“Many business leaders are seeing the relationship between long term success and sustainability, and that’s very heartening.” — Jacqueline Novogratz, entrepreneur

There are various perceptions about the hardship of environmental impact business. First, it is difficult for startup players to generate inclome–let alone profit–and it obviously takes a long time. Second, these beliefs have limited investors’ interest. However, that doesn’t mean it doesn’t exist.

Many startups are carrying a mission to save the earth instead of earning profit beforehand. In Indonesia, you can count it on the finger of one hand. It includes a renewable energy startup Xurya and waste management startup Duitin. The objective is to make the earth greener and friendly to humans.

WLabku, a waste management startup backed by Gayo Capital impact investor, is carrying the same mission, which is to recycle bagasse into a valuable product in order to achieve zero carbon emission acceleration in Indonesia.

DailySocial had a discussion with two important figures at Gayo Capital, Jefri R Sirait as Co-Founder & Managing Partner and Eldo Wana Kusuma as Investment Principal about recycling development, business metrics, and environmental impact in this business segment.

WLabku’s profile

Founded in 2019, WLabku is a waste management startup that recycles sugarcane waste as animal feed (bagasse). In additiont, this recycled product can be used as biofuel (plant and animal based) to produce heat, energy, electricity, as well as manufacture of pulp and building materials. The quantity obtained ranges from 22%-36%, depending on the portion of fiber and cleanliness of the sugarcane supply.

Why sugarcane? Citing information on the Gayo official website, bagasse is a fibrous residue left after milling, containing a moisture content of 45%-50% with a mixture of soft and fine fibers and parenchyma tissue with high hygroscopic properties. Bagasse also contains cellulose, hemi cellulose, pentosan, lignin, sugar, wax, and minerals.

In Indonesia, sugarcane has been planted on a 450,000 hectares land. The average yield in community plantations (about 266,000 hectares) is less than 80 tons per hectare with a yield level below 8%. The potential market capitalization of recycled sugarcane is around 5% of old bagasse equivalent to IDR 2.2 trillion.

In 2020, WLabku secured an investment from Gayo Capital through two funding rounds. Based on Crunchbase data, WLabku received seed funding in January 2020 of $1 million, and a second round in July 2020 through convertible notes at $90,000.

Co-Founder & Managing Partner, Jefri R Sirait revealed, WLabku is one of Gayo Capital’s investment portfolios that offers added value as a biomass waster. He said, there are lots of unused materials that can actually be reused (circular economic) in the agricultural sector, livestock, and even the society.

He considered the recycling of used materials to be one of the important keys to strengthening food and energy security in Indonesia, as well as being able to produce carbon farming.

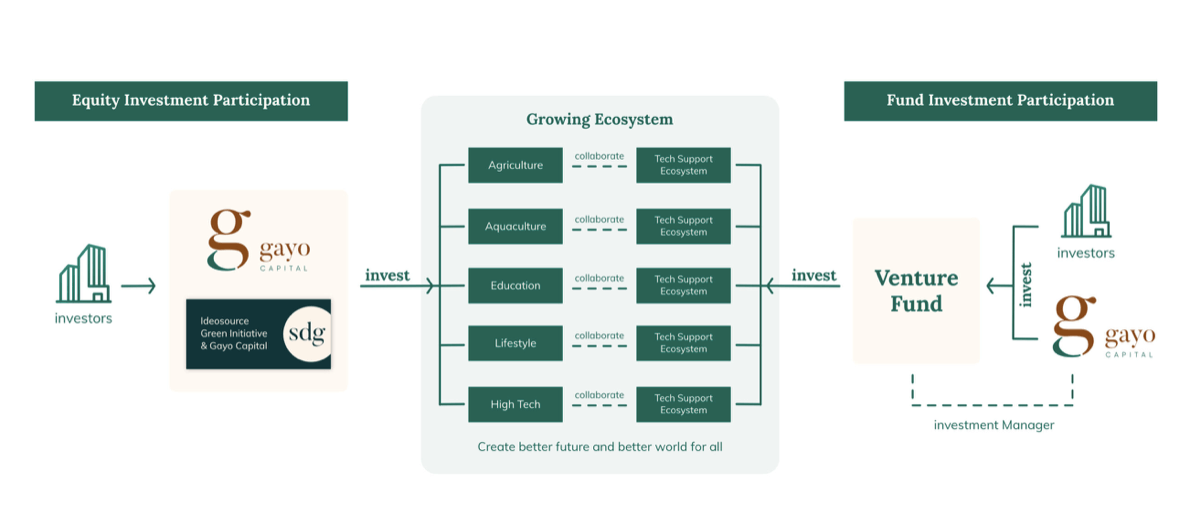

“From the beginning, Edward [Ismawan Chamdani] and I, as Founders of Gayo Capital, saw the Sustainable Development Goals (SDGs) as well as farmers, ranchers, fishermen, and MSMEs must be the epicenter in Indonesia. This is a strong basis for how rural areas can support the cities’ development. It is also fundamental in our investment and we bring the tech to them. WLabku will complete our portfolio ecosystem in the fields of waste management and agriculture,” Jefri said.

What’s on the pipeline?

There are two big agendas on WLabku’s pipeline. First, exporting bagasse that has been recycled into valuable products. For example, recycling into raw materials (feedstock). WLabku takes on the role of recycling and processing it into cattle feed, then exporting it to several countries, including Japan and possibly New Zealand.

The Investment Principal, Eldo Wana Kusuma said that one of his supplier’s clients was confused about processing bagasse waste that had accumulated for years. This waste can cause odor pollution in the surrounding environment, and trigger new costs to accommodate waste. Once burned, the process takes a long time. It means, more production results than the process of destroying the waste.

