Banking, the oldest financial industry in the world, is now demanded to transform towards digital, both in service to consumers and in its operations. While on the external side they are also required to work closely with fintech startups so as not to be increasingly eroded by technological trends.

Many recognize, by utilizing digital technology can provide efficiency, because it does not merely rely on the quantity of physical and non-physical assets. So most of the solutions offered are disruptive, disrupting old habits.

Banks cannot rely on cooperation with third parties forever so that business does not erode. They are demanded to be more efficient by fully adopting digital, finally a newer banking model is known as digital bank (or virtual bank).

According to IBM, digital banks are different from other forms of digital banking because they are only online, do not have branch offices in a country. Consumer expectations from here are savings on bank facilities and staff which ultimately translates into higher interest rates for savings and lower interest rates for loans.

The most noticed difference is the emotional connection when visiting the branch office to interact, rent a safe, ask for bankers’ advice and so on.

Digital bank in Indonesia: Awaiting for legal umbrella

Indonesia is yet to have a legal umbrella related to the digital bank. The discourse has been spoken yet the formal framework is yet to be drafted. Currently, the most active digital banks are still under the name of conventional banks, such as BTPN Jenius (2016) and DBS Digibank (2017).

Legal regulation regarding digital bank is accommodated by POJK Number 12 of 2018. As stated, the definition of digital banking services is a service developed by optimizing the utilization of customer data in order to serve customers faster, easier and in accordance with demands; and to be run independently by the customer, by taking into account the security aspects.

OJK also mentioned that providers are limited to banks that were at least categorized as commercial banks (BUKU) II or core capital ownership between IDR1 trillion to IDR5 trillion. Regulations regarding virtual banks or banks without physical presence have not been accommodated in the POJK.

The limitation aims for the regulator wants to ensure that all fundamentals carried out are in the guidelines of banking regulations. Entering the BUKU II category can influence the scope of business activities of the bank itself, the most influential is that they can start the payment system and e-banking activities without having to be limited if they are still in BUKU I category.

In terms of the services provided, either Jenius or Digibank have not really targeted the unbanked. The map of its distribution is strategically not directly mass but slowly entering big cities. For example, Jenius by the end of 2019, opened booths in Malang, Medan, Makassar, Palembang, Yogyakarta, Bali, and of course Jakarta in its pilot project.

However, this is no longer an issue because Jenius is now facilitated with video call KYC, therefore, one can create an account without having to visit the booth. It’s an innovative feature, but it does not enough.

There must be an impact on unbanked society. It’s different from the current situation, fintech lending or payment expansion intends to make fast customer acquisition because there’s business “pie” where the banking industry has yet to cover.

Although the legal umbrella is yet to be drafted, based on the issued regulation, the digital bank map is getting crowded. Marked by the entrance of conglomerates, big-name investors, and startups are acquiring small banks since last year.

Salim Group took Bank Ina Perdana, Jerry Ng (senior banker) and Patrick Walujo (Northstar Group) towards Artos Bank, BCA to Bank Royal and Rabobank (to be merged into one of BCA’s subsidiaries), Akulaku to Bank Yudha Bhakti.

All actions above are yet to come to its peak, except Akulaku and Bank Yudha Bhakti. However, the preparations have begun. BCA, for example, has targeted Bank Royal to start a pilot project in the second half of this year and is ready to add Rp3 trillion capital to boost up its movements.

Meanwhile, Bank Artos has been occupied by BTPN’s former employees, effective as per November 15, 2019. They are Jerry Ng (President Commissioner), Anika Faisal (Board of Commissioners), Kharim Indra Gupta Siregar (President Director), Arief Harris Tandjung (Deputy Directors Main) and Peterjan van Nieuwenhuizen (Directors). This succession marks great hope to repeat the success of Jenius under the same leadership.

The close relationship between Patrick Walujo and Gojek has started a rumor of Bank Artos to become GoBank (Gojek’s banking). He said the rumor was not true. In a panel discussion forum, he mentioned there was a discussion to make use of the Gojek ecosystem with the employment of Bank Artos with expertise in banking.

However, it turned out the concept of Bank Artos did not exclusively involved as Gojek bank. Although, banks are specifically directed to become digital banks. “Because we see a demand that market alone cannot fulfill, in terms of the digital bank,” Patrick said while being a speaker at a conference in late January 2020.

Before investing in Bank Artos, Patrick had previously invested in BTPN in 2008, through TPG Nusantara, a joint venture with Trans Pacific Group. He bought 71% of BTPN’s shares for $195 million (around Rp1.8 trillion then). The shares were released gradually until 2015, they secured Rp5.3 trillion by releasing 17.5% shares.

