Grab, through Grab Financial Group, getting deeper on fintech service followed by strategic partnership which has been announced since last year. However, most services are available in Singapore and to be distributed to other countries where Grab business run, including Indonesia.

The leading fintech service is included in a roadmap titled “Grow with Grab”. There’s also the latest online payment method called “Pay with GrabPay” for online merchants. The online website receiving this code are Qoo10 and 11Street, both are the biggest e-commerce players in Singapore and Malaysia.

Next, the integration of “Pay with GrabPay” with cashier machine (POS) of offline merchant without having to change their old devices. The Coffee Bean & Tea Leaf and Paris Baguette are to be the pilot project.

In terms of fintech lending, the result of JV with Credit Saison, Grab is now provide “Pay Later” with two main function. First, the service allows consumers to pay Grab at the end of the month without additional cost. Second, as the virtual credit card that allows consumers to have installments with certain tenor and 0% interest.

“Both products are given to Grab users who deserve the historical credit. Grab Financial Group set the credit risk based on a series of criteria, including the duration of using Grab, its frequency, and spending pattern,” Grab Financial Group’s Senior Managing Director, Reuben Lai in the official release.

In addition, Grab also presents micro insurance marketplace, a JV with Zhong An. Medical insurance is available for driver partners and personal accident insurance when partners demand for more cover. This service is accessible directly through Grab.

In the future, automotive insurance product will be available with the concept of “Pay-as-you-drive” premium payment. It allows driver partners to pay insurance only when they drive, as well as micro life insurance, and critical illness insurance.

Regarding the launching of this fintech service in Indonesia, there’s no official statement.

