Lifepal announced a series A funding worth of $9 million or equivalent to 130 billion Rupiah. The round was led by ProBatus Capital with the participation of Cathay Innovation, Insignia Ventures Partners, ATM Capital and Hustle Fund.

Combined with the previous round, the company has raised a total investment of $12 million. This follow on funding will be channeled to its product improvement and user experience.

Was founded in 2019 by Giacomo Ficari, Nicolo Robba, Benny Fajarai, and Reza Muhammad; Lifepal has transformed into an insurance marketplace platform. The direct-to-consumer (D2C) approach allows them to distribute hundreds of insurance products to the public.

“During the pandemic, we experienced a strong increase in demand along with increasing awareness of health risks combined with the availability of online platforms [..] Lifepal addresses the evolving needs of consumers by reducing the problems associated with traditional agents through full digitization of the value chain for a superior user experience,” Giacomo said.

Meanwhile, ProBatus Capital’s Founder & Managing Partner, Ramneek Gupta said, “We invested in Lifepal because of its potential to change the way Indonesian consumers buy insurance. They built a platform that uniquely serves consumers by including educational content that helps customers understand their needs.”

Market size

Based on data compiled by DSInnovate in a report entitled “Insurtech Ecosystem in Indonesia Report 2021“, the gross written premiums (GWP) in the Indonesian insurance industry has reached $20.8 billion in 2020 with a CAGR of 3.9% from the 2016 period. The main problems that many complain about are related to the claim process and accessibility to insurance products. From this thesis, insurtech startups have emerged with various unique business models.

“The insurance market in Indonesia is yet to be optimized and well-served, it is proven that less than 2% of Indonesians have insurance, thus making it ready for digital disruption,” Cathay Innovation’s Director, Rajive Keshup said.

The digital approach has turned out to be fruitful. Lifepal’s internal data reveals that it has experienced 12x yoy growth with a monthly growth of 20%. The strategy is to combine the strengths of content, community, and product distribution channels to produce more efficient business processes on the user side.

Lifepal currently accommodates more than 300 insurance policies in the fields of health, automotive, property, and travel, partnering with 50 provider companies.

Insurtech platform

Also stated in the report, there are currently around 11 startups that focus on presenting the insurtech platform. Beyond that, there are also market products and enablers to support the digital insurance business system.

Each platform also has a unique approach. Take, for example, Fuse, which digitized the agency concept that has been a long time practice by traditional insurance. This is considered relevant to the Indonesian market, as 97% of the population is still underinsured due to lack of confidence in the current insurance system.

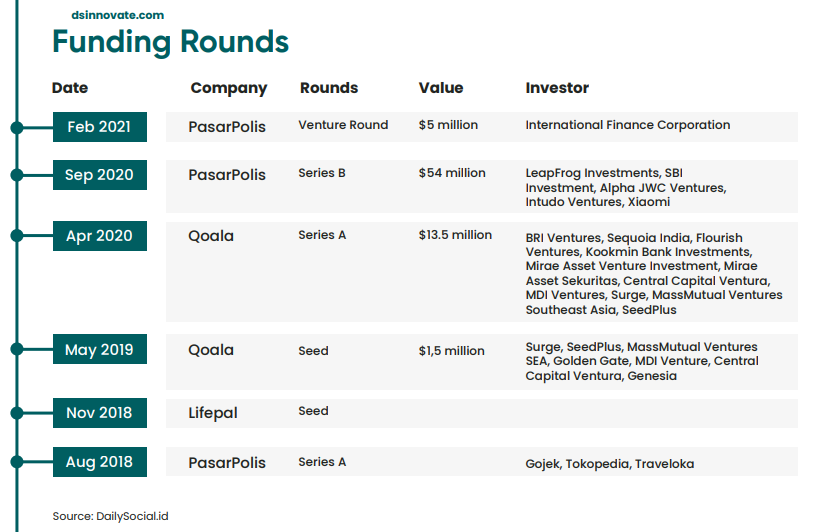

This year alone, three other insurtech startups have announced new funding. First, PasarPolis with more than 70 billion Rupiah funding from IFC. Then, Prixa.ai received 40 billion Rupiah funding led by MDI Ventures and TPTF. Also, Fuse has recently announced its series B funding.

–

Original article is in Indonesian, translated by Kristin Siagian