Fuse insurtech today (09/8) announced the closing of its series B funding with an undisclosed amount. The round was led by GGV Capital with the participation of previous investors, including East Ventures Growth, SMDV, Golden Gate Ventures, Heyokha Brothers, Emtek, and some undisclosed investors.

The fresh funds will be focused on developing its digital platform and continuing the expansion to other countries in Southeast Asia, outside of Indonesia and Vietnam. Previously, Fuse has secured series A funding in late 2019, led by EV Growth.

This insurtech platform was founded in 2017 by Andy Yeung and Ivan Sunandar. The company claimed to be a pioneer application that focuses on the agent-base model. This is considered relevant to Indonesia, as 97% of the population is still underinsured due to lack of confidence in the current insurance system.

Using the approach, the company is said to record Gross Written Premium (GWP) exceeding $50 million or equivalent to Rp720 billion in 2020 and is confident enough to claim as the largest insurtech platform in Indonesia [by transaction].

Fuse has partnered with 30 insurance companies, offering more than 300 products, including through employee benefit programs and integrated e-commerce sites.

“We always focused on product innovation and will continue to invest in developing platforms that make insurance accessible and affordable to everyone in Southeast Asia. A total of 7 insurance companies have chosen Fuse to be their strategic insurtech partner in Indonesia,” the CEO, Andy Yeung said.

Market competition

Discovering the current insurtech landscape in Indonesia, Fuse’s two closest competitors, in terms of business size, are PasarPolis and Qoala. With different metrics, PasarPolis confirmed, as of August 2020 they had issued 70 million new policies every month. The total successful policies released in 2019 reached 650 million in its operational countries, Indonesia, Thailand and Vietnam.

Earlier this year, PasarPolis secured IDR 70 billion funding from IFC, following the IDR 796 billion Series B round which was announced in September 2020. The startup is backed by several investors, including LeapFrog Investments, SBI Investment, Alpha JWC Ventures, Intudo Ventures, etc.

Another insurtech startup is Qoala. Last April 2020 the firm announced 209 billion Rupiah series A funding led by MDI Ventures through the Centauri Fund. Also participated several investors including Sequoia India, Flourish Ventures, Kookmin Bank Investments, Mirae Asset Venture Investment, Mirae Asset Sekuritas, Central Capital Ventura, SeedPlus, etc.

Since March 2020, the company claims to have proceed more than 2 million policies per month, the number increased from the previous one 7,000 policies per month in March 2019.

Market potential

According to DSInnovate data in the “Insurtech Report 2021“, the GWP recorded by the insurance industry in Indonesia has reached $20.8 billion in 2020. The number is dominated by Life insurance with 73.8%.

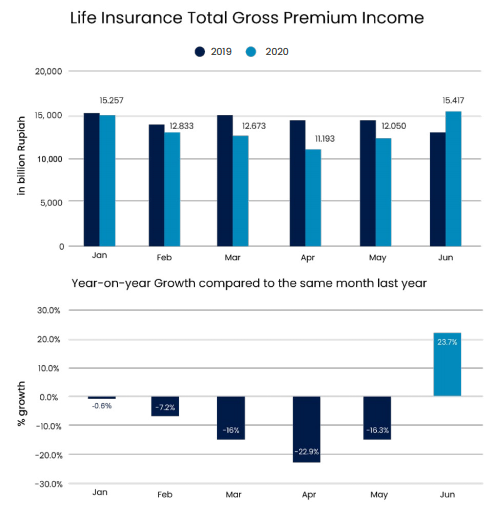

Although the pandemic has affected its emerging penetration in Indonesia, this sector was relatively able to recover quickly as viewed from the Gross Premium Income.

The insurtech potential to democratize the insurance business in Indonesia is wider than ever, including in the context of capturing new users and educating the market. Further from the report, there are several important factors to encourage insurance adoption in Indonesia in relation to digital services.

First, in terms of the claim process, convenience is the key (48% of respondents). Moreover, the service provider brand must be convincing (39%). Furthermore, proceed with costs (37%) and benefits provided (11%).

–

Original article is in Indonesian, translated by Kristin Siagian