Platform pembayaran dan dompet digital OVO hari ini (26/1) meluncurkan fitur terbarunya “Invest” bekerja sama dengan Bareksa dan Manulife. Reksa dana pasar uang menjadi produk pertama dari sinergi ini, menargetkan kaum milennials yang baru mulai menjajaki dunia investasi.

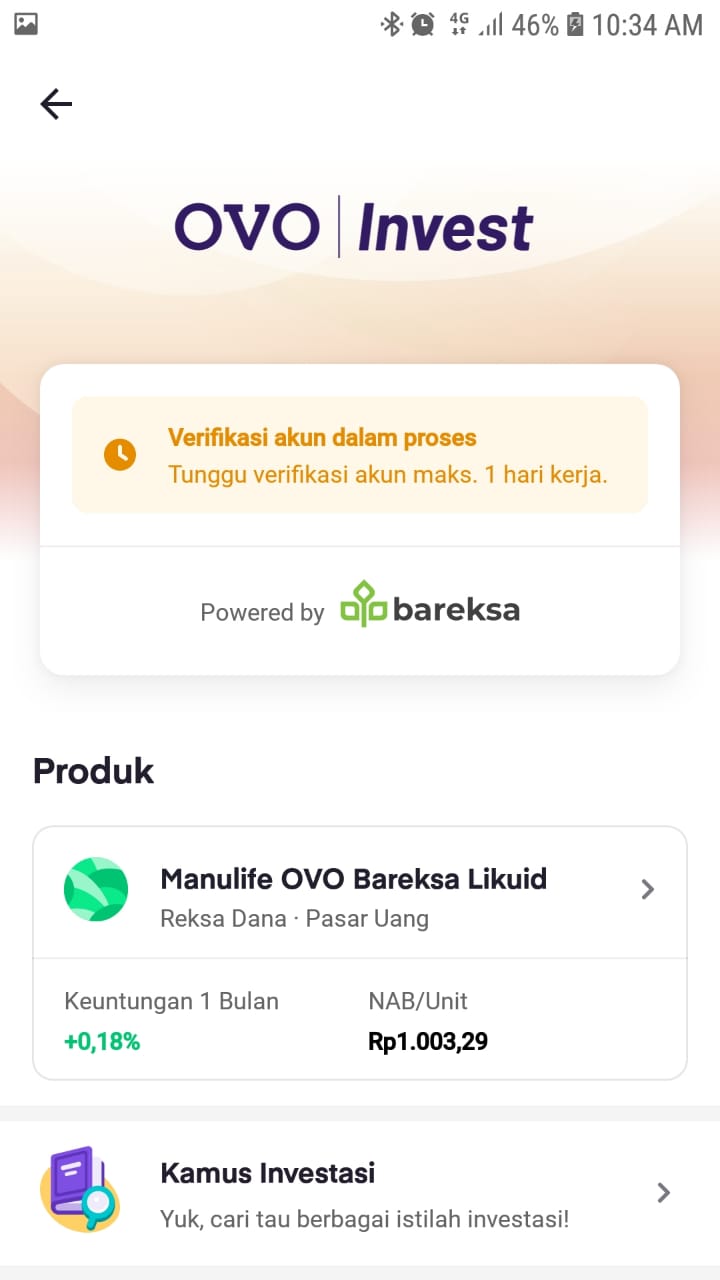

Presiden Direktur OVO sekaligus Co-Founder/CEO Bareksa Karaniya Dharmasaputra mengungkapkan, “Peluncuran fitur Invest adalah bagian dari komitmen kami untuk membuka akses yang terjangkau, terpercaya, dan nyaman dalam pengelolaan investasi, khususnya bagi investor pemula. Produk yang kami sediakan secara eksklusif di platform OVO adalah reksa dana pasar uang Manulife OVO Bareksa Likuid (MOBLI) yang dikelola oleh Manulife Aset Manajemen Indonesia, salah satu perusahaan manajemen investasi terbesar di dunia.”

