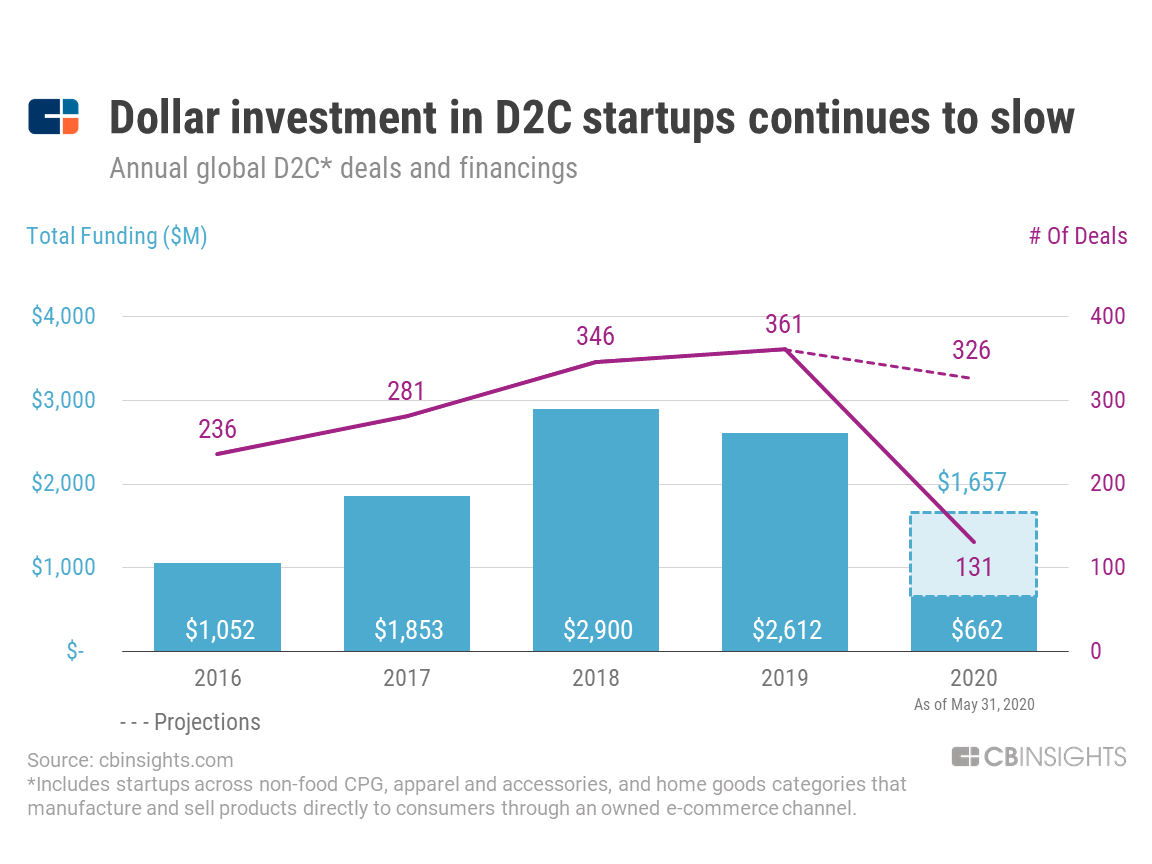

Social commerce startup Dagangan announced its series A funding worth of $11.5 million or equivalent to 163.7 billion Rupiah. The round was led by Monk’s Hill Ventures with the participation of MMS Group, K3 Ventures, Spiral Ventures, and Plug and Play.

Previously, the startup that was founded in 2019 announced a pre-series A funding with an undisclosed value from CyberAgent Capital, Spiral Ventures, 500 Startups, and Bluebird Group in June 2021.

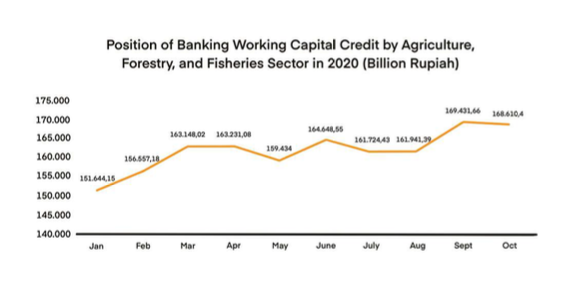

Dagangan’s Co-Founder & CEO, Ryan Manafe revealed to DailySocial, the company has achieved revenue record in mid-2020, the trend continues today. It is suspected that various restrictions during the pandemic has resulted in the demand for daily needs online are rising.

