Recently, I met one of my colleagues who works in a French cosmetics and personal care product company. His job takes care of the supply chain, including planning for product distribution through retail stores and e-commerce. With a fairly high transaction intensity in the online marketplace, my colleague boasted that he didn’t need a large number of team members. This is because the e-commerce enabler service makes it easier for businesses to manage these needs, even as a whole.

The initial concept of e-commerce enablers was to make it easier for brand principals to enter the online industry. Through a single dashboard, they can manage their product in online marketplace services at once. Also, some startups provide fulfillment solutions. This includes solutions for warehousing, packaging, and logistics. Instead of just being a transaction channel, e-commerce enabler has become an end-to-end solution to the distribution process.

Regarding my colleague’s experience, the digital approach makes it easier for companies to get data of the current trends or transactions, he said, it is very useful for business analysis. For example, to help brand principals present promos for products with low penetration – at this stage, even the enabler partners he worked with, helped formulate their strategies.

My colleague is one of the many (big) brand managers in Indonesia who experience the benefits of the e-commerce enabler service. As we look at the list of clients through sites that provide related platforms, there are quite many big brands that have taken advantage of its services, including FMCG, fashion, and even furniture.

Logistics ecosystem

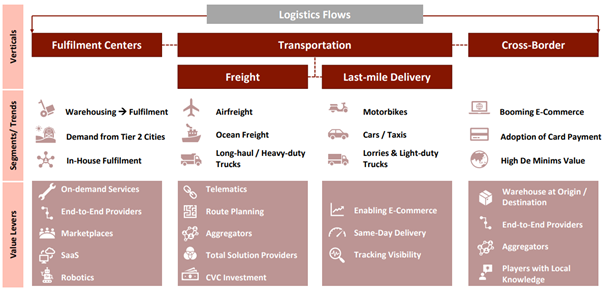

In a report entitled “Tech Logistics in SEA“, it explains the logistics ecosystem that supports today’s e-commerce business. The services needed are very diverse, especially when it comes to specific challenges in a region. For example in Indonesia, which is geographically an archipelago country, sometimes requires at least 2 modes of transportation used for shipping, for example by land-sea or land-air.

The challenge is then translated by startup players as an opportunity. Some platforms finally launch with more specific services, such as truck or ship logistics vehicle management. With attractive revenue potential, the Indonesian e-commerce giant is starting to try to work on this comprehensive solution independently, for example, what Tokopedia did through its IaaS vision or Shopee through its “Dikelola Shopee” service.

Customer demands also drive the transformation of the e-commerce logistics system. According to a survey conducted by PwC in 2018, it was stated that 51% of consumers prefer same-day delivery for the items they buy. In fact, 74% of consumers are willing to pay more to get this fast delivery process.

In a tier-1 cities, especially the Jabodetabek area, this model has been implemented massively by e-commerce players who work with last-mile delivery service providers. A new challenge arose after talking about shipping in tier-2 and tier-3 cities. The mileage and limited expedition services make the one-day model uneven.

Fulfillment centers placed in strategic areas can accelerate the distribution of deliveries up to one day. Indeed, the development must be fueled with very comprehensive data, to determine the point and also to help the brand principal determine what products will be “entrusted” in these third party warehouses. On the other hand, the logistics management platform is also competing to build a route planning system for logistics vehicles that can work more efficiently.

Business trends

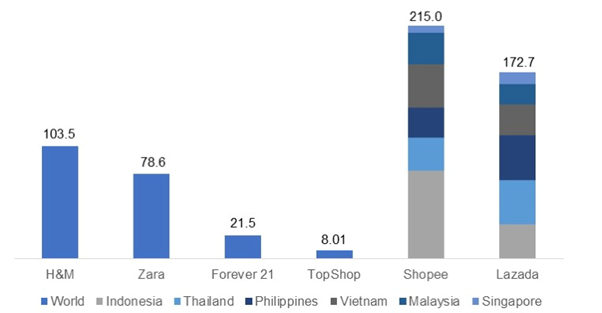

Initially, the online marketplace platform was presented to facilitate customer to customer (C2C) transactions. However, internet penetration has succeeded in significantly increasing e-commerce users in all countries. Like it or not, (big) brands have to rethink their strategies, by trying to take advantage of online distribution channels. The results are effective, even the brand’s presence continues to be increased in the online marketplace.

The research entitled “2020 Ecommerce Fulfillment Trends Report” revealed interesting data. 86% of respondents, who are e-commerce merchants, said they sell their wares on more than one channel. Not a few also sell through social media. In the future, 69% of merchants plan to continue increasing their online sales channels to increase their potential. The use of the fulfillment system will be one of the moves to do.

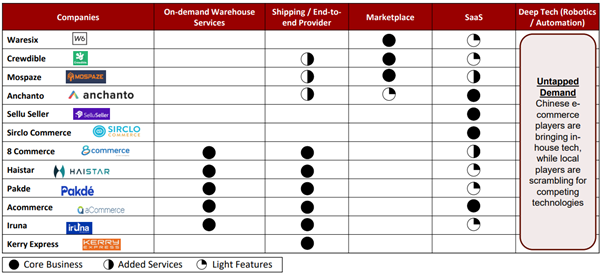

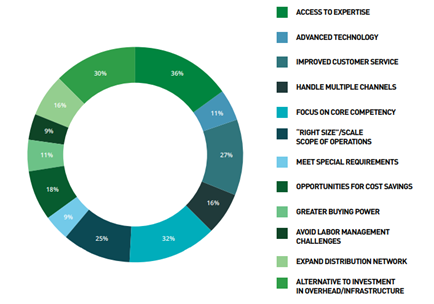

There are many factors to increase the relevance of enablers and fulfillment players. In the same research, merchants have many reasons to entrust these services to third parties. Skills, technology, customer service, and capabilities to manage multi-channels are being delivered most often.

Despite the business practices, these patterns indirectly change the e-commerce order. If C2C was previously identified with purchases from individual merchants or SMEs, now big brands are starting to take part. Even massively surpassed. We haven’t come across a consumer survey that validates this, but at least there are patterns that point to it. For example, there is a special channel in e-commerce dedicated to principal brands (for example LazMall, ShopeeMall, BukaMall, TokoMall) or a feature that makes it easy for users to filter products sold by principal brands.

Around the early era of e-commerce growth, we may have seen a trend of companies flocking to create their own e-commerce. However, if you look at the statistics on his visits, it seems that the online marketplace system tends to be more suitable to be adopted to reach online market share. For stock management and fulfillment, third party solutions are also being pushed up.

Recently, e-commerce enablers have begun to expand their services to the fulfillment system. The latest one is TokoTalk which has just introduced its service. Previously there were Sirclo, GudangAda, Jet Commerce which also strengthened their fulfillment system.

Next step: cross border?

In terms of local, the current enabler and fulfillment system is quite sufficient. However, trade barriers are starting to fade, prompting merchants and brand principals to start doing cross-border commerce or trade across countries. In Southeast Asia, several platforms have tried to facilitate these needs, for example aCommerce, Boxme, Anchanto, Janio, Perpule, and Qxpress.

The potential is quite broad, including by investors. One of them is MDI Ventures which is quite intensive in providing support for Anchanto. Anchanto provides SaaS-based products that make it easier for businesses to manage e-commerce operations. It includes warehouse and inventory management systems. They currently operate in Singapore, India, Malaysia, the Philippines, Australia, South Korea, and Indonesia.

–

Original article is in Indonesian, translated by Kristin Siagian