HiPajak was developed into one-app tax assistance to help users for tax report, calculation, return, and consultation. Appears in a form of website and application, the platform was made of AI-based chatbot. Although it’s robot-assistant, it was designed with a lay language for easy understanding.

It’s not a random decision, the service was developed based on the founder’s experience to manage taxes. She believes other people sometimes have difficulty to manage their taxes.

“It starts when I help a family business, we had some issues with tax payment. It’s a simple matter, we lost the bill and got charged, although we’ve paid the tax. I thought, how can this country get further with this kind of unresolved issue. After that, I come up with the idea to develop HiPajak,” HiPajak’s Co-Founder and CEO, Tracy Tardia to DailySocial.

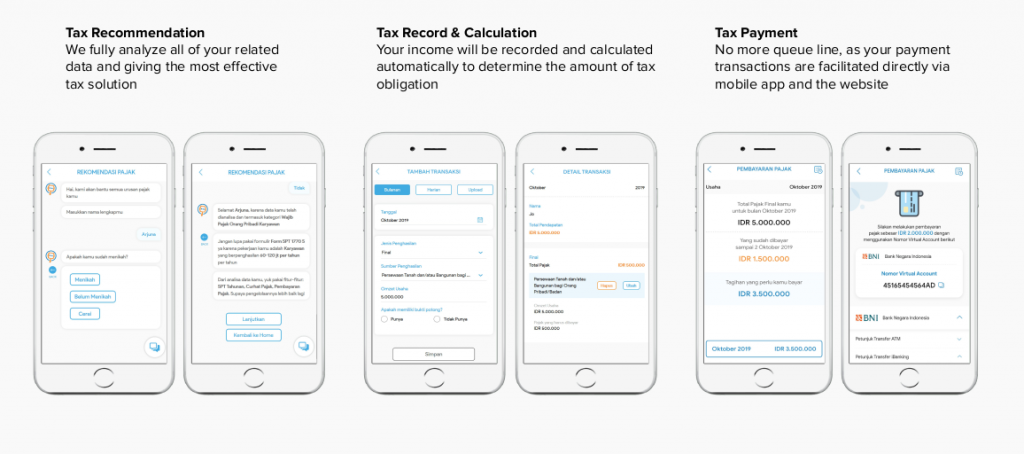

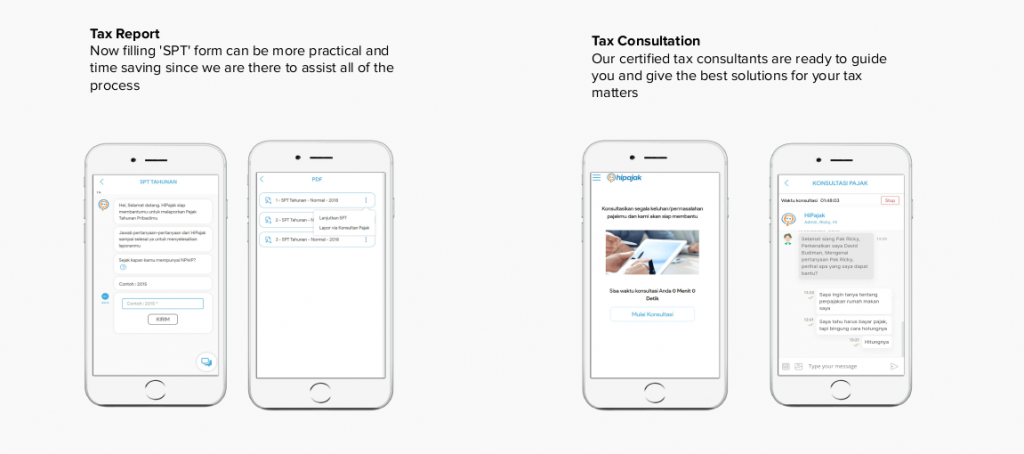

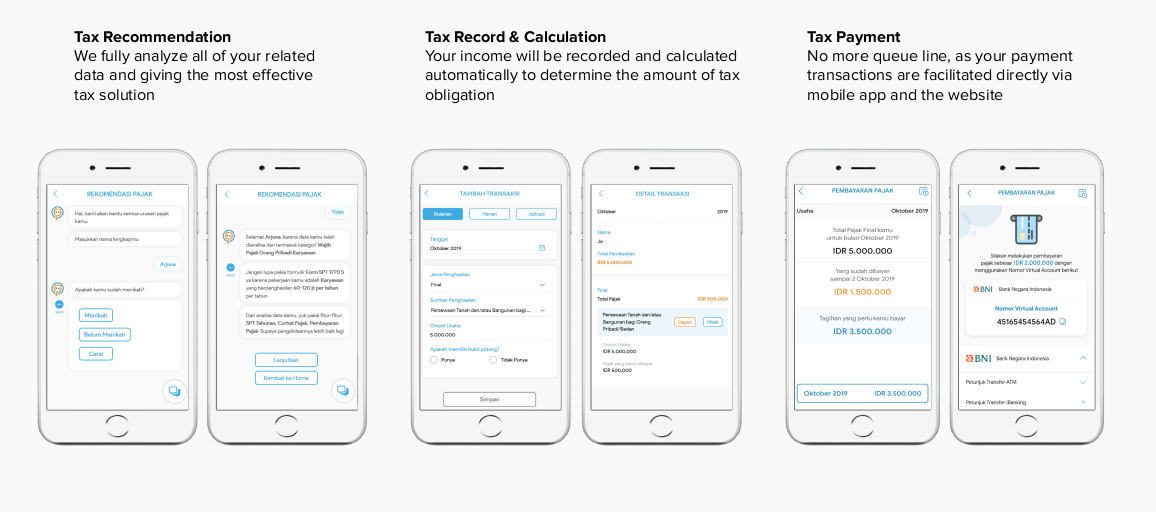

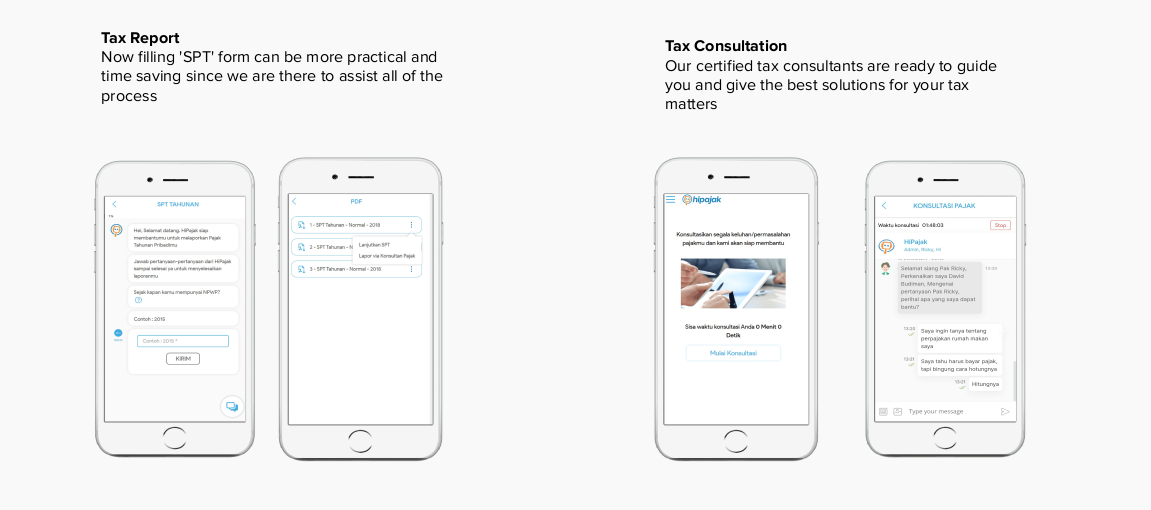

In practice, after downloading and login into the app, users will be required to answer several questions. Moreover, the system will analyze the tax position and provide further assistance. Next, reporting, calculating, payment and return can also be processed in the platform.

“As the one-app tax assistance, we provide administrative assistance such as filling out documents, consulting to tax planning. All consultants are certified,” Tardia said.

Business model and features

The founder’s aware of some similar digital services in Indonesia. It includes OnlinePajak, KlikPajak, Pajakku, MitraBijak, and others. There are also other tax consultants running a non-digital business, either an individual or as a group.

