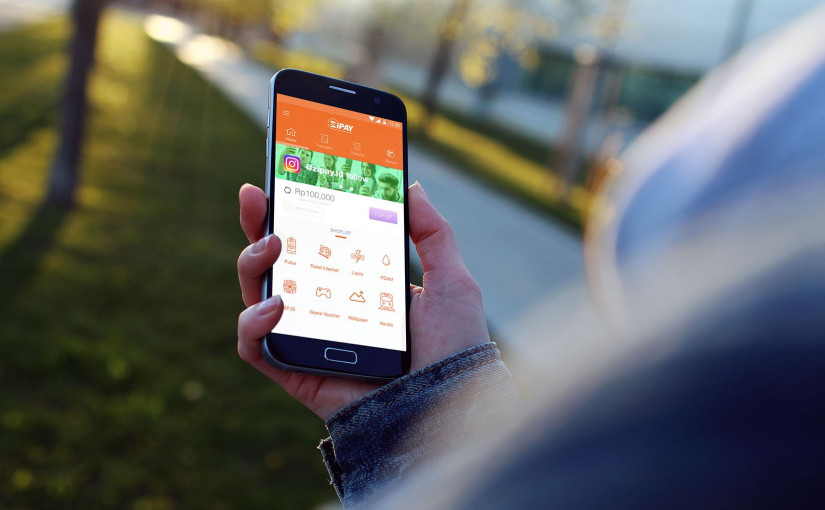

Zipay e-money platform officially acquired the license from Bank Indonesia and legally operated on May 6th, 2019. The business run under PT Max Interactives Technologies.

Currently, the Zipay service is available to all Android or iOS users. Some basic services, such as PPOB, game vouchers, data plan, BPJS, and water bill are available.

Looking back to the Fintech Report 2018 issued by DailySocial, there are many non-bank payment services appeared to date. Some have gotten the license to held e-money operation, while others only registered as fintech providers.

Having a license is an important factor for legal operation in the financial platform. It means, the company provider has standardized, either to the limitations or the risk mitigation.

Based on the issued survey in Fintech Report 2018, 98% of 1419 respondents using the fintech platform said the service provider “must be” registered and monitored by authority.

However, as the increased players, regulators continue to make adjustments. Regarding the Bank Indonesia Regulation (PBI) in 2018, there is a rule No. 20/6/PBI/2018 as an update regarding the e-money system. In general, the criteria applied to provider companies is tightening, for example, related to paid-up capital, company ownership status, and transaction value.

As the other niche players, Zipay seems to be targeting specific user segments. Because it’s quite difficult to defeat the leading players of today’s market, like Go-Pay, Ovo, Dana or LinkAja; particularly related to the service integration. We have tried contacting Zipay to get the strategy and target market.

Unlike OJK (as a license issuer for lending-based fintech platforms), BI seems to be more selective in giving out license. As of June 2019, there are only 3 new players registered, those are OttoCash, LinkAja, and Zipay.

–

Original article is in Indonesian, translated by Kristin Siagian