Noice’s audio-on-demand platform has received seed funding from several investors, including Kenangan Kapital, Alpha JWC, and Kinesys Group. This round will be used to accelerate the development of Noice’s local content and technology this year. Although the value is undisclosed.

In his interview with DailySocial, Mahaka Radio’s President Director, Adrian Syarkawie revealed there’s another investor, claimed to be a unicorn startup, that is involved. He said this unicorn will provide opportunities for synergy between the two companies and greater technology transfer. “I can’t announce the name yet. We will push [closing] in the second quarter,” Adrian said.

Noice was first developed as a streaming radio platform. However, Adrian said this service is considered insufficient to the growing market. Meanwhile on-demand content is growing rapidly in some countries, including Indonesia.

“If it’s only streaming radio, it seems [lacking] for digital applications. Also, people can still access radio from other media. Therefore, we are looking forward to what will be attractive to consumers through this application, and then we will get to the podcast content,” he said to DailySocial.

With PT Mahaka Radio Integra Tbk (MARI) strong position in the radio business, the company also formed a joint venture with PT Quatro Kreasi Indonesia to establish PT Mahaka Radio Digital, Noice’s parent company. Quatro is a consortium of four recording companies in Indonesia, including Musica, Aquarius, My Music, and Trinity.

This consortium, Adrian said, is linked to the common vision of each music label owner to develop applications that focus on local voice-based content.

Investors in tech

This year, Noice will focus on developing application platforms and content localization. Those two things had was not the company’s main focus at first, considering that Mahaka Radio Integra’s main business was producing content. Adrian also said that the Noice platform was not quite optimal at that time in terms of technology as it was developed by a third party.

“We are not a tech company. However, we are aware that we cannot develop from content alone in the future, technology is necessary. Therefore, we have two concerns, content and technology. Mahaka Radio Integra and Quatro are strong in content, and we try to find investors who can provide support in technology,” Adrian said to DailySocial.

Kenangan Kapital is an angel fund owned by Kopi Kenangan’s Co-founder and CEO, Edward Tirtanata, which focuses on portfolios in consumer tech. Kopi Kenangan is also part of the Alpha JWC portfolio. Meanwhile, Kinesys Group focuses on early-stage startup funding.

“Currently, investors are yet to act as shareholders because [their investment] is in the form of convertible loans, which will then be converted into equity. We are looking for partners who can provide guidance in terms of technology and collaboration. For example, investors invest in other portfolios, to be synergized with Noice. We do it gradually as we focus on developing content,” he explained.

With this rank of investors, Noice has added new resources that will focus on the technology side. The company formed a special team from India to internally develop the platform.

Business roadmap 2021

Furthermore, Adrian said that Noice’s technology focuses divided into three phases. First, the launch of the Noice 2.0 beta platform with the new UI / UX this March. Second, the company will launch the 2.X version in May. In this phase, Noice starts to enter an open platform, aka content that can be uploaded individually or personalized content. Third, Noice will begin monetization, either with an advertising or subscription scheme.

With this platform, the company began to boost the number of podcast content this year targeting 4,000-5,000 episodes. As of December, Noice has more than 3,000 podcast episodes, 62 podcast content titles, and signed up to 80 podcasters.

Adrian said, entertainment content, especially comedy and horror, is currently the most popular genre in Indonesia. Nevertheless, Noice will continue to expand its content into various categories, such as education and business. “We produce 95% of the content on Noice ourselves. We hired an exclusive podcaster. We run the idea and podcaster execute the content,” he explained.

For now, Noice content can still be accessed for free. Monetization will only be discussed if the user base, monthly active users (MAU), and time spend increase. Regarding target, Noice is aiming for an increase in user base up to four times from its current position, total play up to eight times, and the amount of exclusive original content increased by two times.

“Currently, we have not focused on monetization as resistance is still an issue with the Indonesian market when talking about the subscription system. Of course, we will start to accelerate advertising and subscription schemes in the future, maybe later in the third stage.”

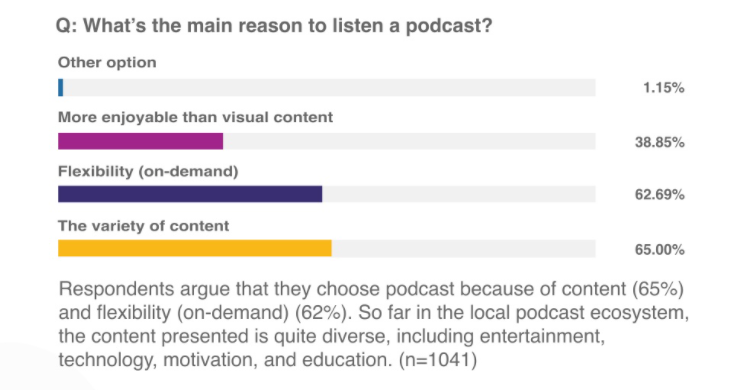

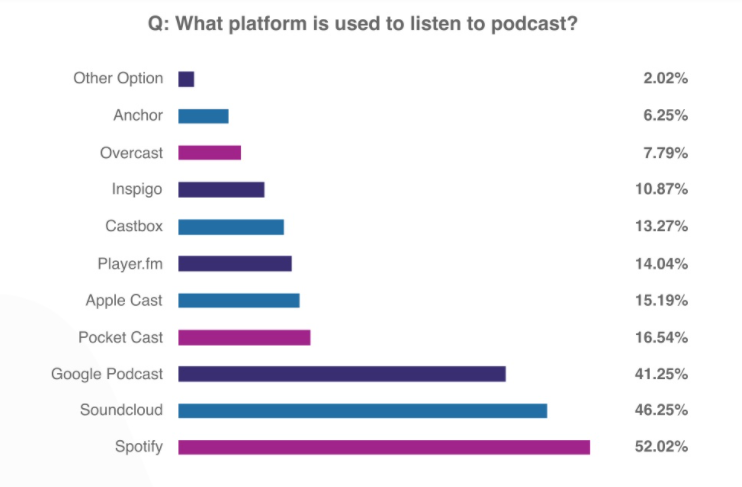

Based on Spotify data, Indonesia will dominate the most podcast consumption in Southeast Asia in 2020. As many as 20% of the total Spotify users in Indonesia listen to podcasts every month, and this number is higher than the global average percentage.

–

Original article is in Indonesian, translated by Kristin Siagian