Over the past decade, telecommunication operators have been experimenting to find the right formula to improve its business performance. Since the emergence of over-the-top (OTT) services in Indonesia, operators have developed various service models to bring in new customers and increase ARPU.

A series of operators have tried e-commerce and digital money businesses. They failed to develop a sustainable business. From two years ago, the operator is finally back with a new strategy. This time, it’s not creating digital services. Instead, they provide services that remains in the corridor of its core business, but with a different approach.

Operators introduce digital-based prepaid services. It is said as various user transaction activities are carried out entirely through the application. In this case, the operator offers a unique value proposition to accommodate market demand that likes to try new ways.

For example, consumers can customize the SIM card, or in other words, select a ‘special number’ through the application. Likewise the purchase and registration of cards. This method is definitely different from what we usually do; buy starter packs and top up data at the counters.

Currently, consumers have three choices of digital prepaid brands, by.U, Live.On, and MPWR. There used to be four, but Switch Mobile decided to discontinue its service in early 2021.

The question is, will digital prepaid services be able to survive the hustle and bustle of the telecommunications industry which is getting saturated? DailySocial, through this writings, has compiled various perspectives regarding the digital prepaid phenomenon and its projections in the future.

Changing operator’s branding

As previously said, telecommunications services are identical to conventional methods. In fact, the idea of digitizing this process has been achieved considering that operators have its own applications that serve to provide data or credit package purchases. However, this is not the goal.

According to Telkomsel’s former President Director, Emma Sri Hartini, by.U could bring “refreshment” to the telecommunications industry that was more familiar with the presence of the old card brand. She considered by.U to be able to embrace the younger generation without having to be closely associated with Telkomsel, which has often been associated with expensive cellular cards.

Another reason is that today’s young generation tends not to want to be dictated to the service needs, aka product-driven. Digital prepaid cards offer service customization that is considered to be able to meet the needs of users in this segment.

Smartfren’s President Director, Merza Fachys previously said the same thing. This digital cellular brand can be positioned as a completely new product without the need to be associated with the existing parent brand.

Big job on increasing awareness

Based on its timestamp, by.U is the first digital prepaid product launched in Indonesia (October 2019). Then, followed by Switch Mobile (March 2020), Live.On (October 2020), and MPWR (December 2020). Almost two years later, are these products able to disrupt the existence of cards that have been circulating in the market for a long time? Can the new approach brands steal consumers’ attention?

The hypothesis above can easily be broken considering the Switch Mobile’s sudden discontinuation within only a year. Switch did not specify the reason behind this closure. We can assume this service is a failure in the market. It may also be because consumers are not used to enjoying cellular services in a new way. Otherwise, it could be a lack of awareness due to the Covid-19 pandemic situation which makes it difficult for service providers to market its products offline.

Another assumption is that the cellular market is already saturated, making it difficult to gain significant traction. Moreover, it is targeting certain segments, not the mass market.

Quoting Katadata, the Central Statistics Agency (BPS) noted that cellular card users reached 341.28 million in 2019, down from 435.1 million in 2017. Its penetration exceeded the total population of 269.6 million in 2019.

| Platform | Provider | Rating |

| by.U | Telkomsel | 4.5 (5M+ downloads) |

| Live On | XL Axiata | 3.7 (100K+ downloads) |

| MPWR | Indosat Ooredoo | 2.7 (1M+ downloads) |

| Switch Mobile | Smartfren | Terminated |

We tried to validate this with every digital prepaid service provider, but most were reluctant to share the data. Telkomsel isthe only provider willing to reveal a little information. by.U’s Principal Growth Lead, Riko Ringgoanto said its users reached 2.5 million after two years of launching. This means that by.U only contributed 1.4% of the total 169.2 million Telkomsel subscribers in the first semester of 2021.

Riko added, this achievement has exceeded the prior expectations. This target even consider the Covid-19 factor where consumers tend to reduce their spending. With the current total user and engagement, he said that by.U is already product-market fit.

“Awareness is still our big homework for the past two years. Due to Covid-19, it has become difficult for us to market advertisements and offline events. However, we continue to intensively do digital placements, enter youth communities in the region, and hold webinars. As by.U is a digital-only prepaid, it seems that it is becoming less chaotic. Indeed, offline channels still number one promotion in Indonesia. When the situation improves, we are prepared to promote in offline locations, such as MRT and KRL,” he explained.

Meanwhile, XL Axiata’s Head of External Communications, Henry Wijayanto agred on this. Although marketing activities have become limited, his team sees a positive impact where people are now getting used to doing digital activities.

“Similar challenges faced by all digital telco brands on how to increase awareness and credibility. Moreover, as a new brand, these things will often appear. We will continue to increase sustainable partnerships to encourage consumer needs to go digital,” Henry said to DailySocial.

Is it enough for disruption?

Secretary General of the ITB Telecommunication Policy and Regulatory Study Center Muhammad Ridwan Effendi said that the emergence of digital prepaid will be difficult to disrupt prepaid brands that have been around for a long time. In addition to today’s prepaid products, Indonesians seem to prefer products with more simple feature and easier to remember. Therefore, the new products emergence is considered to be difficult to survive.

“In some countries, digital operators such as the MVNO model enter with a community approach. However, it is still less successful here. There are [prepaid] products entering the youth community segment, eventually disbanding. Maybe we need to try to enter a wider community, such as religion, motorcycles, or music. This concept has been successful in several countries,” he explained.

