On the previous edition, DailySocial published a series of articles based on a mini survey highlighting QRIS based on the general consumer’s point of view and the transaction experience through digital financial apps. We have published both topics through two different articles, the first and second part.

Related to the previous series, DailySocial, throuh this writing, intend to validate a number of respondents’ assumptions regarding merchants as one of the barriers to QRIS adoption in Indonesia. In addition, the mini survey only represented a small part of the facts and challenges. This writing is part of our efforts to bridge issues in the field to stakeholders.

The mini survey was validated through several interviews with F&B startups in Indonesia, including Kopi Kenangan, Hangry, and Livera, on their perspectives of QRIS adoption in its outlets.

Customer and Merchant Presented Mode

A little reminder, two years after launching, the transaction value of Quick Response Code Indonesian Standard (QRIS) has reached Rp 9 trillion in the first semester of 2021 or grew 214% yearly (YoY). Bank Indonesia (BI) also recorded 8.2 million Indonesian merchants have adopted QRIS. The number has increased by about 3 million since the end of 2020.

Through this achievement, BI seeks to continue increasing the adoption of QRIS to all levels of Indonesian communities. In particular, considering the unprecedented situation due to Covid-19 pandemic, cashless transactions will always be on demand.

One of BI’s efforts is to release the Customer Presented Mode feature to facilitate the use of QRIS in the near future. The Customer Presented Mode allows merchant’s cashiers to scan a mobile user’s QRIS. Merchants will be provided with a scanner from the payment provider.

On the other hand, the Merchant Presented Mode we use enables transactions by scanning QRIS at the merchant and completing transactions through certain payment apps. Before QRIS, users have to submit the phone number on each EDC belonging to the payment service provider.

“In the near future, we will launch the Customer Presented Mode feature following the existing Merchant Presented Mode. We are also piloting QRIS transactions for cross borders, both inbound and outbound,” Bank Indonesia’s Assistant Governor and Head of the Payment System Policy Department, Filianingsih Hendarta said.

Validating QRIS adoption issues on merchant

Based on the QRIS mini survey results, we summarize some of the main reasons respondents are yet to use the QRIS method. First, they think that merchants only use QRIS as a ‘display’ or not properly utilized. Next, QRIS is already available, but not yet activated by merchants.

In addition, the clerk or cashier does not understand how to proceed transactions using QRIS. Also, there are too many QR Code displayed as each payment service provider has its own QRIS. Then, the availability of QRIS at merchants is still limited.

We have tried to validate the above issues by gathering a wider perspective from various F&B startups. However, only Kopi Kenangan, Hangry, and Livera are willing to reveal their perspectives of QRIS implementation. The challenges they experienced were quite different considering that Kopi Kenangan relies on physical outlets, while Hangry and Livera rely on cloud kitchens.

In a statement to DailySocial, Kopi Kenangan Management said as many as 500 of its physical outlets have accepted the QRIS-based payment method. According to the records, the Kopi Kenangan transaction volume using QRIS payment method has increased 98% from May 2020 to August 2021. This growth is in line with the increase in public awareness of the QRIS payment method.

His team denied the assumption about cashiers who did not understand the QRIS terms. It is because Kopi Kenangan always provides education to staff regarding the procedures. Usually, the staff at the booth will ask the customer’s preferred payment method and its promotion.

“To date, the internet connection stability becomes the main challenge. It hinders the QRIS transaction process. Sometimes the barcode does not appear, or unavailable to be scanned,” Kopi Kenangan Management said.

Meanwhile, Hangry’s COO, Andreas Resha admitted that there is no crucial obstacle when his merchant staff processed QRIS transactions. The reason is, most of Hangry’s transaction orders use the delivery rather than take away method.

“We don’t have exact numbers, but we have seen a decline number since the pandemic, especially with many people doing activities at home. Therefore, the non QRIS based delivery methods are more widely used than the takeaway methods,” he said.

Currently, Hangry has implemented the QRIS payment method in 49 outlets across the Greater Jakarta and Bandung areas. Andreas admitted that his team is currently preparing a dine-in restaurant concept which will be opened in the near future and will include the QRIS payment method as well.

From a different perspective, Livera’s Founder and CEO, Marcello Judhandoyo considered that the QRIS adoption seems to be underutilized for F&B business people with cloud kitchen concept. It is because the money for food/beverage purchases via the ride-hailing platform will go directly to the merchant.

In a general note, cloud kitchen is a term used for restaurants that do not provide dine-in services, providing delivery and takeaway only.

“When it comes to the QRIS adoption in the F&B business with cloud kitchen concept, it’s actually not optimal. However, in the case of manual ordering via WhatsApp, it is actually possible. Livera offers payment via QRIS by sending a barcode to consumers. Unfortunately, in this case, most Livera consumers prefer transfer method. In fact, QRIS offer easier method as consumers don’t have to worry about the various bank accounts, let alone having to register one by one in the mobile banking application,” he explained.

Livera just started the business in 2020 and its operations are currently cloud kitchen only. Meanwhile, new product orders are available via delivery on the Gojek, Grab, and Tokopedia platforms as well as manual order via WhatsApp.

Expanding access of QRIS technology

No one thought the world would experience the Covid-19 pandemic where mobility would be very limited. In fact, the Government had just launched QRIS a few months before the first PSBB. This momentum can actually encourage the QRIS adoption, even more significantly than its current achievement.

At the same time, the cloud kitchen trend is developing among F&B businesses to deal with stifling costs and business uncertainty in the midst of a pandemic. People prefer to transact faster and easier without having to meet face to face and do physical interaction.

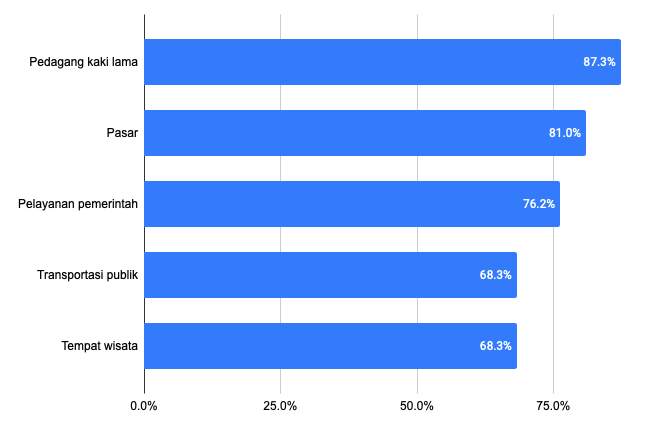

The government’s act to introduce the Customer Presented Mode can also help accelerate the QRIS adoption. However, it is far more important to expand its implementation, therefore, it does not rely only on modern retail merchants. As many as 87.3% of our respondents expect QRIS to be used at street vendors, markets (81%), government services (76.2%), and public transportation (68.3%). This is actually the most anticipated thing to accelerate a more massive QRIS adoption.

–

Original article is in Indonesian, translated by Kristin Siagian