Amid the stagnant industrial growth, telco operators continue to seek new breakthroughs through their products/services. Experienced in failing to develop a digital business, operators are getting serious to enter the application-based prepaid card service since last year.

In Indonesia, this service is considered new by the way it works very differently from ordinary prepaid cards. All activities from card ordering, number selection, registration, and data purchases are made through the application.

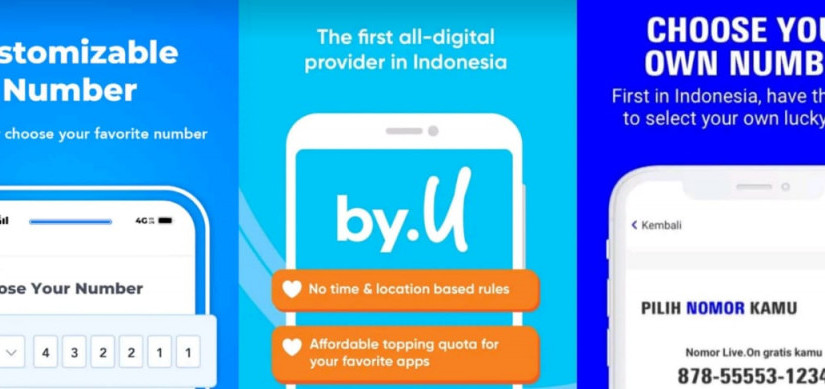

This service was first launched in Indonesia by Telkomsel in October 2019 under the brand by.U. A few months later, a similar service Switch Mobile was launched on the market. Switch Mobile is the latest Smartfren prepaid product.

In addition to the two operators, XL Axiata (XL) will dive into digital-based prepaid services in the near future. Based on DailySocial’s data, XL will soon join the club with Live.On.

The Live.On application is available on Google Play, but is not yet run officially. In our observation, XL opened Live.On official shop in Shopee to purchase the starter packs.

XL did not comment on this matter. Although, our sources say XL has partnered with Circles.Life to build Live.On. The Live.On app link on Google Play is similar to Circles.Life.

Circles Life is a digital telco startup (MVNO) available in Singapore, Australia, and Taiwan. Circles Life has indeed planned expansion to Indonesia since last year. It is not clear what kind of partnership between XL and Circles Life.

Provide young generations with “refreshment”

The initiative to develop a digital prepaid business indicates cellular operators to seriously targeting young people through branding and business models which is different from the previous cellular products.

Operators strive to present products to be personalized by user demands. This product is considered suitable for young people who tend to choose specific services.

Previously, former Telkomsel’s Managing Director Emma Sri Hartini had mentioned that Telkomsel had been established for 25 years and was seen as an old brand. The launch of by.U is considered to be a “refreshment” step to embrace generation Z without cannibalizing its existing products, such as simPATI, AS, and Loop.

“Gen Z does not want to have boundaries in terms of products, they are not product-driven. In contrast to all this time products that have been driven by the operator. Well, this by.U can be customized according to user demands,” Emma said.

Contacted separately, Smartfren’s President Director Merza Fachys said similar things. He said he wanted this cellular brand [Switch Mobile] to be known as a new product on the market without the need to be associated with the existing Smartfren brand.

“To date, our customers are mostly in class C and D. With this switch product, we aim at higher markets in B and C classes,” Merza said.

Enough with the price war

Furthermore, Merza, who is also the Deputy Chairperson of the Association of Indonesian Telecommunications Providers (ATSI), acknowledged that the telecommunications industry is starting to move towards digital prepaid services. The market awaits whether Indosat and Tri Indonesia to enter similar services.

In fact, prepaid products are actually common. Each operator has more than one cellular product targeting different market segments. However, digital-based prepaid products can be a new strategy for operators to get out of the long-standing price war.

Digital prepaid services promote brand and product novelty without being associated with telecommunications companies. According to Merza, this service can open up opportunities to compete in two market segments, which are affordable and premium markets.

After the failure era of e-commerce, e-wallet, and OTT, operators are still trying to find the right business model to become a digital telco (digico) operator. However, it is yet to find whether this strategy can have a positive impact on the growth of the telecommunications industry. Moreover, the growth space for cellular customers in Indonesia is increasingly difficult.

“To play on existing products, operators can no longer raise prices, customers will started to leave,” he explained.

–

Original article is in Indonesian, translated by Kristin Siagian