The personal financial app Finku announced seed funding of $2.8 million (over 40 billion Rupiah) from B Capital Group. Global Founders Capital and Thrill Capital are involved as co-lead investors. Also participated in this round, Golden Gate Ventures, Goodwater Capital, Alto Partners, and the founders of BukuWarung and Xendit.

On a general note, Global Founders is Finku’s pre-seed investor, along with 500 Startups in August 2021. This latest round’s value is still undisclosed.

The company is to use the fresh money for more diverse product innovations and team expansion to empower more Indonesians. The company is soon to launch a consumer credit product. In the future, Finku is to combine several credit advantages, including low interest rates, cost transparency, with a set of personal finance features to facilitate credit access in a more responsible way.

In an official statement, the company said to take advantage of the increasing number of e-wallet users to access digital payments in Indonesia. The reason is, to build a more resilient and inclusive society in terms of financial, they must have access, ability, and independence to manage finances regardless of income background.

B Capital Group’s Principal, Ayu Tanoesoedibjo said, “We believe that Finku has produced a high-quality product that digitally transforms the personal finance space with a user-centric, highly intuitive, and easy-to-use mobile application for the general public.

“Finku’s ability to reach hundreds and thousands of users in the following months after its launch is a proof to the vast market potential and the team’s passion, commitment and perseverance to achieve the company’s vision. We are excited to support this effort and can’t wait to see them reach more milestones in the future,” Ayu said, Friday (13/5).

Finku’s growth

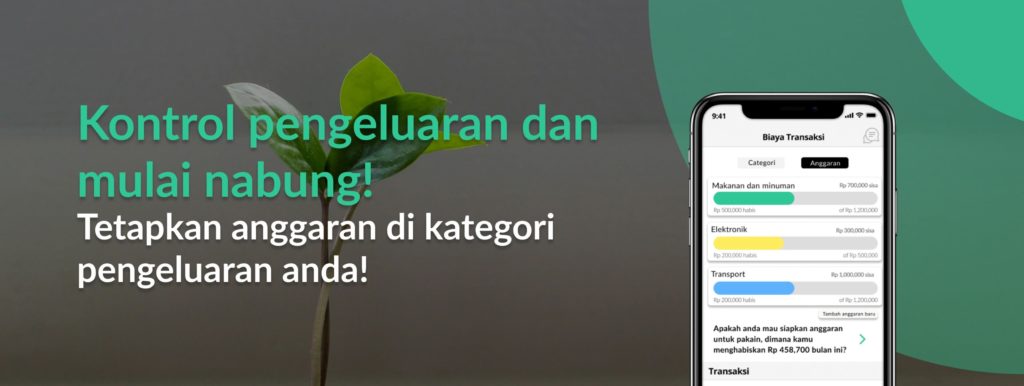

Finku was launched last year, founded by Reinaldo Tendean, Shyam Kalairajah, and Shylla Estee. The app offers users greater access to finance and financial management expertise, through apps that automate expense tracking and personal budgeting, as well as providing personalized financial advice according to their spending habits.

This allows users to track their transactions through bank, e-wallet and investment accounts more easily, as Finku has streamlined their daily financial management processes. This application can automatically collect and calculate various financial data to produce a real-time figure.

The Finku app feature also allows users to create financial plans that can be automatically divided into more than 28 categories. The app also illustrates graphs and reports, billing, and subscription management features.

A consumer credit product that will be released in the near future, allows users to access credit facilities for their daily needs. This access to credit serves to increase users’ financial capacity and ability in daily life to a certain extent that will not cause problems in their finances.

To date, Finku has more than 350 thousand application users. It is claimed that last year it grew exponentially, ranking 7th for the financial application category in the Apple Store Indonesia. Finku is also part of the 15 startups selected to participate in the Startup Studio Indonesia accelerator program.

–

Original article is in Indonesian, translated by Kristin Siagian