Indonesia has the largest underbanked population in Southeast Asia. Millions of low- and middle-income workers struggle to cover unexpected expenses each month, putting significant financial pressure on their paycheck.

Tobias Fischer, Sasanadi Ruka, and Kevin Hausburg intend to address this issue by establishing wagely in March 2020 in Jakarta. Those three hold digital industry background that counts for Wagely’s vision and mission to provide financial welfare to employees by providing access to early salaries.

Fischer used to work at Grab Financial Group, Capital Match, ADB, and Rocket Internet. Meanwhile, Ruka previously worked at Tokopedia, Jenius, AWS, and HappyFresh. While Hausburg has strong experience in digital marketing for many global companies.

In an interview with DailySocial, Fisher explained that Wagely helps businesses increase the productivity, engagement and loyalty of their workforce by offering employees an innovative financial benefits platform to access earned wages and financial education.

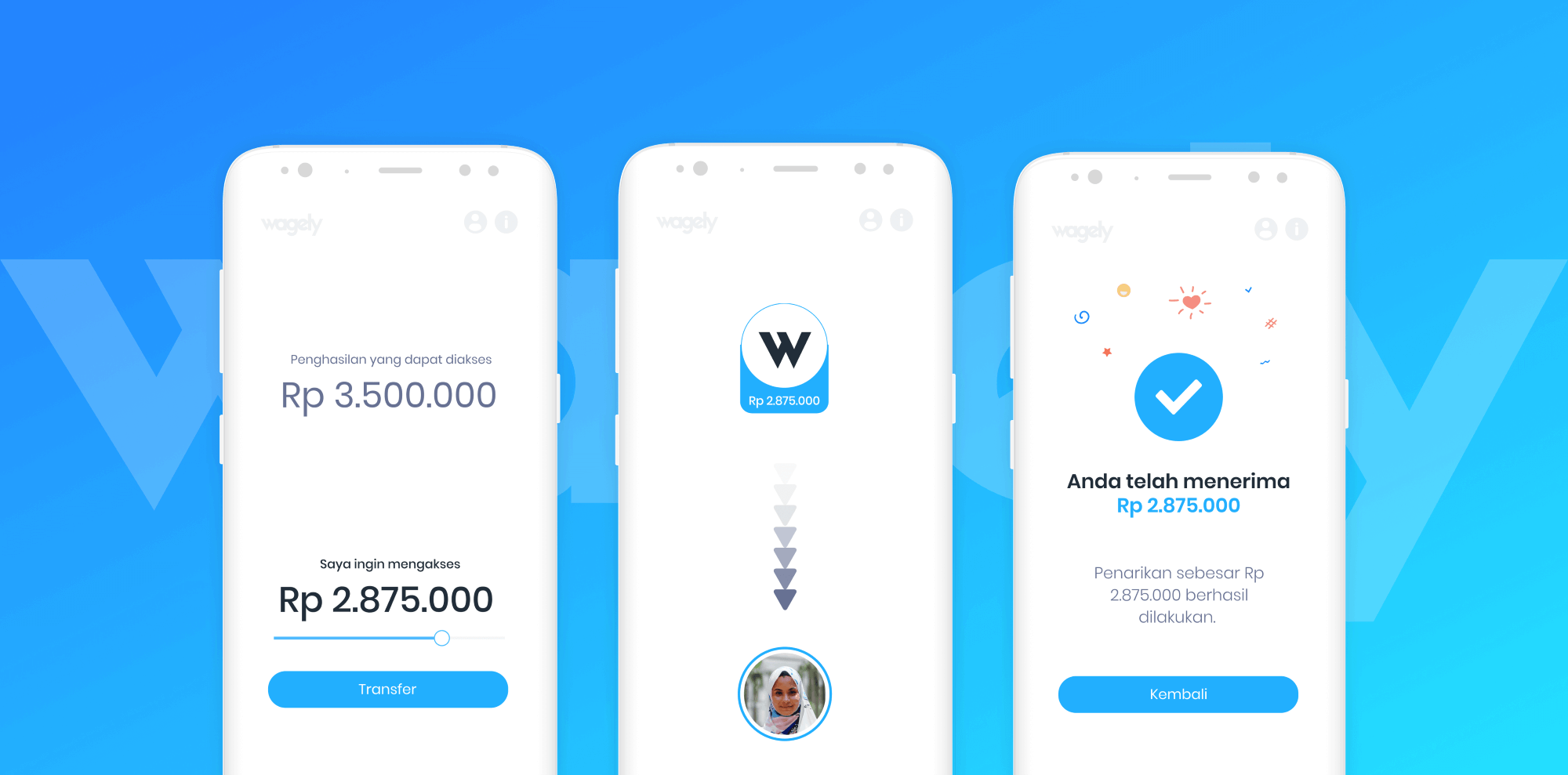

Employees can withdraw up to 50% of the salary instantly and on demand to their payroll bank account. The money will be used to help them pay for unexpected expenses and emergencies. Wagely provides an affordable flat fee per withdrawal with no hidden fees or interest. Therefore, Fisher consider wagely in accordance with the sharia concept.

“Wagely has a unique approach as it does not provide loans to employees but only access to earned salary. Therefore, Wagely does not require any underwriting and available to all employees in a company,” he said.

It is said that wagely has partnered with more than 50 companies, most of the companies are in global and national level. Among those are British American Tobacco, Ranch Market, Mustika Ratu, and others. As many as tens of thousands of employees from all of these partners have been served with early salary access.

Seed funding

In the same occasion, on its first anniversary, wagely officially announced the seed funding of $5.6 million (over 79 billion Rupiah) led by Integra Partners (formerly known as Dymon Asia Ventures). Also participated in this round Asian Development Bank (ADB) Ventures, PT Triputra Trihill Capital, 1982 Ventures, Willy Suwandi Dharma (former President Director of Asuransi Adira Dinamika), and others.

As wagely’s CEO, Fisher said that the fresh funds will be used to accelerate the adoption of the Wagely platform to more employees. It is targeted to attract more than 250 thousand employees as users this year. He said, providing a sound and affordable solution to an emergency cash flow problem is only the first step towards building long-term financial health.

“Ensuring long-term financial well-being means building a holistic platform that offers workers access to affordable services, encourages financial responsibility, and provides a pathway to financial stability and inclusion, with access to earned wages at the core and seamlessly integrated features. We are committed to building a complete ecosystem that builds and protects the future financial sustainability of employees in Southeast Asia.”

In an official statement, Integra Partners’ Partner, Christiaan Kaptein said, “The investment and participation of several Indonesian family conglomerates highlighted Wagely’s leadership role in financial awareness and its ability to build sustainable and responsible businesses by taking advantage of the vast financial services market opportunities in Southeast Asia,” he said.

ADB Ventures’ Senior Fund Manager, Daniel Hersson added, “This investment underscores our belief that Wagely has what it takes to lead financial inclusion and literacy in Indonesia. wagely offers workers what they didn’t have before: fair and accessible financial tools to help them manage inevitable contingencies and emergencies, including those caused by climate change.”

The presence of Earned Wage Access (EWA) platforms such as Wagely in Indonesia, GajiGesa has attracted a lot of attention from investors as the potential it offers. EWA solutions provide companies with the opportunity to reduce turnover, increase employee productivity, and increase business savings.

In the United States, Dailypay has received funding that brought them to the unicorn level. Softbank also invested in similar startups named Payactiv, Jeff Bezon and Bill Gates (Wagestream and Minu), and Peter Thiel (Even).