Unlike in urban areas, people in rural areas have their own challenges in getting their daily needs online. “The situation is getting worse as accessibility issues that persist in rural areas, where retailers have to bear the cost of inefficient logistics for commuting to and from the city. Dagangan aims to address these issues and is now on the right track,” Ryan said.

He continued, “Our vision is to enable 100 million people in underserved rural areas to have easy access to quality daily necessities at affordable prices.”

The fresh money is to be used to develop private-label local products such as frozen foods, groceries, and household appliances. In addition, they will continue product development and add new features including paylater. Access to logistics services will also be sharpened, while talent acquisition efforts and partnership expansion will be enhanced.

Dagangan will intensify expansion in tier 3-4 cities and villages in Java, Sumatra, and Kalimantan.

Business challenges

To date, there are some challenges remain by the company as it started to reach tier 3-4 cities and villages. Among them is user acquisition with low technology adaptation. Education is highly needed, therefore, they are accustomed to using applications and making purchases online. The next effort was to intensify user acquisition activities offline.

“However, we are indirectly helped by social distancing awareness and user willingness to learn and adapt [to digital services]. In the future we plan to reduce the offline acquisitions by gradually switching to digital acquisitions,” Ryan said.

Another challenge is the dependence on local approaches. Therefore, companies need to build strong local teams in each area and establish partnerships.

Problem also arise on the limited logistics infrastructure. With limited infrastructure in rural areas, both suppliers and consumers face the challenge of selling and buying products. Even as e-commerce services increase, the magnitude of logistics costs is difficult to avoid. Dagangan implements Hub-and-Spoke to help solve this problem.

“This also gives us a challenge as we have to keep opening new hubs in various regions. We plan to expand our business not only to other regions, but also to other channels, such as selling our private-label products through e-commerce and export services,” Ryan added.

One of the Dagangan’s focus this year is to develop private-label products. There are many local products with great potential, but only available for the area or focused on tourists (eg bakpia in Yogyakarta). Some of these products are getting exported, but are not widely available even in Java. For people in big cities, they may be able to easily buy these products through e-commerce services, but rural markets remain underserved due to expensive logistics costs.

“This is where Dagangan comes in handy. We want to empower these products, especially those in high demand and most of the not-widely-recognized products (eg honey, brown sugar, local snacks) through our private-label products. beneficial for stakeholders, but can also increase profitability,” Ryan said.

Social commerce outsite big cities

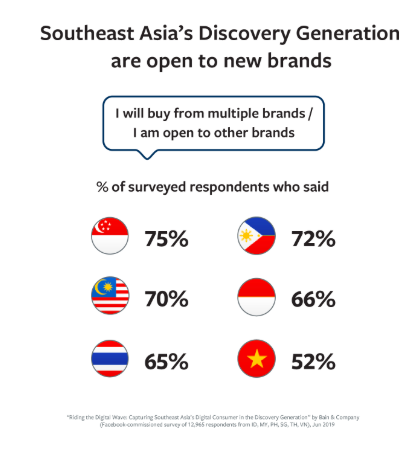

Various social commerce startups focus on markets in rural areas. The concept offered is considered more relevant, because in general, social commerce helps empower the surrounding community as part of the business, for example becoming a reseller.

Another startup in the vertical is Super. Recently received its series B funding of IDR 405 billion in April 2021, they have operated in 17 koa in East Java. The company utilizes a hyperlocal logistics platform to distribute consumer goods to agents in less than 24 hours after ordering. Super works with thousands of agents to distribute thousands to millions of necessities every month. Most of these agents are women.

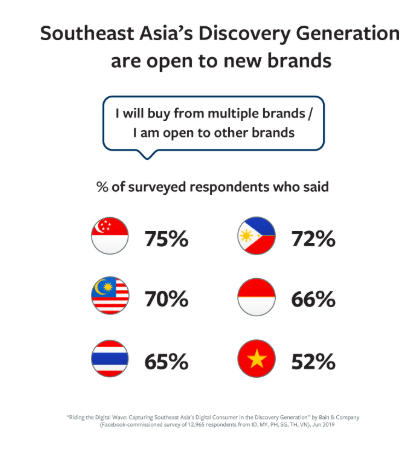

In addition, there are RateS, Evermos, KitaBeli, and others. The size of the market is tempting. According to Bain & Co. data, in 2020 the total GMV for online trading businesses in Indonesia has reached $47 billion. Although the majority come from e-commerce or online marketplaces, social commerce services have no small contribution, which is around $12 billion.

–

Original article is in Indonesian, translated by Kristin Siagian

Application Information Will Show Up Here