“I invite Jerry Ng to join and work on BTPN’s business. The bank entered the mass market, those small traders in traditional markets whose markets are large and well-developed, until the state-owned banks entered,” Patrick added.

When Bank Royal, Bank Artos, and Bank Yudha Bhakti have started, they’re expected to offer more variant products and facilitate the unbanked population.

According to the latest report of e-Conomy SEA 2019 by Google, Temasek and Bain & Company, there is 51% Indonesian population in the unbanked class, 26% underbanked, and 23% banked.

“There are lots of business players in need of funding, yet have difficulty in getting a loan from the bank due to collateral issues. The demand is quite potential for digital bank services,” Walujo said.

Hong Kong might be the best example, with eight digital banks actively run since the license has been issued in 2019. ZA Bank offers interest for a time deposit at a maximum of 6.8% for three months tenor for savings of 100 thousand Hong Kong dollar (around Rp176 million).

Unlike conventional banks, such as HSBC and Standard Chartered, which offers 2%-3% interest for high amount savings.

Managing Director VC Asset Management, Louis Tse Ming-Kwong said this is an effort of new players to increase brand awareness and acquire the customer base.

“the interest war is not limited to virtual banks, but encouraged conventional banks to respond in order to maintain market share,” he said.

Different cities, different growth

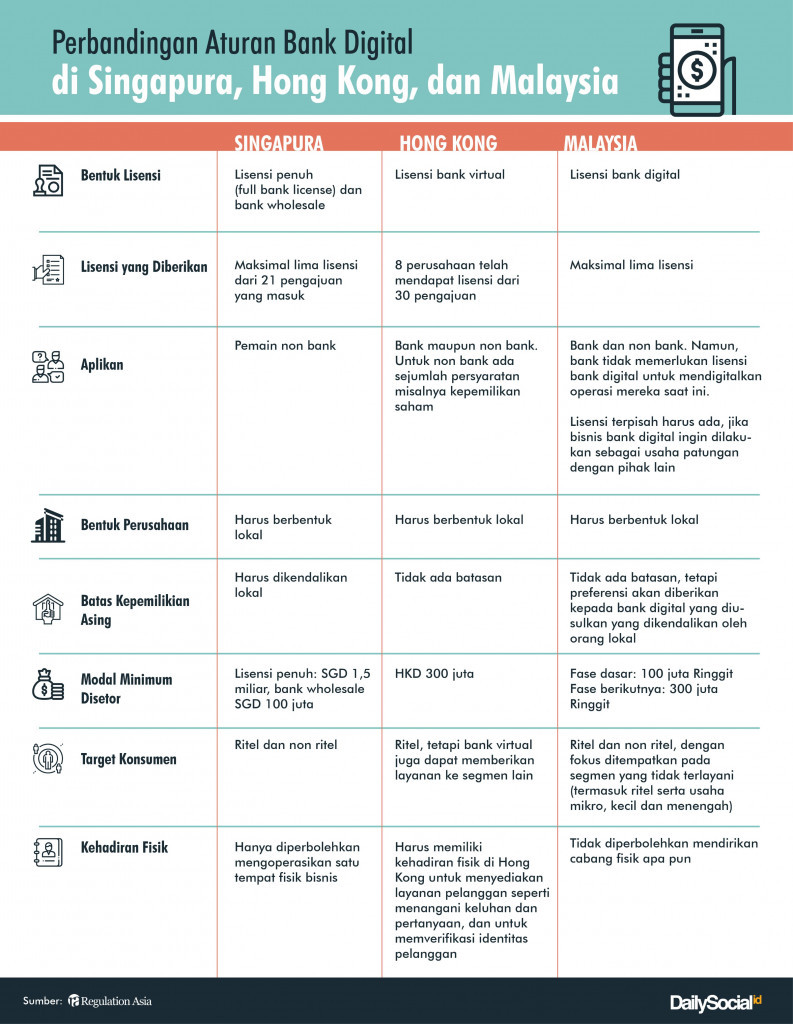

Regarding virtual banks, Indonesia is yet to create a legal umbrella. The requirement to create a digital bank can only available with a banking license. It’s unlike the two neighbor countries, Singapore and Malaysia.