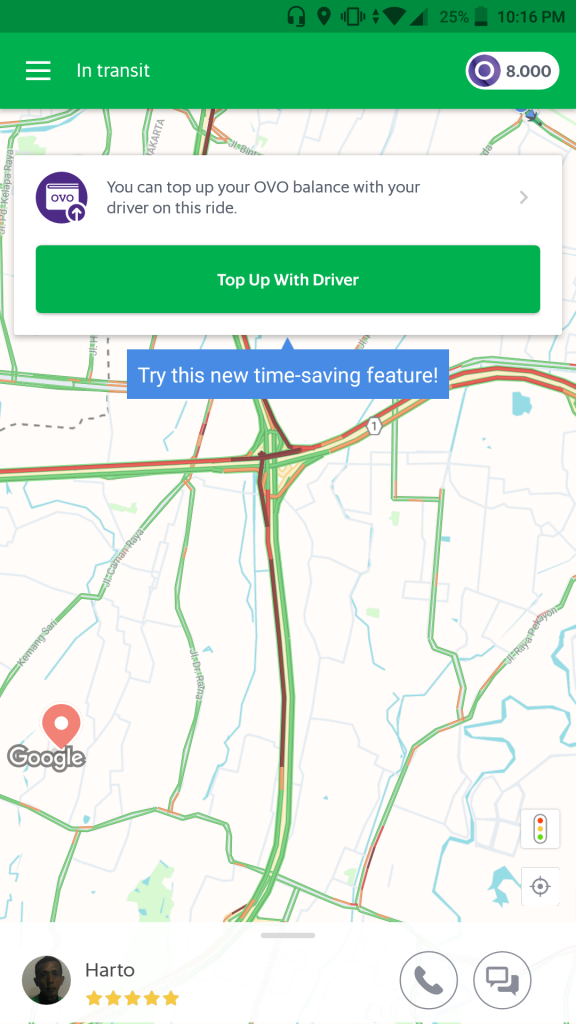

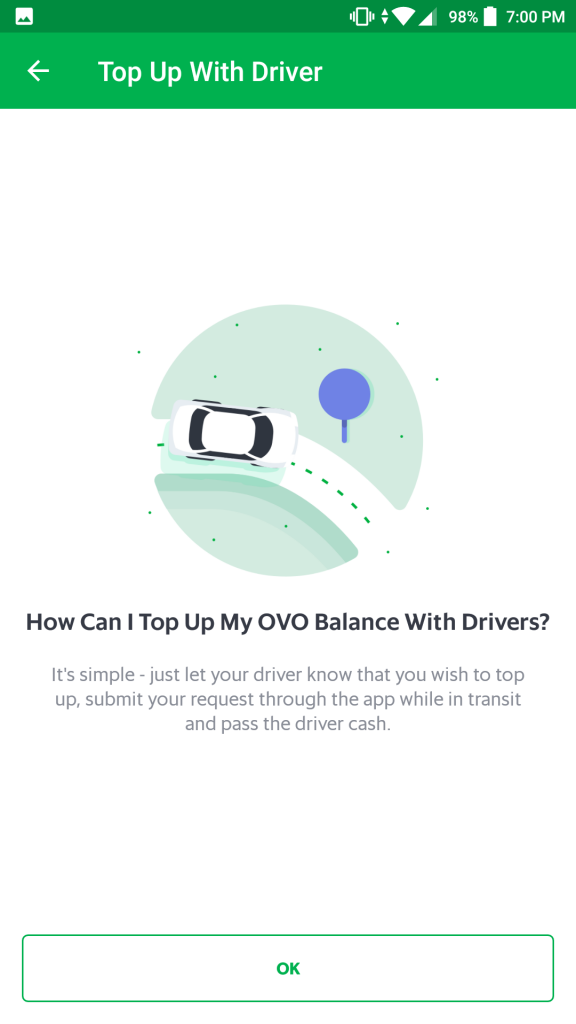

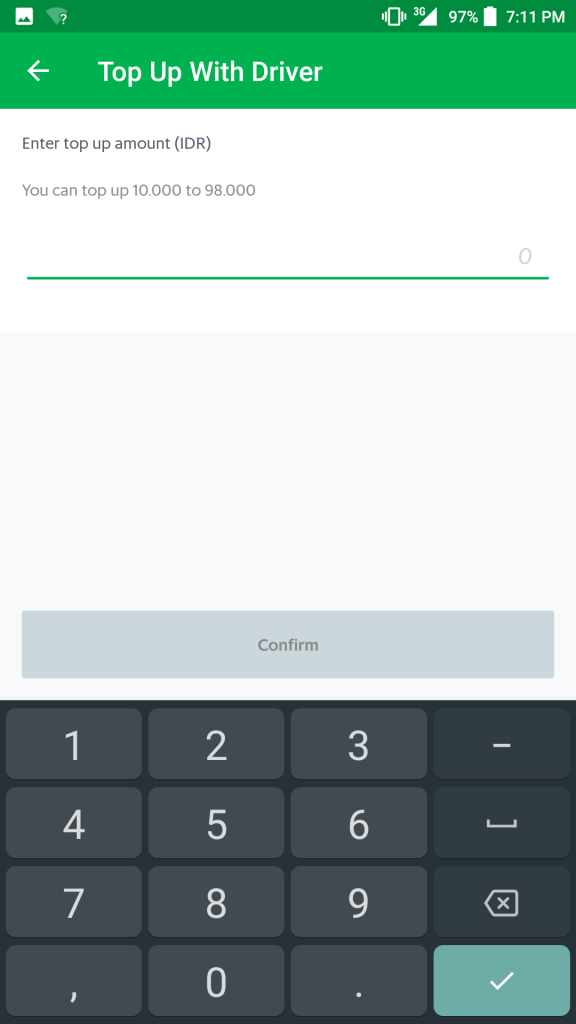

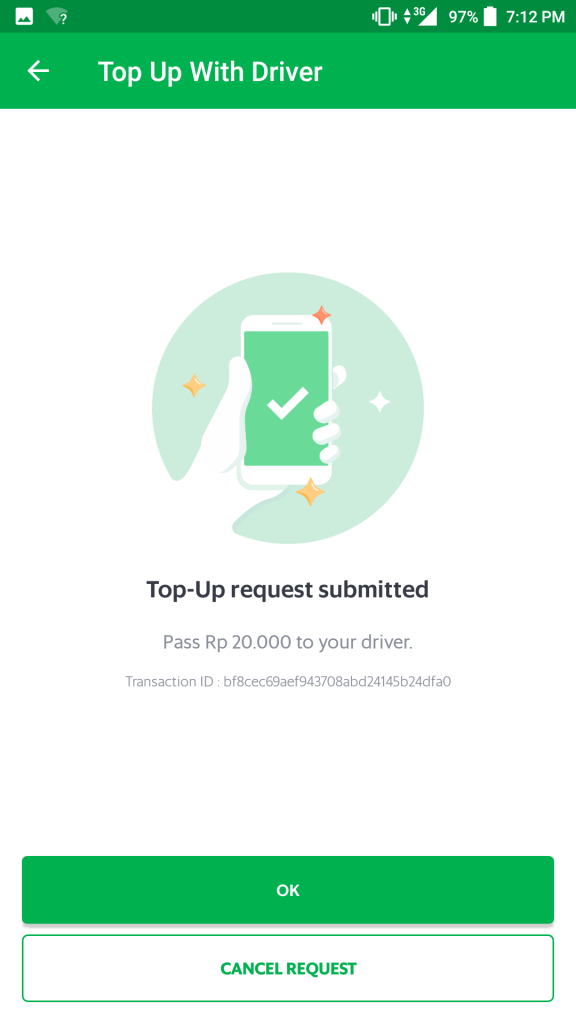

In Indonesia, Grab’s fintech services still related to the payment system. The new app provides payment options with a QR code scanner for Ovo at offline merchants.

Ovo Balance that already connected to Grab can pay for all services from transportation, food & package delivery, and grocery. It also used for electricity purchasing and payment, postpaid and credit bills.