Mengacu pada data Otoritas Jasa Keuangan (OJK), Indeks Inklusi Keuangan di Indonesia saat ini mencapai 76,2 persen. Sementara tingkat literasi keuangan menunjukkan angka yang masih rendah yaitu sebesar 38,0 persen dengan hanya 1,7 persen yang masuk ke area pasar modal. Untuk menjawab tantangan dan permasalahan tersebut, OVO didukung Bareksa sebagai Agen Penjual Efek Reksa Dana (APERD) menciptakan terobosan baru dengan melakukan integrasi e-money dan e-investment.

Sebelum ini, beberapa platform investasi juga lakukan integrasi dengan berbagai layanan digital konsumer. Misalnya yang dilakukan Pluang dengan masuk ke ekosistem Dana dan Gojek. Bahkan saking tingginya minat pasar terhadap investasi reksa dana, Bukalapak juga telah membentuk unit usaha tersendiri yang fokus ke segmen tersebut.

“Sebagaimana halnya kita lihat pada integrasi Alipay dan Yu’e Bao di China, yang telah mencatatkan sukses besar dalam mengenalkan investasi reksa dana secara masif di kalangan milenial. Dalam mengembangkan terobosan ini, kami telah berkonsultasi dengan Bank Indonesia (BI) dan OJK. Untuk itu, kami berterima kasih atas dukungan BI dan OJK yang pro-inovasi dan visioner dalam pemanfaatan tekfin bagi peningkatan inklusi keuangan dan pendalaman pasar keuangan kita,” jelas Karaniya.

