After almost a year of transition, PT Bank Jago Tbk (ARTO) officially introduced the Jago app to the public. This platform provides digital financial services that focus on life-centricity with a collaborative ecosystem approach.

“In order to present innovative and collaborative solutions, we work closely with the ecosystem. We expect this application can provide financial access to the wider community and accelerate financial inclusion. There are many segments we still want to reach in Indonesia,” Bank Jago’s President Director, Kharim Indra Gupta Siregar said at the launching of Jago app in Jakarta.

Currently, Jago app only provides several financial services, such as transfers, bill payments, and e-wallet top ups. Going forward, the company will add more services to target the digital savvy and mass market segments in the middle class, both individuals and entrepreneurs.

This is one of the initiatives of its strategic partnership with Gojek, which is a service that allows millions of customers to open Jago Bank accounts directly through the ride-hailing platform. “Regarding [the partnership with Gojek], our team is still working on the integration process,” Kharim added.

Review of Jago app

Bank Jago claims to be a fully tech-based digital bank. Kharim also emphasized that Bank Jago’s technology and innovation were entirely developed by an internal team. Therefore, DailySocial has the opportunity to try out some of the innovative features of the Jago app.

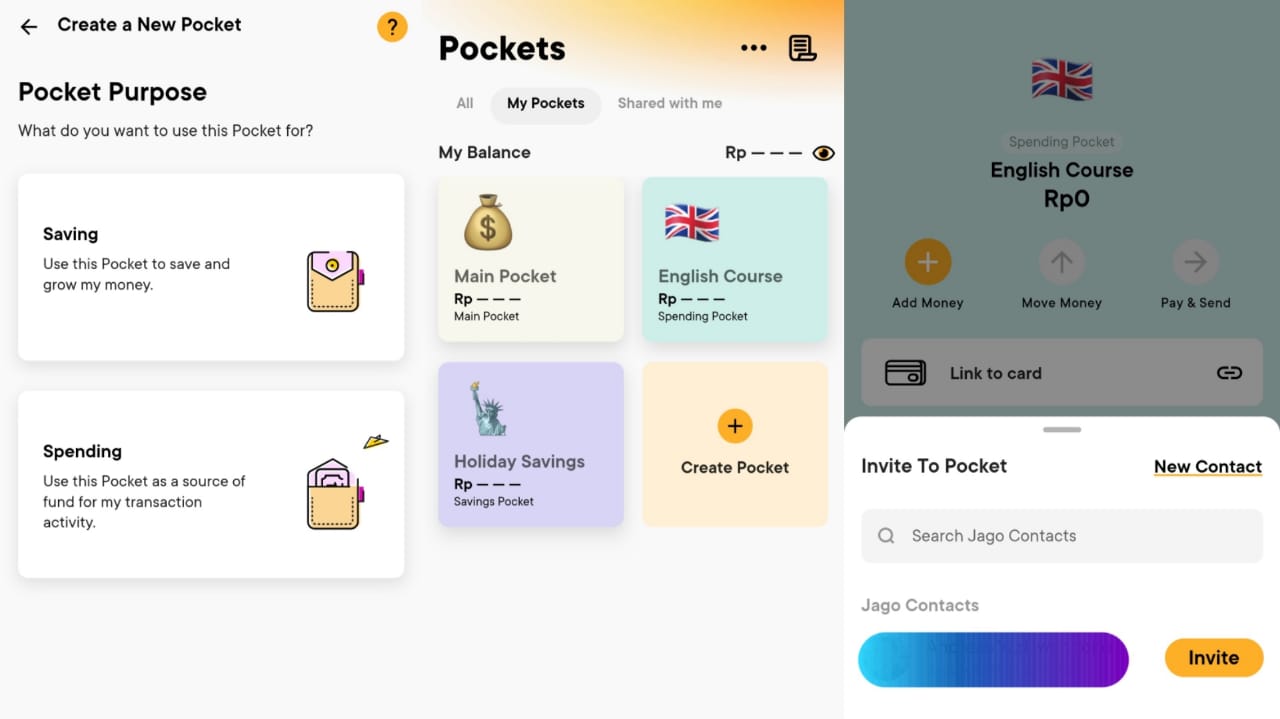

For first impression, the onboarding process to create an account is very fast, e-KYC only take less than 30 seconds via video call. We then tried the “Pockets” feature which allows customers to simply allocate money for different purposes. As seen in the image below, the Pocket feature can be personalized, including name, color, and profile photo.

The bag (Kantong) has two categories, “Savings” and “Spendings”. Users can add saving bags (Kantong Nabung) with various transfer methods, including digital banking (TMRW, Digibank, Jenius), mobile banking (BCA, Mandiri, CIMB, BRI), SMS banking, internet banking (BCA, Mandiri, BNI, CIMB), ATM (BCA, Mandiri, BNI, BRI, Permata, CIMB), and Jago Branch.

