung Pintar) can use Bon Pintar services. In the future, Warung Pintar will continue to strengthen its strategic partnership to continue providing financial solutions that can broadly reach shop owner.

Edward agreed on this. He expects that Bon Pintar can be the beginning for CICIL to expand its close-loop financing services similar to other companies with intention to develop productive financing services for partners in its ecosystem.

“Especially in collaborating with Warung Pintar, we expect CICIL can continue to collaborate closely with Warung Pintar to provide more comprehensive financing service innovations for stall partners, not limited to Bon Pintar financing,” Edward said.

–

Original article is in Indonesian, translated by Kristin Siagian

![[Kiri-kanan] CFO dan Co-Founder Cicil Edward Widjonarko, Managing Partner East Ventures Wilson Cuaca, dan CEO Cicil Leslie Lim / DailySocial](https://cdn-ds.kilatstorage.com/wp-content/uploads/2016/11/Kiri-kanan-CFO-dan-Co-Founder-Cicil-Edward-Widjonarko-Managing-Partner-East-Ventures-Wilson-Cuaca-dan-CEO-Cicil-Leslie-Lim-DailySocial.png)