For this reason, HiPajak relies on business models and features in the application. Aside from chatbot as the main differentiation, they also rely on the freemium model, they also offer free and subscription packages. Automation also expected to provide quick answers and recommendations to users. They also claim to be a low-cost service while still providing personalized recommendations to each user.

Since the soft-launching on November 5, 2019, the HiPajak application has been used by around 500 users. Paid features that are currently the most used by users for tax consultations. Currently, it is still in the process of filing to become an official partner of the Director-General of Taxes.

“In the first quarter this year, we focused on non-employee personal income taxes such as freelancers, Youtubers, SMEs, content creators and others. Next, we will soon make a campaign for #satujutaSPTbaru. Further product development is to submit a proposal for PJAP to DGT and develop corporate income tax and regional tax features,” she added.

Tardia, with two other co-founders in HiPajak, Sukmanegara (CTO) and Enda Nasution (CMO). In its debut, they still running the business in bootstrapping.

Digital tax services in Indonesia

Considered as a SaaS category, a platform to assist tax management has quite large market share in Indonesia. Not only for a large number of workers, but there are also approximately 31 million taxpayers each year, the government intends to maximize tax revenue.

Due to large opportunities, digital players are tightening strategy to win the market. Towards the end of 2018, OnlinePajak secured Series B funding worth of 379 billion Rupiah. The additional capital is to be used for the development of AI-based features and blockchain.

While another platform, KlikPajak chooses to consolidate with other SaaS startups, such as Talent, Sleekr and Journal. They are now present as Mekari, providing comprehensive services to help SMEs manage their business digitally.

–

Original article is in Indonesian, translated by Kristin Siagian