Without a processing plant, bagasse will be wasted as it will end up burning and losing its value. This will have a bad impact on the environment because it triggers the carbon production. WLabku plays a role in solving the above problems by turning waste into valuable products.

Based on a report from the Ministry of Environment and Forestry (KLHK), the amount of national waste generation reaches 175,000 tons per day or equivalent to 64 million tons per year (assuming that each person produces 0.7 kg of waste per day).

Regarding its composition, the major waste by 50% comes from organic (food and plant waste), plastic (15%), and paper (10%). The rest comes from metal, rubber, cloth, glass, and others. Based on the category, households generate the most waste (48%), followed by traditional markets (24%), commercial areas (9%), and the rest from public facilities, schools, offices, and roads.

Second, to accelerate the zero emission program. “The remaining filtered bagasse is not 100% able to be used as feedstock. The remaining residue can be compacted and used for co-firing fuel in the form of pellets to reduce carbon emissions from fossil combustion. This is what I mean by accelerating the zero emission program,” he said.

In 2030, Japan issued a policy prohibiting all factories using fossil fuels. Bagasse can be used as fuel in the form of pellets or feed ingredients compacted in such a way from concentrate or forage materials to reduce the nutritional properties of feed. Meanwhile, the pellets produced by WLabku can reach 4,300 calories.

Business Acceleration

With the various plans, what are Gayo Capital’s efforts to accelerate WLabku’s business?

Gayo Capital plays a role as a venture builder. They also provide assistance and connect business networks to the WLabku’s founder. Gayo is not only involved in terms of capital. Moreover, he said, the three partners at Gayo Capital have strong backgrounds in finance, operations, networking, and business partnerships. It becomes Wlabku’s added value to the society.

Furthermore, Eldo said WLabku’s business scalability can be improved as long as the mature business model is maintained. He said, it will be difficult to achieve this when the founder only considerate the aspect of ‘for the sake of humanity and mother earth’.

One of the challenges is that investing in the environmental sector requires more than one source of capital, it combines private capital and development funding. The distribution must be right on target. For example, a grant from foundations or CSR programs can be used for research, while investments from Venture Capital (VC) will be used for operational costs (opex) and working capital.

For WLabku, the company has conducted its own research, while funding source is led by Gayo Capital. “As long as it is right on target, I think everything can run smoothly. Most of the founders in impact business are too concerned with research and not business wise. Therefore, this is a pretty difficult challenge,” he said.

In order to answer the above question, Eldo is aiming for a strategic collaboration between WLabku and the portfolio ecosystem at Gayo Capital. Especially collaboration across products/services in the corridor of sustainability. For example, waste-to-energy or clean energy. This means that business scale up is not only limited to owners of a business model similar to WLabku.

“We cannot depend solely on fossil fuels and this has actually been our agenda for a long time. We hope that there will be collaboration between the portfolio and the penta-helix approach at Gayo Capital, and this should be accelerated even faster.”

Impact vs profit

Which comes first, impact or profit? A difficult question to address the challenges of various investors when making impact investing in the environmental or sustainability sector.

Eldo said that his team is currently trying to prove WLabku’s business model to be acceptable in the market, converting waste into valuable products to solve problems in the accumulation of factory waste. Once the idea is proven, Gayo will then talk about financial returns.

Meanwhile, he said that the average VC investment in general is around 3-5 times in a 5-10 year fund lifetime (ranging from 27%-30% return per year).

“Profit has yet to become our main focus, although investors will eventually seek for a return. In the initial stage, we aim for impact. Actually, thanks to the stakeholders, we have [started] aiming for both, both impact and financial return,” he said.

WLabku uses a number of metrics to measure business growth as well as impact on the environment. From business growth, Gayo uses such metric as the number of suppliers and buyers.

In parallel, he observed that the more supplies are supplied, the less waste factory waste will be. The more people who buy, the faster the acceleration to realize the zero carbon emission program.

Meanwhile, WLabku measures the amount of bagasse that is recycled and the environmental impact of their solutions. It can be measured by the level of reduction in odor pollution or environmental pollution. “To [measure] the impact, we use tools with the ESG Report,” he added.

On a general note, ESG (Environmental, Social, Governance) Reports is a reference or formula for measuring the impact of environmental pollution. ESG reports operational data of various companies focusing on three areas, environmental, social, and corporate governance.

In Indonesia, the ESG has been implemented on the Indonesia Stock Exchange (IDX). In March 2021, IDX launched the new index IDX ESG to promote environmental, social and governance practices of issuers (listed companies on the capital market). In the long term, the implementation of ESG is expected to drive more capital flows to Indonesia.

One-for–all metric

DailySocial had a short discussion with Partner at Patamar Capital, Dondi Hananto, about the general metrics and scalability of impact investing in Indonesia. In terms of social impact, he said, currently there is no one-for-all metric that can be used to measure business growth, both equity and non-equity. It all depends on the business model and impact the startup is pursuing.

Meanwhile, in the environmental impact segment, Dondi said that his business development could not fully rely on commercial financing considering that the market in Southeast Asia is yet to mature. Therefore, it requires encouragement from other funding sources (blended finance), including foundations, CSR, or social funds.

It becomes one of the factors why business scalability at startups in environmental impact is difficult to accelerate. Not to mention the clash in the pursuit of ‘impact versus profit’ considering that both are hardly achieved at the same time. Dondi considers it difficult to withstand the impact in the long term if the business has been profit-oriented from the beginning.

“From a business model perspective, I haven’t seen [environmental startups] that can be quickly scalable. However, the trend is getting there,” said Dondi.

–

Original article is in Indonesian, translated by Kristin Siagian