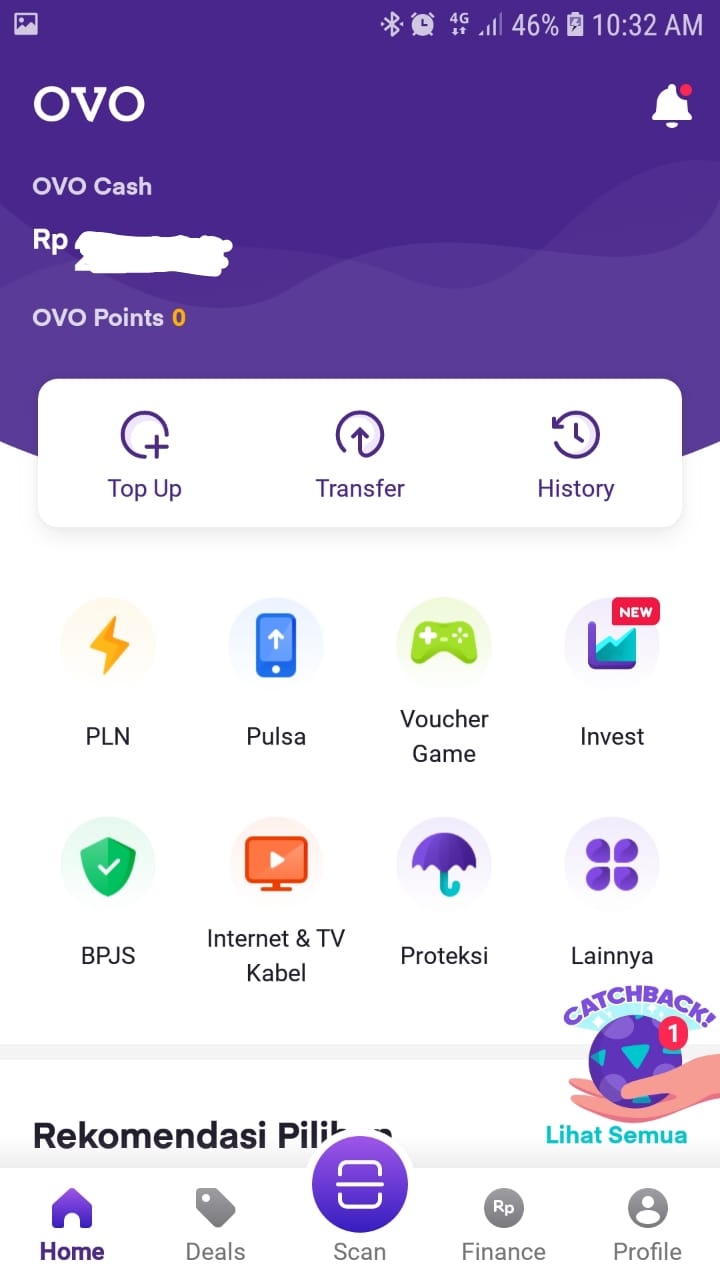

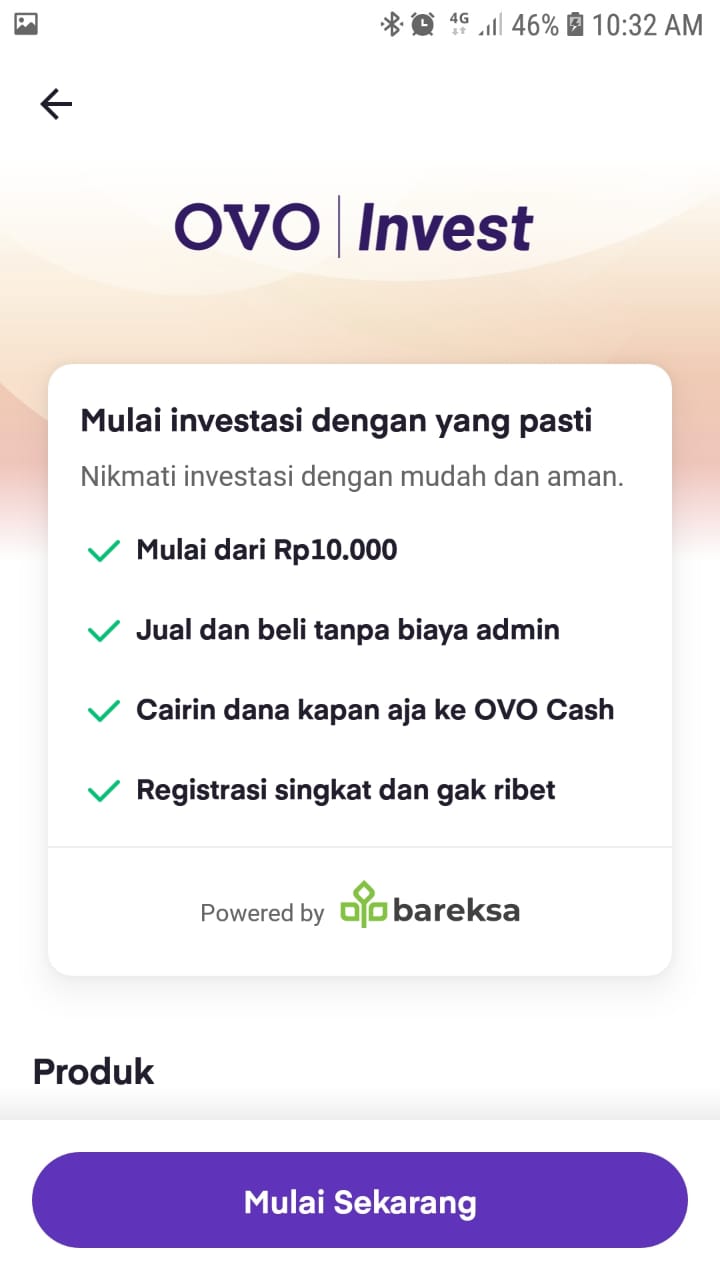

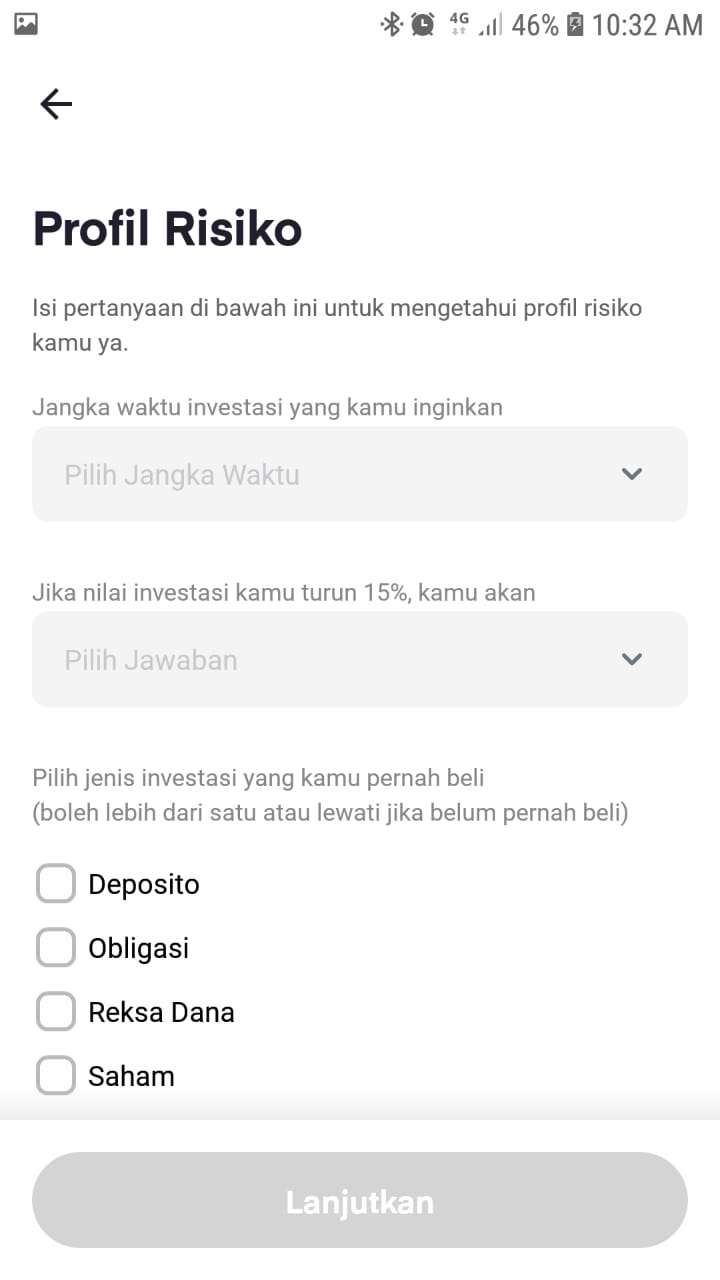

Reksa dana pasar uang MOBLI tersedia secara eksklusif di aplikasi OVO. Para pengguna yang sudah memperbarui layanan akan menemukan fitur “Invest” di halaman utama OVO. Setelah masuk ke dalam fitur “Invest”, pengguna hanya perlu mengisi profil resiko serta menunggu proses verifikasi dan bisa langsung mematok nominal yang ingin di-invest mulai dari Rp10 ribu.

Selain menawarkan kemudahan dan kenyamanan bertransaksi [belanja, membayar tagihan, dll] dan berinvestasi dalam satu platform, keunggulan lainnya adalah proses pencairan instan, yang memungkinkan investor dapat mencairkan investasi mereka langsung ke saldo OVO Cash.

Salah satu Financial coach yang ikut hadir dalam acara peluncuran OVO “Invest”, Philip Mulyana turut menyatakan bahwa investasi reksa dana juga dapat menjadi salah satu opsi tabungan dana darurat yang baik untuk investor pemula. Pertimbangannya adalah reksa dana pasar uang merupakan salah satu instrumen investasi yang paling aman namun memberikan retur yang lumayan.