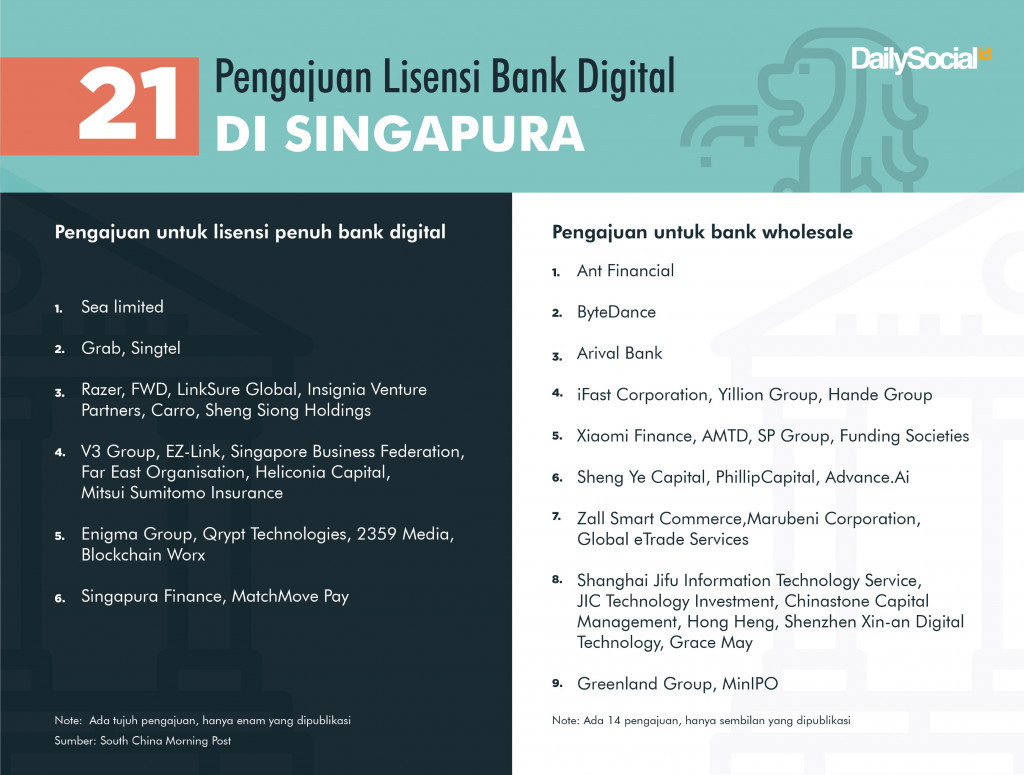

Singapore issued five licenses for non-banking digital banks, two of those with full license and three for wholesale bank licenses. The announcement will be made in June 2020 and the five selected companies are expected to start their business immediately in mid-2021.

Requirements given by the Central Bank of Singapore are also different for each license. For a full license must meet the capital of 1.5 billion Singapore dollars and must be controlled by local people. They are allowed to provide a variety of financial services as well as to save savings from retail customers.

Meanwhile, wholesale banks allow those who want to serve SMEs and other non-retail segments. With minimum capital of 100 million Singapore dollars. Submissions are open to local and foreign companies.

There are 21 candidates competing for the license, both in the form of consortium and individuals. The interesting part, most of the submissions came from technology companies from China because the Central Bank of Singapore has opened this opportunity for non-banking.

The entrance of new players in the Merlion Country is not highlighting on the “new kid”, it’s rather the kind of service to offer. As the Professor of Information Systems at Nanyang Business School Boh Wai Fong said, new players are expected to be able to serve low-income people or new companies that cannot meet traditional bank credit requirements.

There are 38% of adults in Singapore who are underbanked, even though the country has been mature in terms of the financial industry, according to the 2019 e-Conomy report compiled by Google, Temasek, and Bain & Company.

In a helicopter view, the high interest of foreign technology players in Singapore indicates further penetration to the Southeast Asian market. Although this license will only be valid in Singapore, the business model is considered very feasible to be replicated in the region.

As important, Singapore does not have a digital bank at all. The country has been dominated by large banks such as DBS, UOB, and OCBC. The three, according to Boh, are already “too good for too long” and monopolize the market.

Malaysia also conducted the same contest by issuing five digital bank licenses. Submission is open to non-banks, bank is capable whether they want to separate the digital banks through joint ventures.

The neighbor country issued a draft exposure on the License Framework for Digital Banks as a way to promote the development of digital banks in line with directions taken by regulators in Singapore and Hong Kong. Both have issued similar work license frameworks in the past two years.

The Central Bank of Malaysia said the draft will be finalized in the first half of this year. At the same time, the application for a new license can be made for interested candidates.

Meanwhile, the Philippines has granted four digital bank licenses to CIMB Bank and ING Bank, Tonik and Rizal Commercial Banking Corporation (RCBC). Except for RCBC, digital banks are run by regional banks. Thailand has already formed a digital bank named Timo which was established in 2016.

–

Original article is in Indonesian, translated by Kristin Siagian