GrabClub is still beta version

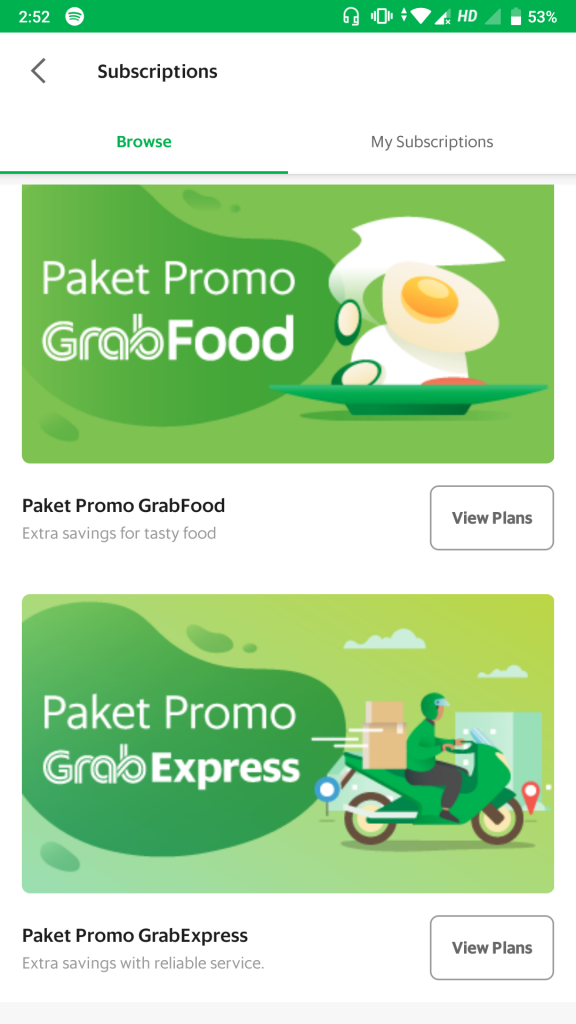

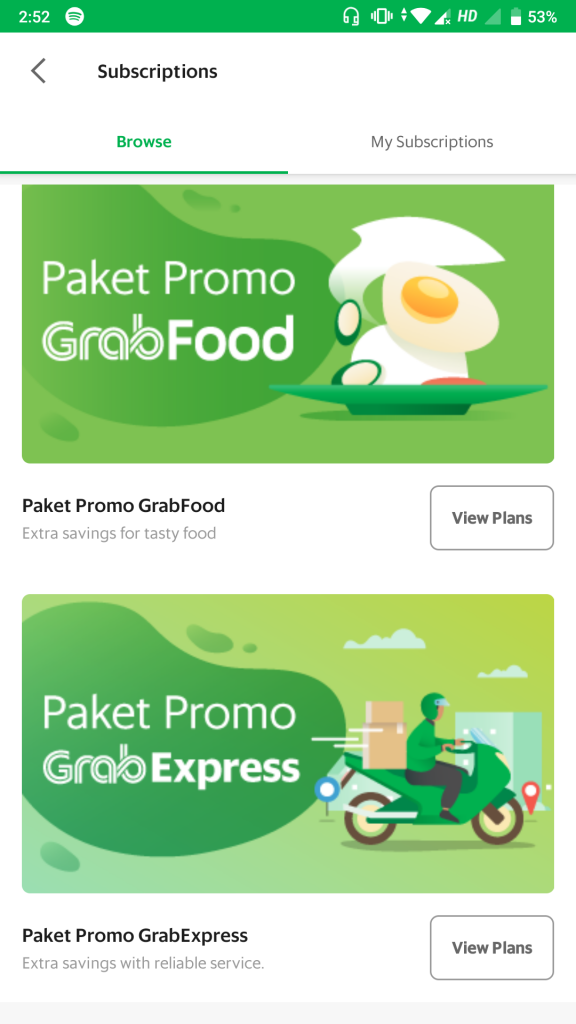

On the other hand, Grab hasn’t released the upgrade version of subscription package (formerly known as “GrabClub”). In December 2018, DailySocial had reported the presence of this feature in Indonesia. It is then disappeared and finally re-emerged since mid-March 2019.

Grab Indonesia’s representative said the subscription feature can be found in GrabRewards. Users can choose GrabFood promo package starts from Rp75 thousand and Rp125 thousand to subscribe for a month.

It was explained that this package contains voucher worth of Rp35 thousand valid for GrabFood purchases and a shipping fee of Rp5 thousand. If you choose a package that costs Rp 75 thousand, users will get a discount voucher for five transactions and 10 times for the shipping.

Then, there’s GrabExpress starts from Rp40 thousand valid for two weeks. In this package, users will get up to 50% discount of delivery and to be used for 20 transactions.

Previously, Grab said this subscription feature is a company’s weapon to overcome price wars with Gojek. The long-term strategy is believed to have a good retention rate in maintaining user loyalty.

–

Original article is in Indonesian, translated by Kristin Siagian