Currently, Indonesia has at least more than ten brands of cellular cards, both prepaid and postpaid cards. In order to boost efficiency with today’s competitive cellular market, several operators have started to streamline its service brands.

Citing Liputan6.com, Telkomsel finally merged the prepaid brands from SimPATI, Loop, and Kartu AS into Telkomsel Prepaid. According to internal research conducted over the past year, Telkomsel sees customer segmentation as less relevant in the digital era. It is now more focused on presenting packages according to customer needs and interests.

Meanwhile, Telecommunications Observer from ITB, Ian Josef Matheus actually present a different perspective. Instead of coming up with new brands and approaches, operators should give consumers more understanding that postpaid and prepaid costs are eventually the same.

“Prepaid is indeed the biggest contributor to cellular operator income. However, prepaid cards should only be made in one brand and indeed what the community really needs. It is to avoide confusion for customers or potential customers with the combined advantages,” he told DailySocial.

In addition, operators can actually develop more innovations for postpaid because their ARPU is considered to guarantee more income. For example, providing volume-based or time-based on-demand payments for digital applications developed by mobile operators.

“Unfortunately, operators are yet to have a killer product which popularity can match WhatsApp, Zoom, or Telegram. In fact, self-owned applications can reduce outgoing traffic and streamline spending costs. Even if they cannot develop internally, at least operators can collaborate with the digital ecosystem to encourage increasing ARPU,” he added.

Respondent’s perspective

DailySocial had the opportunity to conduct a mini survey from the user’s point of view. As a disclaimer, this survey does not fully reflect the facts and problems in the field. This survey was conducted to show users’ perspectives regarding the use of digital prepaid services, as well as our efforts to validate it with related service providers.

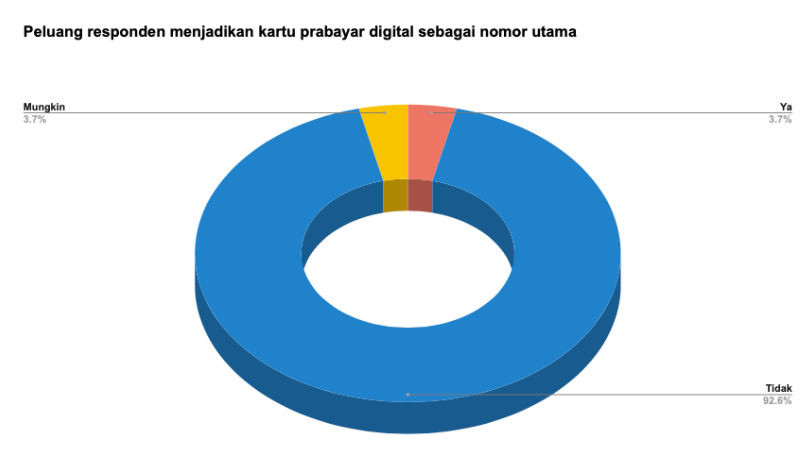

The survey shows that most respondents use digital prepaid as a secondary number for their mobile data or internet needs. Respondents also admitted that they did not plan to make it their main number.

Some respondents admitted that they did not want to use it for some reasons, including not keen to install the application, not being interested, its complicated, and too many numbers. As many as 40% of respondents said they were not interested in trying digital prepaid in the future, 40% said they were interested, and 20% answered maybe.

“Before it was launched, we were aware that by.U would be used as a secondary number, and from the start we did not try to make by.U the main number. According to our internal research, the most spending was on secondary numbers. That’s why we tried to present rewards, free quotas, and additional features (music, podcasts, etc.) to increase user engagement. Therefore, they don’t just do mere transaction,” Riko said.

| (+) | (-) |

| Choose your own number | Speed issue |

| SIM Card is being delivered | SIM Card took a long time to arrive |

| Additional quota for certain app | Delivery charge |

| Unlimited active period | Application running slow |

| App-based SIM registration | Customer service is difficult to reach |

| Unlimited data without FUP | Unlimited data up to 2Mbps |

| SIM Card available through e-commerce | Data package is often changing |

| Affordable data cost | May not work in remote area |

Various user perspectives regarding digital prepaid services / DailySocial Mini Survey

We also spoke with two anonymous sources regarding the use of Live.On and MPWR. Each has the same concern with user experience even though the issues are different.

According to Live.On users, the internet speed is fairly good as the signal and capacity in the area are strong. He said, the package is relatively affordable, not more expensive than Telkomsel, but not much cheaper than its parent operator XL. However, the Live On user experience from the payment side is considered less than optimal.

“I use Live.On for secondary numbers on different devices. When making payments, it becomes complicated because all e-wallet applications are already installed on the main device. Inevitably it has to be done on the same device because it requires synchronization. It should be just e-wallet number for it can be directly arranged,” said one user.

Meanwhile, MPWR users also claimed to have no problems with signal and internet. However, he considered the MPWR application to be less responsive and seamless. The appearance is also considered a bit different from most applications which usually come with up and down scroll modes.

“The MPWR looks sideways so it doesn’t feel good. In my opinion, the myIM3 application is actually better than MPWR. How come it loses to the parent application, even though the [MPWR] tagline is digital.” he said.

–

Original article is in Indonesian, translated by Kristin Siagian