However, the thing is that the money stored in Kantong Nabung cannot be transferred to external account thereby reducing the potential for unnecessary expenses. For transfers, users must move money to the Pay Bag (Kangtong Bayar). If it’s changed, users can make transactions and the interest will be charged to 0.5% p.a. While changing to Kantong Nabung will activate an interest of 3.5% p.a.

In fact, users can invite other account holders (collaborators) to save together. User can authorize a collaborator to “see” or “use” the money in the bag. There is a daily limit that can be set.

Kharim said, the collaborative financial management feature is not yet owned by banks in Indonesia. This feature was developed by research conducted by the company. He said, there are still many use case in financial service to be explored in the future.

In addition, he said that this feature has gone through a risk management process considering that the use case is still relatively new and has the potential to be called a term savings if it is stored for a long time. “This is one of the challenges for the treasury team at Bank Jago. In this case, we simulate what market this fund will be rotated, therefore, we have made adjustments in providing services,” he said.

Meanwhile, Bank Jago’s Digital Banking Director, Peter van Nieuwenhuizen added that collaborative features are very possible to be implemented into financial services. This is because people in Southeast Asia are familiar with collaboration culture, especially Indonesia, which is known to be active in socializing.

“The new [features] we are developing are new models for banking, therefore, it will take 1-2 years to see how do you do with ‘Pockets’ or how to figure out what works best,” Peter said.

Another leading feature by Jago Bank is the payment of invoices with a variable value, post-paid for example. Through this feature, users can automatically make payments or via a reminder to confirm the value of not fixed bills.

Flashback through Bank Jago

Bank Jago officially shifted from Bank Artos in June 2020. This identity change was an effort to transform Bank Jago into a post-acquisition digital bank by a group of investors led by Jerry Ng through PT Metamorfosis Ekosistem Indonesia (MEI) and Patrick Waluyo through Wealth Track Technology Limited (WTT).

Gojek Group, through its subsidiary, GoPay (PT Dompet Anak Karya Bangsa), is also a 22% shareholder. Then, in early March, the Singapore government-owned investment institution, the Government of Singapore Investment Corporation Private Limited (GIC), also acquired Bank Jago shares.

In conclusion, Bank Jago’s shareholder consists of PT Metamorfosis Ekosistem Indonesia (29.81%), Wealth Track Technology Limited (11.69%), PT Dompet Karya Anak Bangsa (21.40%), GIC Private Limited (9, 12%), and the public (27.99%).

Previously, senior banker and founder of Bank Jago Jerry Ng said that this collaboration could be a key strategy to accelerate the growth of the digital bank business. He gave an example, digital banks in China and South Korea are oriented towards ecosystem collaboratio, therefore, they can pursue growth through products with a wider spectrum.

This also answers various strategic partnership actions from various verticals by Bank Jago since 2020. This inorganic strategy can accelerate growth. Currently, Gojek is a sole strategic partner. This means that this partnership includes opening a direct account (onboarding) through the Gojek application, without the need for the Jago Bank application.

| Ecosystem | Vertical | Partnership |

| Gojek Group | Ride-hailing | Strategic partnership, shareholder |

| Akulaku | Lending | Loan channeling scheme (Rp100 billion) |

| Akseleran | Lending | Loan channeling scheme (Rp50 billion) |

| Kredit Pintar | Lending | unknown |

| Logisly | E-logistic | unknown |

“We have to create a unique value proposition. What we do is combine the two because we both have advantages. Bank is no longer the center of ecosystem, but part of the ecosystem. If we put ourselves in the right position, we will have a strategic role because whatever consumers do, in the end is payment,” Jerry said.

Other digital banks

The competitive map for digital banks in Indonesia will be even stronger this year. After Bank Neo Commerce and Bank Jago officially introduced application-based digital services, several other banks are anticipating their realization to become digital banks. On our records, there are several names, from Bank Digital BCA, SeaBank, and KB Bukopin.

Bank Agro, which is currently applying for a digital bank license to OJK, has recently appointed Kaspar Situmorang as the President Director through the Annual General Meeting of Shareholders (Annual GMS). Kaspar was previously the Executive Vice President of the Digital Center of Excellence, one of the digital transformation divisions in BRI’s holding company.

BRI’s Director of Digital, Information Technology and Operations Indra Utoyo said to DailySocial last year that BRI Agro has a great opportunity to be converted into a digital bank because it has launched the digital lending platform Pinang (Pinjam Tenang) which is the initial test case to the market.

Meanwhile, SeaBank, which is the new identity of Economic Welfare Bank (BKE), is reportedly exploring the potential to acquire another bank to strengthen its capital structure. That way, SeaBank can get a digital bank license. SeaBank is recorded as a Commercial Bank for Business Activities (BUKU) II with a core capital of IDR 1.3 trillion as of September 2020 and total assets of IDR 3.6 trillion as of December 2020.

–

Original article is in Indonesian, translated by Kristin Siagian